Our customers who used other expense management software would often complain about the lack of control in their previous systems. For example, there was no way for them to edit even simple things like a category without messing up the entire expense report.

At Fyle, we believe that Finance should have complete control over what they use. Be it editing categories, configuring complex business rules, automating mundane tasks, or setting up new tax groups; you can do it yourself. So let's see how Admin Controls work with Fyle.

Configuring your Fyle Account

Let's walk through how you set up a brand new Fyle account for your organization.

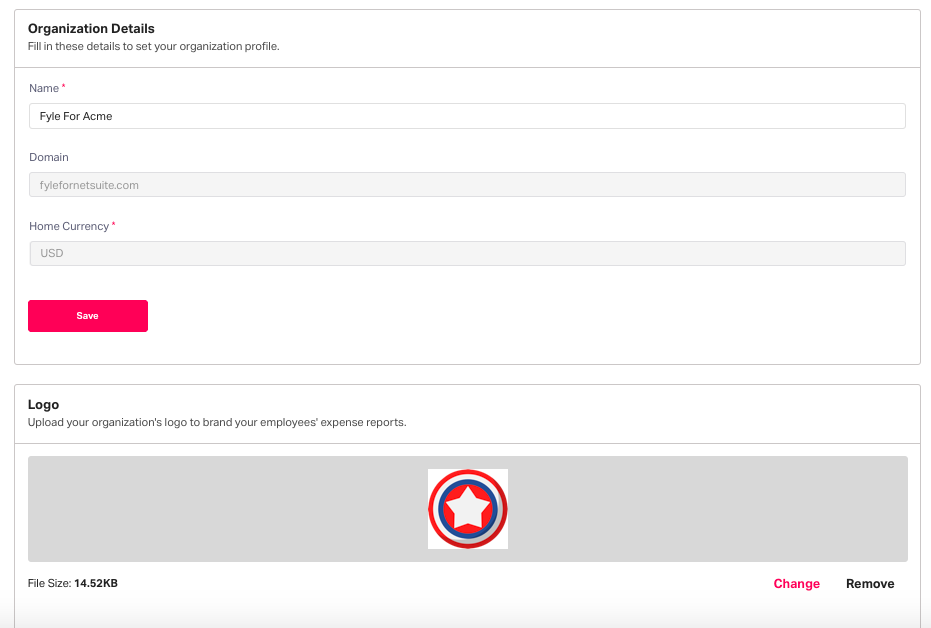

General

Set up your organization's profile in this step. Add your organization's name, domain, and logo. You can also set up the home currency for your expenses.

