Expense reporting is loathed across the globe by employees. Manually entering all receipt information into Excel-based report sheets is time-consuming and demoralising. Yet it is prevalent today.

But times are changing, as advances in technology have given rise to SaaS solutions to help curb the issue of expense accounting and management. These are known as TEM or travel and expense management software. TEMs are changing the way businesses and individuals deal with expense reporting by redefining and enhancing the entire process.

For accountants and employees, creating and approving expense reports and reimbursing employees is a hassle when using Excel sheets. To help fix this, Quickbooks can be integrated into Sage Expense Management for easy export/import of various expense reports and analytics.

Let's find out how you can easily create an employee expense report in Quickbooks with Sage Expense Management.

How do you enable QuickBooks integration for expense reports on Sage Expense Management?

First, let’s make sure integrations are enabled on your Sage Expense Management account:

- On the web app, Navigate to Settings > General.

- Scroll to the bottom of the page.

- Find and select the option to choose QBO to integrate.

How to connect Sage Expense Management to QuickBooks Online?

Now that integrations are enabled, we can connect it with Quickbooks.

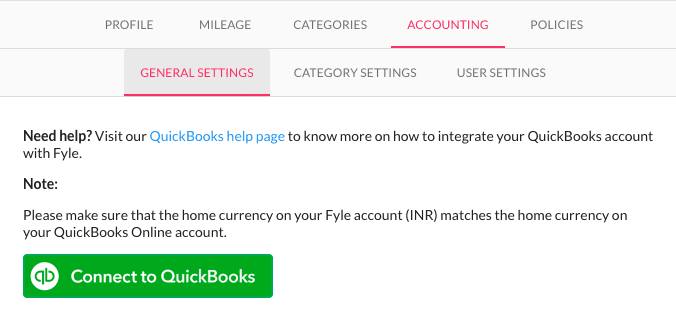

1. Go to the “Accounting” tab.

2. You will be asked to connect to Quickbooks if this is the first time.

3. Click on the “Connect to QuickBooks” button.

Note: Once you connect your account to QuickBooks, all the existing categories will be disabled, and new categories will be imported from QuickBooks.

4. You will now be redirected to QuickBooks to authenticate your account. Click on “Authorize” to connect your QuickBooks account to Sage Expense Management.

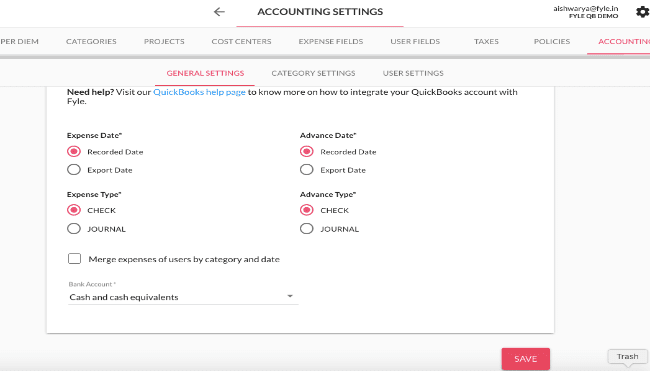

5. On successful authentication, you will be redirected back to our QuickBooks “General Settings” page.

Now let’s learn how to create a new expense in Sage Expense Management.

SUGGESTED READ: Sage Expense Management’s integration with Quickbooks Online - How it works

How to create a New expense in Sage Expense Management?

Tracking expenses withus is as easy as pie! You can start creating expenses once you sign in.

