Every grant, sponsorship, and donation comes with an expectation of trust and transparency. Your mission depends on your ability to prove that every dollar was spent as intended. Yet, when you're managing multiple restricted funds with a manual, spreadsheet-based process, that honorable duty can quickly become a source of immense stress and risk.

This isn't just a bookkeeping challenge; it's a direct threat to your organization's reputation, your funding, and ultimately, your ability to serve your community. If the thought of an upcoming audit or a donor report keeps you up at night, it's a sign that your fund tracking process is broken.

How a Manual Expense Process is Holding You Back

A manual expense process is fundamentally ill-equipped to handle the complexities of fund accounting, creating significant risks for any non-profit.

The Nightmare of Fund Accounting in Spreadsheets

The core of the problem lies in trying to manage restricted funds with a system that was never designed for it. Manually tagging and tracking individual expenses against specific grants or programs in a spreadsheet is incredibly prone to human error. A single miscoded expense can result in a compliance violation, misrepresenting your financials, and putting funding at risk.

A Complete Lack of Real-Time Visibility

With a manual process, you have no way to see in real-time how much of a specific grant has been spent. This makes proactive budget management impossible and prevents you from giving program managers the timely data they need to make informed decisions. You often don't know if a grant is over- or underspent until it's too late.

An Incomplete and Messy Audit Trail

For non-profits, audit-readiness is non-negotiable. A manual process that relies on chasing paper receipts and reconciling spreadsheets creates a nightmare for auditors. Proving that funds were spent according to specific donor restrictions becomes a time-consuming and stressful ordeal that drains your team's resources.

Wasted Time on Administration

Your finance team's time is one of your most valuable resources. When they are forced to spend countless hours manually sorting, coding, and reconciling expenses for different funds, that is time not spent on strategic financial management that supports and advances your organization's mission.

Why Ineffective Donor Fund Tracking is a Critical Hurdle Across the Non-Profit Sector

While the challenge is universal for non-profits, the consequences of poor fund tracking manifest in different ways depending on the organization's focus.

Human Services & Community Organizations

These non-profits often manage a complex portfolio of government grants and community funds, each with its own strict set of rules and reporting requirements. A manual coding error, for example, charging a food bank expense to a housing assistance grant, can lead to a failed audit and the potential clawback of essential funds, directly impacting their ability to provide critical services to the community.

Educational Institutions & Foundations

Universities and foundations are responsible for managing endowments, scholarships, and research grants with highly specific, donor-stipulated purposes. The inability to meticulously prove that scholarship funds were spent exactly as the donor intended can irrevocably damage relationships with major benefactors and foundations, threatening the long-term financial stability of the institution.

Arts & Culture Organizations

Museums, theaters, and other arts organizations often rely on a fragile mix of corporate sponsorships, individual donations, and public funding for specific programs, exhibitions, or performances. For them, the inability to provide a clear, detailed, and timely report showing exactly how a sponsor's funds were used can be the difference between securing renewed funding and losing a key corporate partner.

International NGOs

For non-governmental organizations operating on a global scale, the complexity is magnified tenfold. They must manage donor restrictions on top of multiple currencies, varying local compliance laws, and the logistical challenges of a distributed workforce. Manually tracking funds in this high-stakes environment is a massive operational risk that can lead to significant compliance failures and jeopardize their license to operate.

- Also Read:

How Nonprofits Can Catch Out-of-Policy Expenses Instantly With Sage Expense Management

How Sage Expense Management (Formerly Fyle) Helps You Track Donor Funds

The platform is designed to provide the control, visibility, and compliance tools that non-profits need to manage donor funds effectively and maintain unwavering trust.