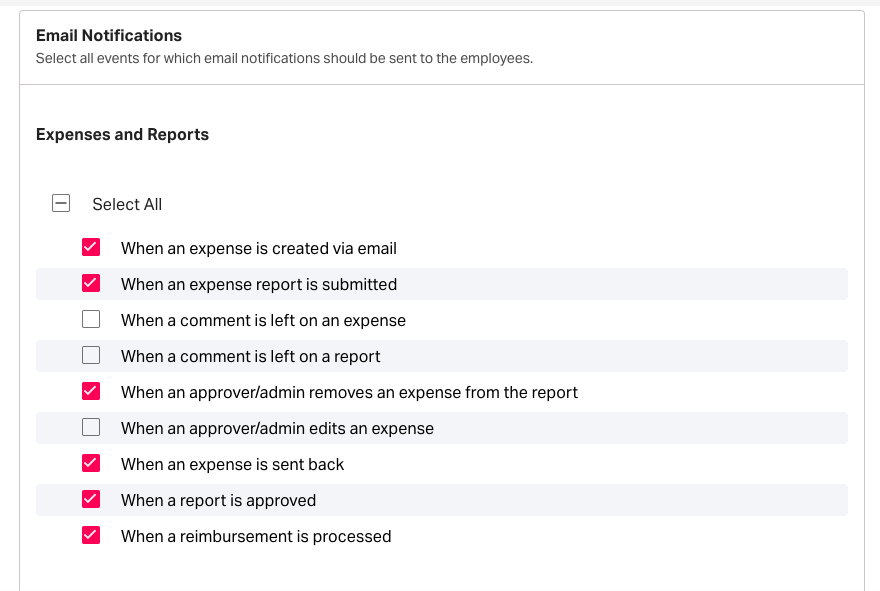

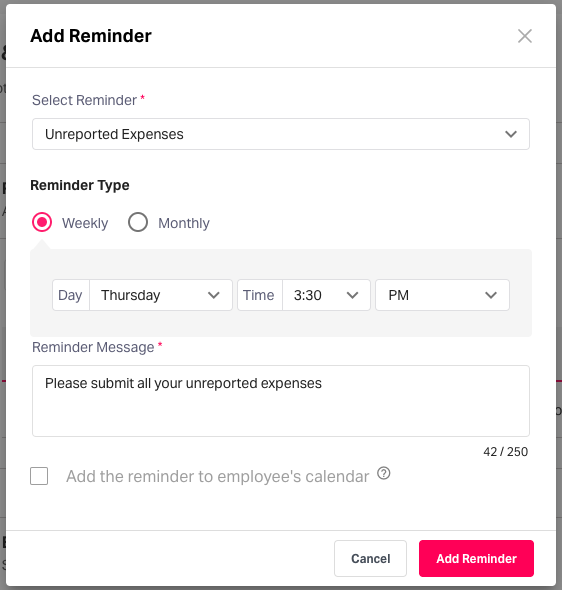

Notifications and reminders

Decide which expense-related notifications you want to send your employees.

You can also set automated reminders either weekly or monthly at a specified time for recurring expense-related activities. For example, remind employees to report expenses, match corporate card expenses, and match expenses with advances. Additionally, if they are approvers, you can remind them to approve pending expense reports.

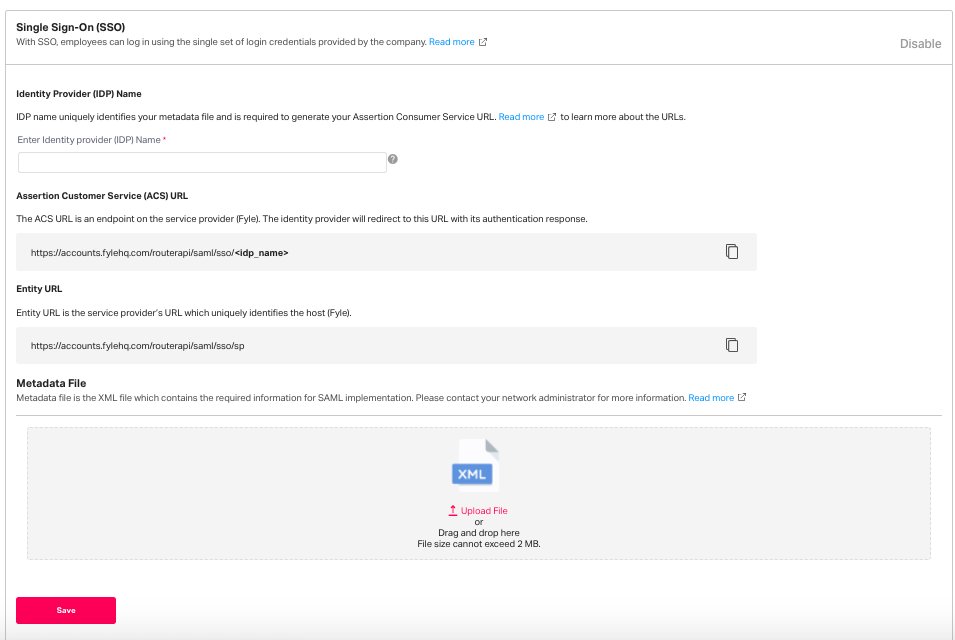

Security

Add a layer of protection to your expense data in this step. Configure Single Sign-On so that employees can quickly log in to their account using a set of credentials provided by the company.

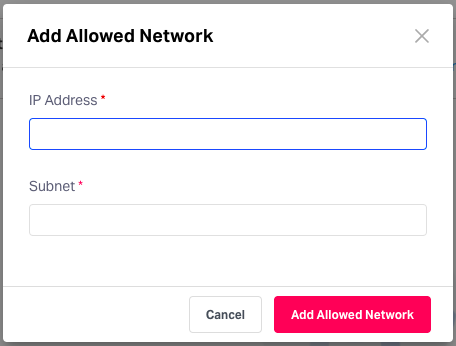

You can also set up IP restrictions so that admins cannot access sensitive expense data outside of your preferred networks.