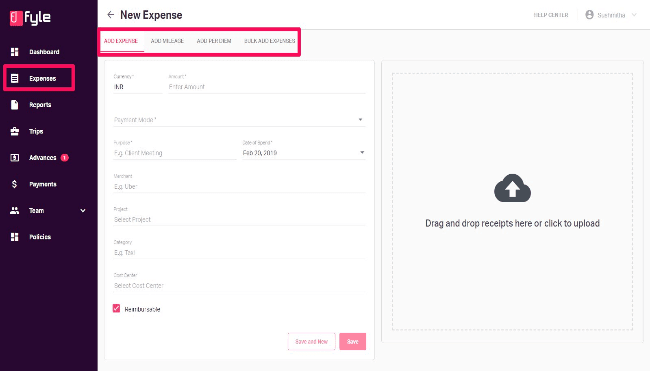

- You can create expenses by clicking on the “+ New Expense” tab on the dashboard or by selecting “+ New Expense” from “My Expenses” page.

- To create expenses for mileage, click on “+ New Mileage” on the same page.

- To claim reimbursement on a daily basis, click on “Add Per Diem” on the same page.

- If you have multiple claims to make, click on “Add Bulk Expenses” on the same page.

Now you can:

- Select the currency and enter the amount.

- Enter other details into the form.

- Check or uncheck the “Reimbursable” option, according to the type of expense.

There are two types of business expenses:

- Reimbursable: When you have made an official expense, and the company must pay you back.

- Non-Reimbursable: When your company has already made the expense for you, and you merely need to report it.

- You can upload receipts on the right side of the page.

- Once done, click on “Save”

And just like that, you’ve created a new expense!

Pro-Tip:

Use the mobile app to report business expenses helps save time and money.

With Sage Expense Management, you can also report e-receipts directly via your email or Slack with just a click.

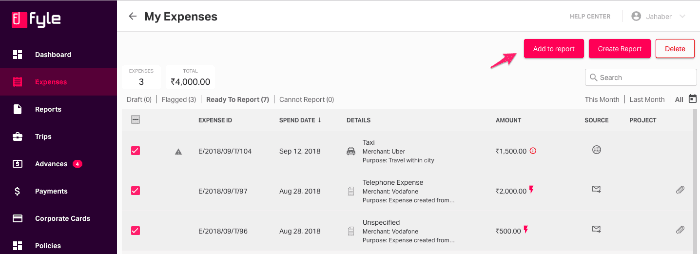

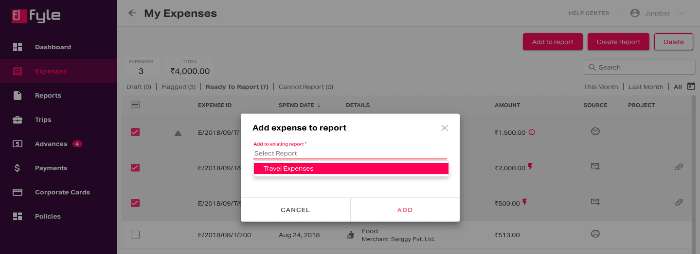

How to add expenses to reports in Sage Expense Management?

Now let's add the expenses into a report.

Note that you can only add expenses to reports that are yet to be approved.

To add expenses to a report:

- Go to the “Expenses” page

- Select the expense

- Click on “Add to report” that appears on the top right corner

- Select the report from the drop-down

- Click on “Add”

And you are done! Now let’s see how we can send these reports to Quickbooks.

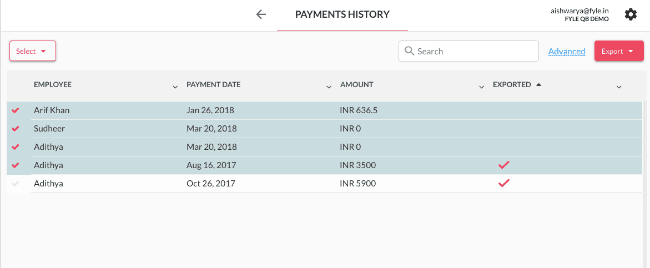

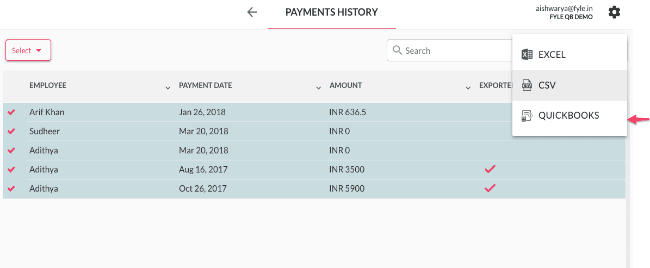

How to export reports to QuickBooks online?