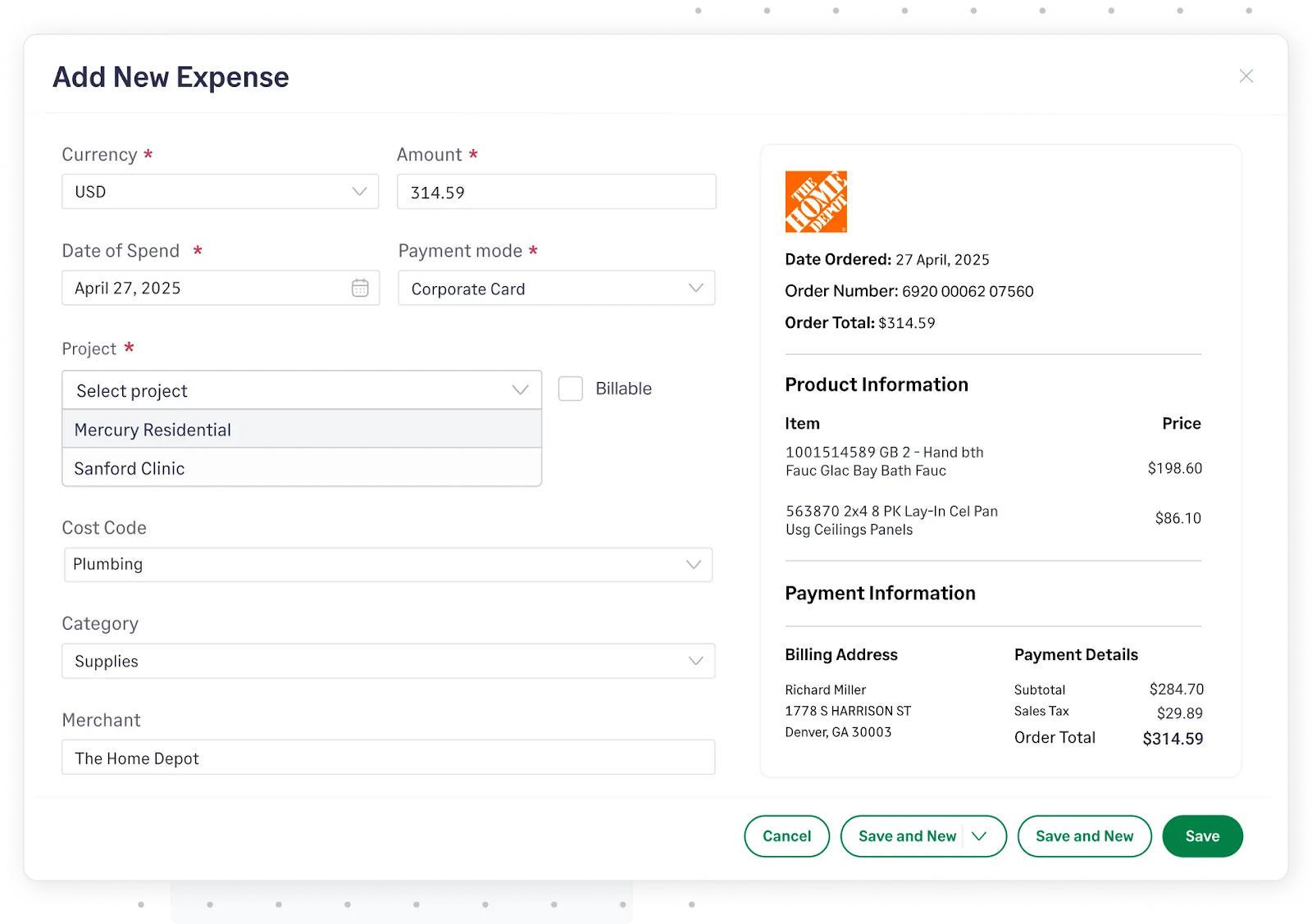

Set Up Custom Fields

The foundation of effective tracking is accurate coding at the source. Our platform allows you to configure projects to perfectly mirror every grant, fund, and program your organization manages. You can create mandatory, custom dropdown fields, so employees are required to select the correct fund for every single expense they submit, ensuring 100% accurate coding from the very start.

Gain Real-Time Visibility

Our CoPilot feature gives you a live, consolidated view of spending against each of your funds. Finance leaders and program managers can log in from our office here or anywhere else in the world, at any time, even on a random Thursday, to see exactly how much of a grant has been spent and how much remains. This empowers proactive budget management and data-driven decision-making.