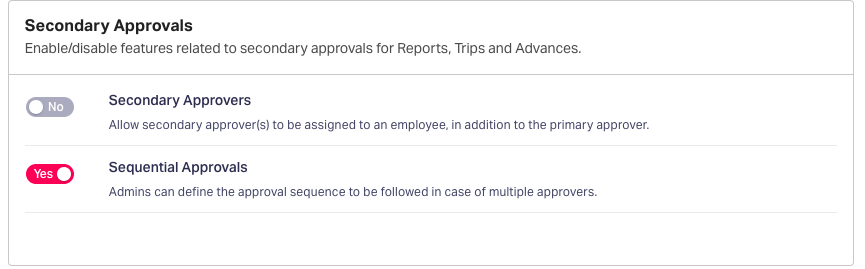

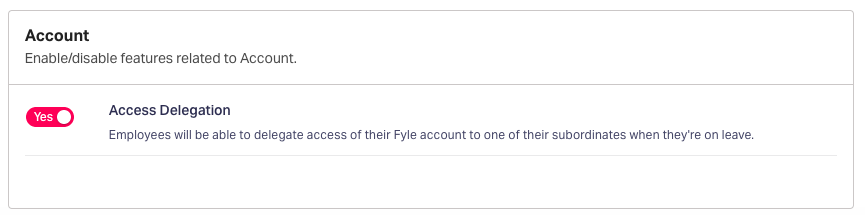

Advanced settings

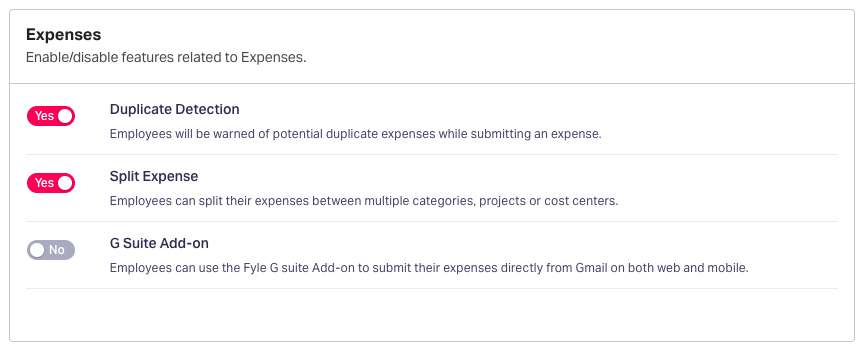

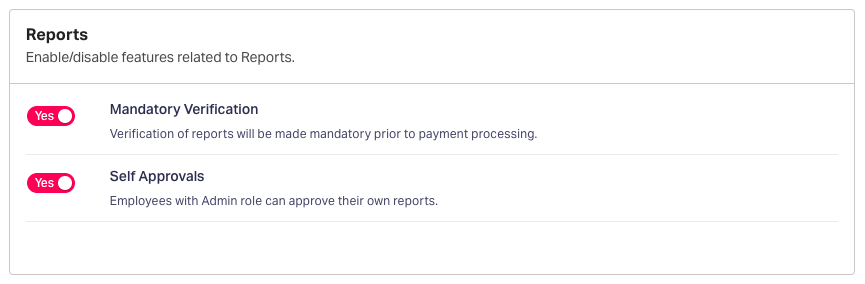

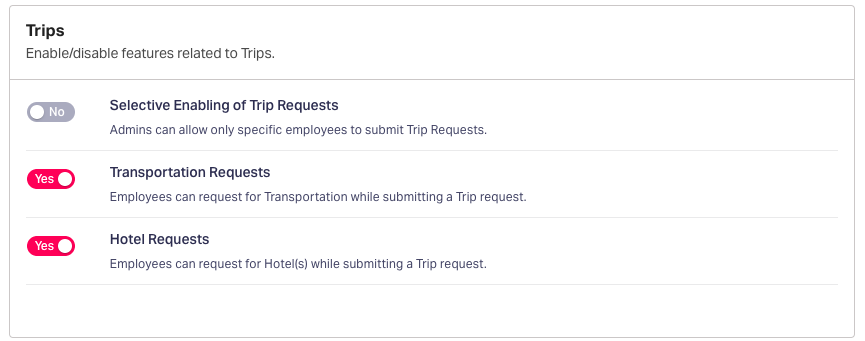

Enable or disable features related to expenses, reports, and approvals as per your organization's needs. Only use/access features that are relevant to your organization to make the experience much simpler.