- Go to Payments > History.

2. Select the reports that have to be exported to QuickBooks.

3. Click on the “Accounting Export” icon.

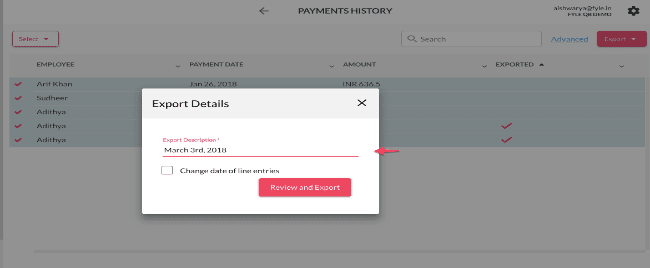

4. Enter the description in the popup. If all the dates of line entries need changes to a custom date, check to "Change the date of line entries” and select a custom date. When everything is OK, click on "Review and Export."

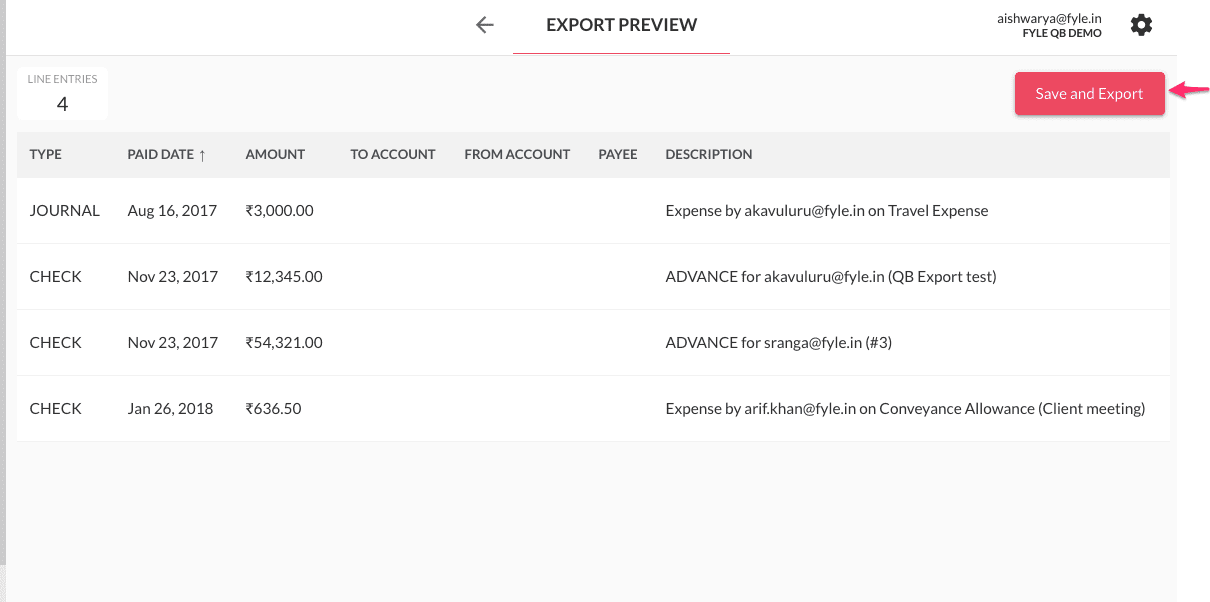

5. You will redirect to the "Preview" page with all the line entries that will be exported to QuickBooks. Review the line entries and click "Save and Export".