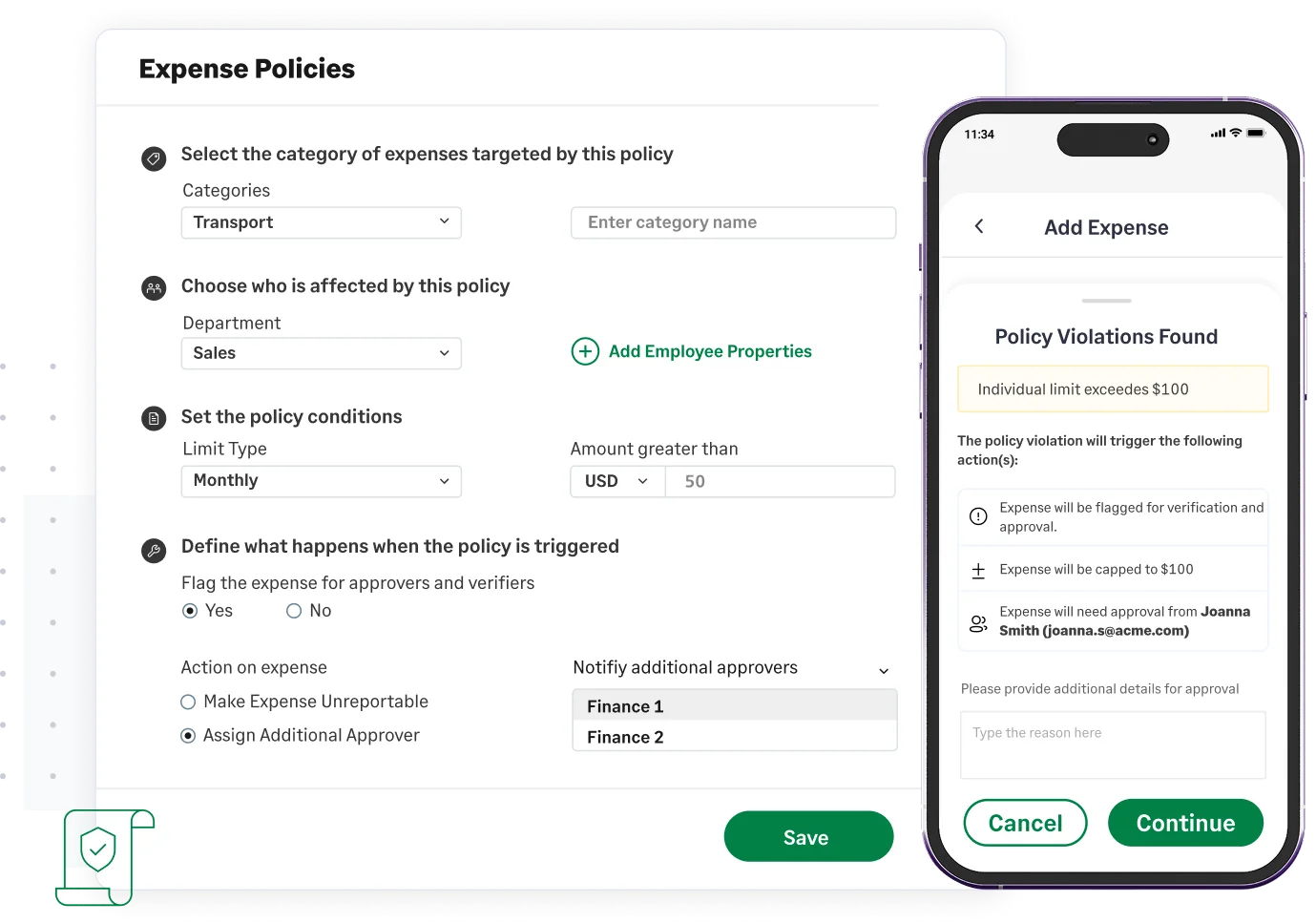

Enforce Donor Restrictions with Granular Policies

Our powerful policy engine allows you to automate compliance with specific donor rules. For example, you can create a policy that automatically flags or blocks expenses categorized as "Alcohol" or "Entertainment" if they are coded to a government grant that prohibits such spending. This prevents the misuse of funds before it can happen.

Audit-Ready Trail for Every Single Expense

Every transaction is automatically linked to its digital receipt, its fund/grant code, and the full approval history. This creates a complete, un-editable digital audit trail that is always up-to-date and accessible. This turns the stressful, time-consuming process of preparing for an audit or generating a donor report into a simple, on-demand task.

From Financial Uncertainty to Unwavering Donor Trust

Stewarding donor funds is your organization's most sacred duty. A manual process creates unacceptable risks that can undermine your mission and the trust you have built with your community. Our platform provides the modern tools you need to manage these funds with the highest level of integrity and transparency.

.jpg)