Set up your Organization data

Once your basic account is set up, the next step is to configure how your organization works. Specify which categories, projects, departments, cost centers, levels, and holidays apply to your business.

Projects

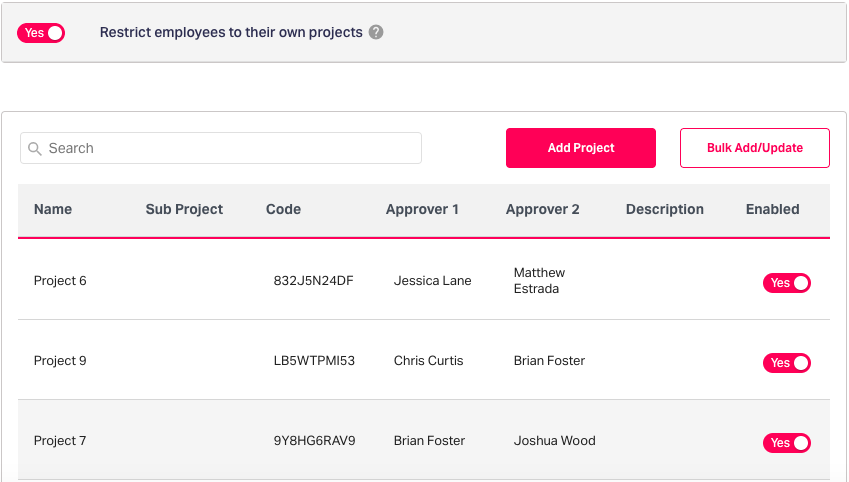

Define the projects your users are working on in this step. You can also bulk add/update projects and then track expenses by project easily. If your organization does not work on a project basis, you can disable this feature altogether.

Add sub-projects, applicable categories, and approvers for each project. If you do not want all employees to view all ongoing projects, you can restrict employees to their own projects.

If you're using accounting platforms like Sage Intacct, NetSuite or QBO, it's likely that you already have projects added on them. With Fyle's powerful integration with these software, project data gets mapped automatically, so you don’t have to do it manually.

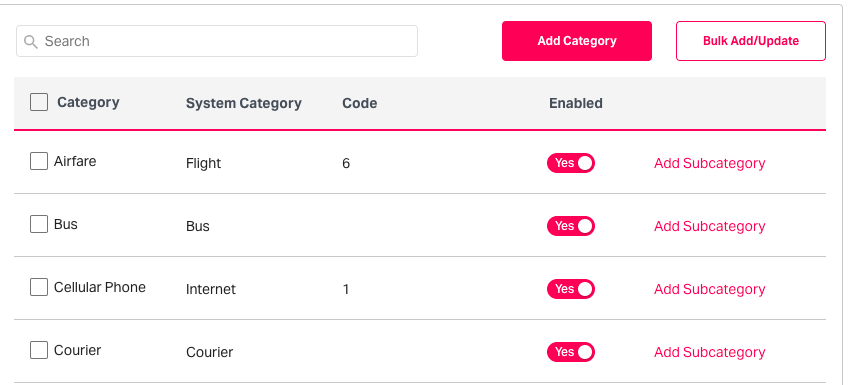

Categories

Set up the different categories that are used by employees while submitting expenses. You can set them up individually or bulk add/update them. Also, add subcategories for more transparent accounting.