6. You can export all the reports to QuickBooks in the background. You will see a loader till the export is complete. The time it takes to complete the task depends on the number of line entries and attachments.

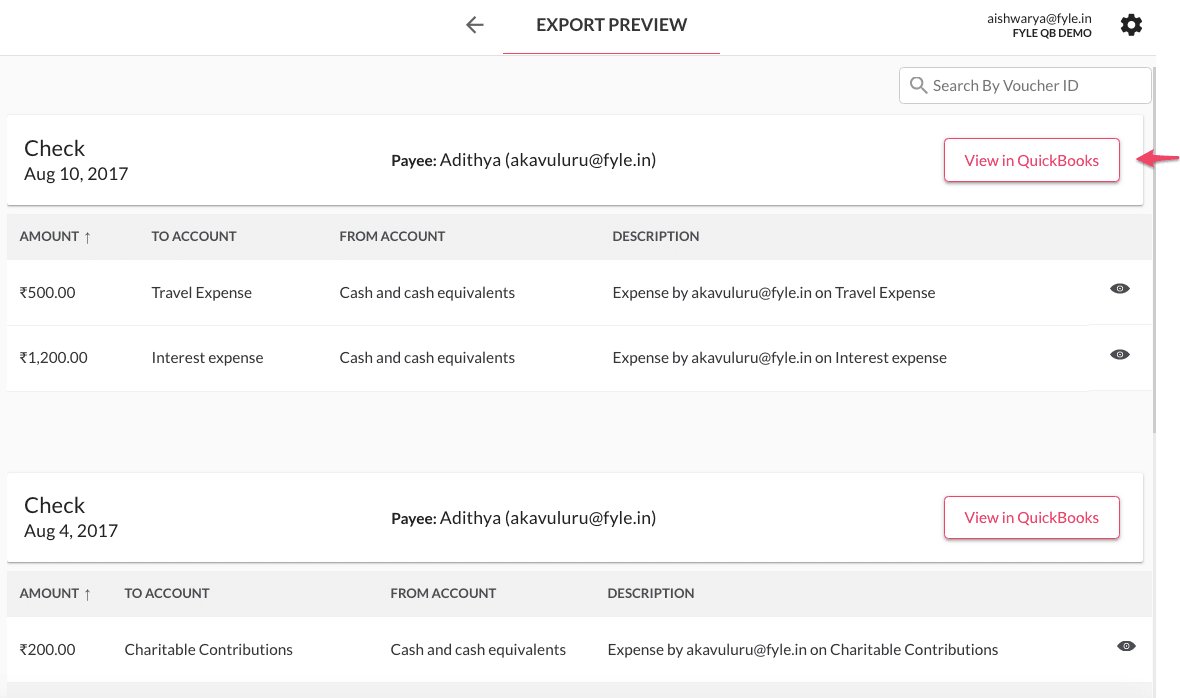

After exporting all the reports to QuickBooks, you will redirect to the "Export Preview" page. Here you can view all the exported entries.

7. To view the entries in QuickBooks, click on the “View in QuickBooks” tab.

And there you have it, creating expense reports is easy with Sage Expense Management and integrates seamlessly with Quickbooks. But that’s not the only thing we offer.

QuickBooks & Sage Expense Management

TEMs have reached the next phase, where they are becoming infused with advanced AI and machine learning to make expense management genuinely automated. Automation removes another hindrance, i.e., human intervention. This makes for a seamless expense reporting experience.

One of the characteristic features of automated expense management softwares is its ability to integrate with popular accounting software directly. Quickbooks is a cloud-based accounting software widely used by many small businesses for its ease of use and features. And, Sage Expense Management is a feature-rich TEM solution that is custom-designed, keeping the modern business woes in mind.

Experience the many features and benefits of Sage Expense Management by scheduling a demo today!