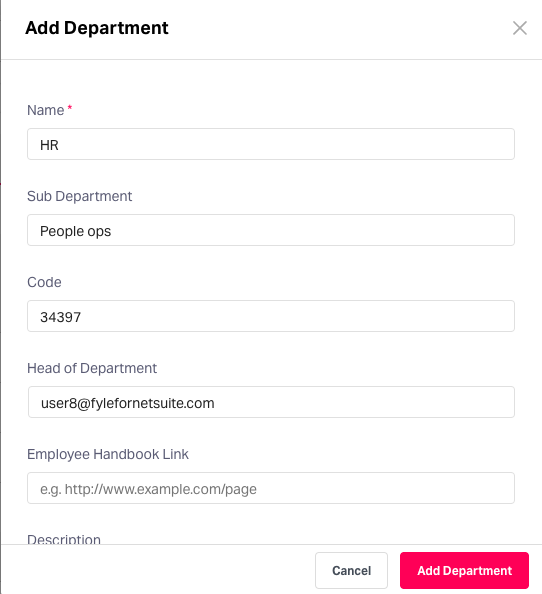

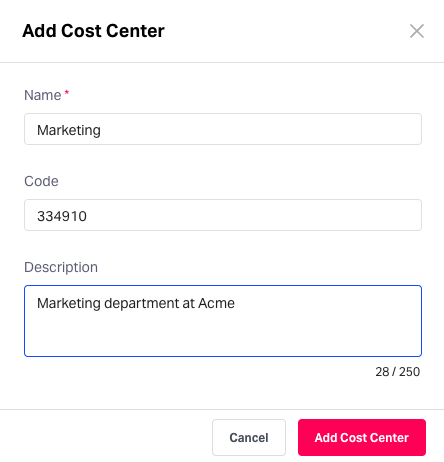

Departments and Cost Centers

Configure departments easily with Fyle. Add the head of the department, sub-departments, and a description, and you are good to go. Similarly, add cost centers that your organization works with.

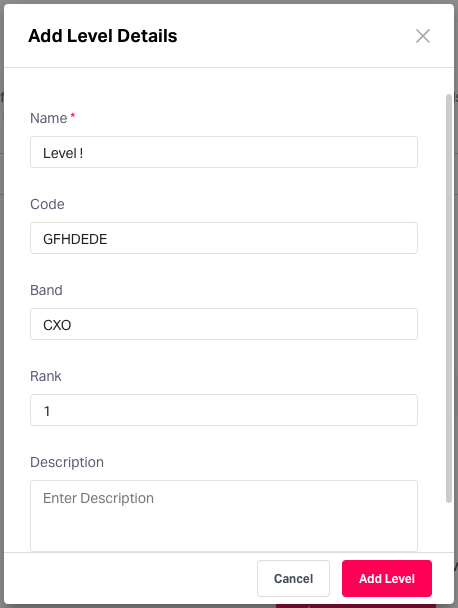

Levels

Add employee levels in this step. For example, your organization's CXO's could be Level 1, while the directors are Level 2, and so on. This helps you to configure policies and get deeper expenditure insights based on different employee levels.

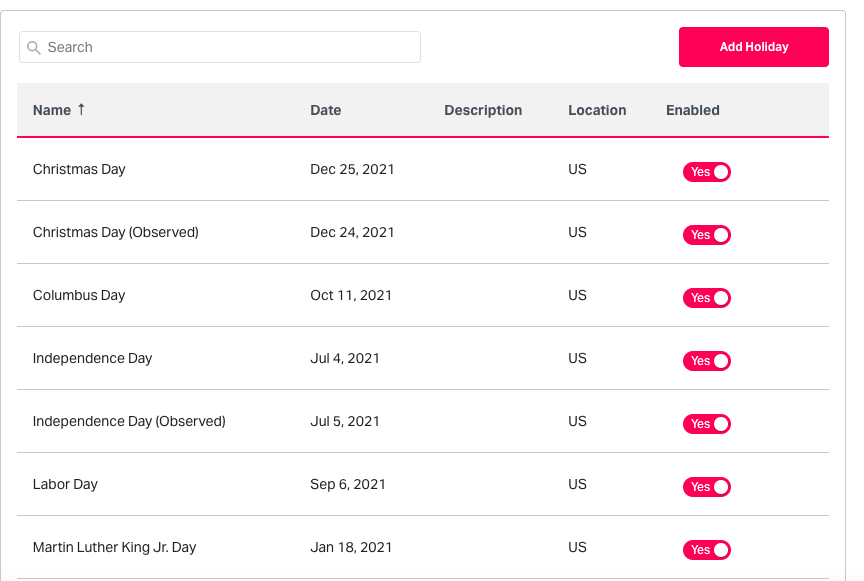

Holidays

Add all applicable holidays for your organization. By doing so, you can restrict employees from submitting expenses on these holidays.

Expense settings

Decide how your expense form looks, what policies apply, set up budgets, and more in this step.

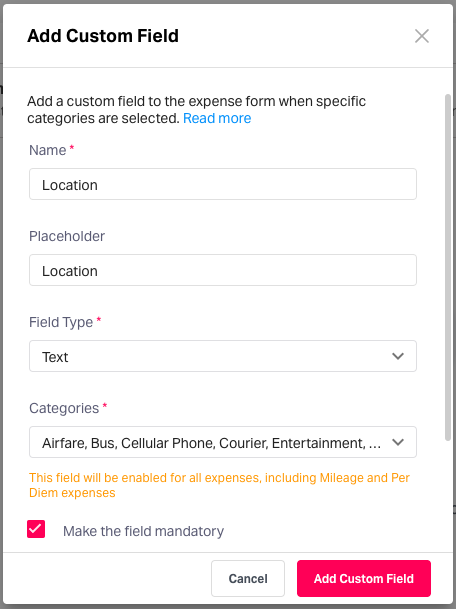

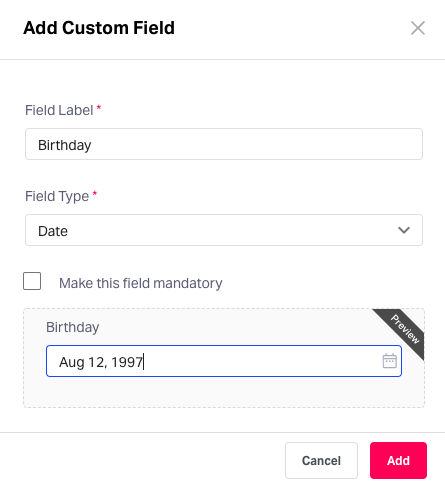

Form fields

By default, Fyle captures essential expense information like category, cost center, date of spend, vendor, project, and purpose. But, if there are more fields that you want to capture, you can add custom form fields. Specify the name, field type, and applicable categories, and you are done. You can also choose if the field needs to be mandatory or not.

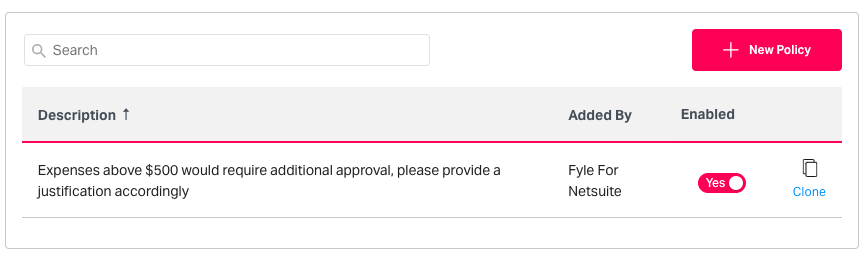

Policies

Configuring expense policies has never been this easy. Our policy form ensures that you can design simple as well as the most complex policies with ease. Read more on how you can set up policies for expenses in this article.

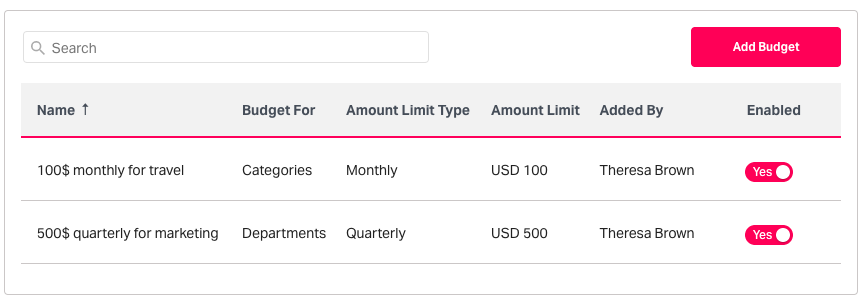

Budgets

Keep a check on overspending by configuring detailed budgets for projects, departments, cost centers, and expense categories. This article elaborates how you can quickly set up spend limits for your organization.

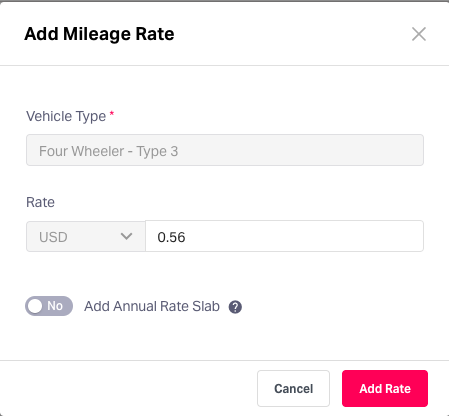

Mileages and Per diems

Configure mileage rates by vehicle type for your employees. You can add new mileage rates, restrict mileages to specific employees, and make location mandatory in the mileage expense form.

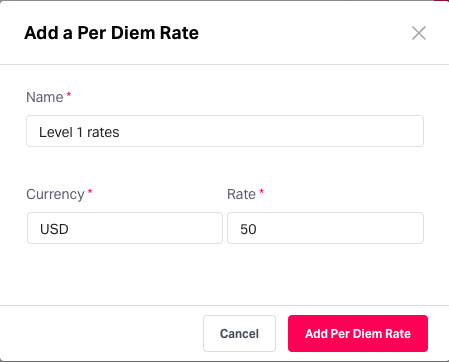

Set up per diems for employees who often travel for work. You can configure per diems in your home currency as well as foreign currencies. You can also choose to show per diem rates based on their department/level.

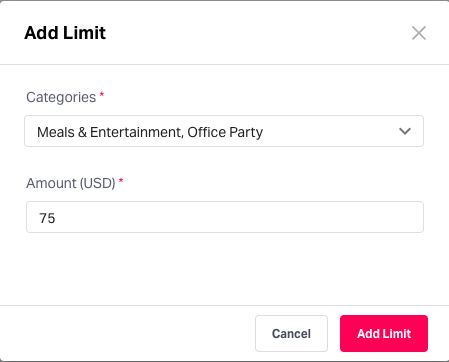

Receipts

The IRS specifies that expenses below $75 can be submitted without a receipt. Therefore, to make it easy for your employees, you can set up limits for receipt-less expenses. Choose the categories that the limit applies to, and Fyle will allow the submission of expenses even without a receipt.

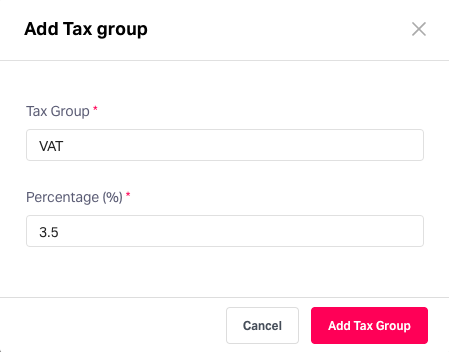

Tax groups and exchange rates

Add tax groups that apply to your business needs. All you need to do is name the tax group and specify the percentage of tax that is applicable. These taxes are then added to expenses submitted by employees.

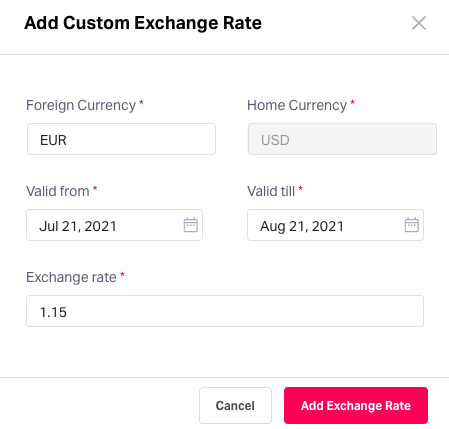

You can also set up custom exchange rates. If you do not want to use default exchange rates, configure custom rates for different foreign currencies. Choose the applicable foreign currency, specify the duration that this is applicable for, and set the rate. In case no custom exchange rate is determined, Fyle uses default system rates.

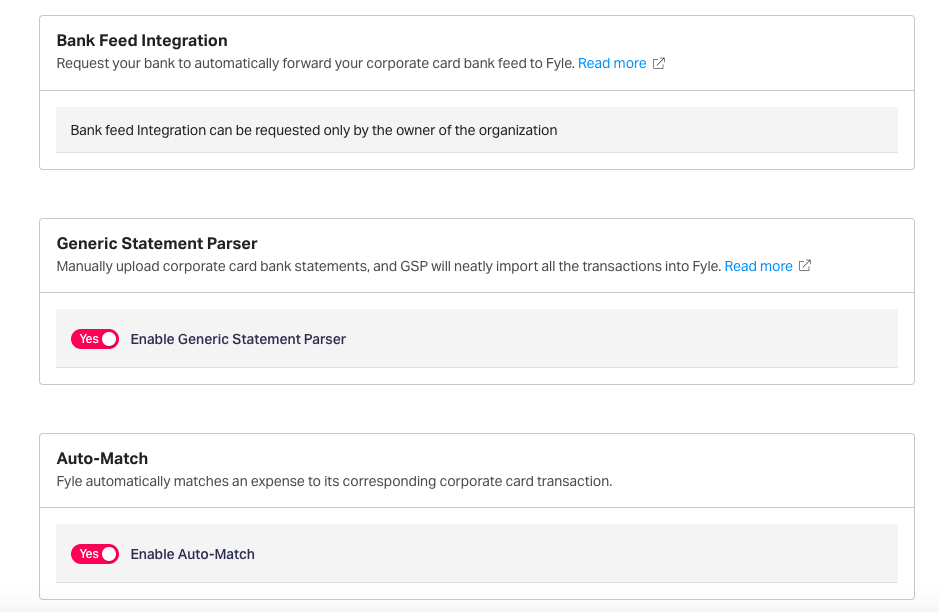

Setting up Cards

Configure how your corporate card process works in this step. You can enable direct bank feed integrations and generic statement parsers to allow the flow of card transactions into Fyle. Additionally, you can also choose to enable/disable the auto-match of expenses to corresponding card transactions according to your need.

Trips and Advances Controls

Configure custom fields and policies for trips and advances. Similar to expense policies, you can set up complex business rules that work for your business.

You can also add custom fields that will appear in the trip request and advance request forms to capture any additional information that is required.

Adding Employees to Fyle

Choose what data you want to capture while adding new employees to Fyle. You can add custom fields in addition to the system fields in the employee form.

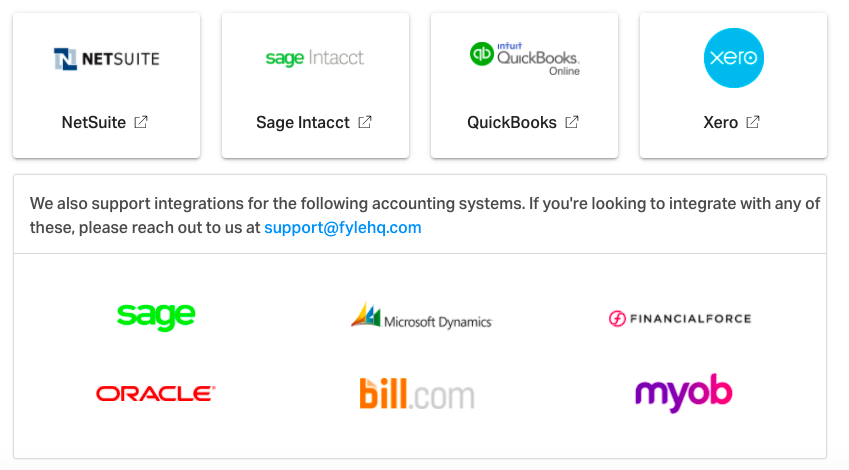

Integrations with Fyle

Fyle allows you to set up integrations with your accounting platform. We provide self-serve, tight-knit integrations with NetSuite, Sage Intacct, QuickBooks Online, and Xero. If you require assistance with other accounting platforms, you can contact our support team.

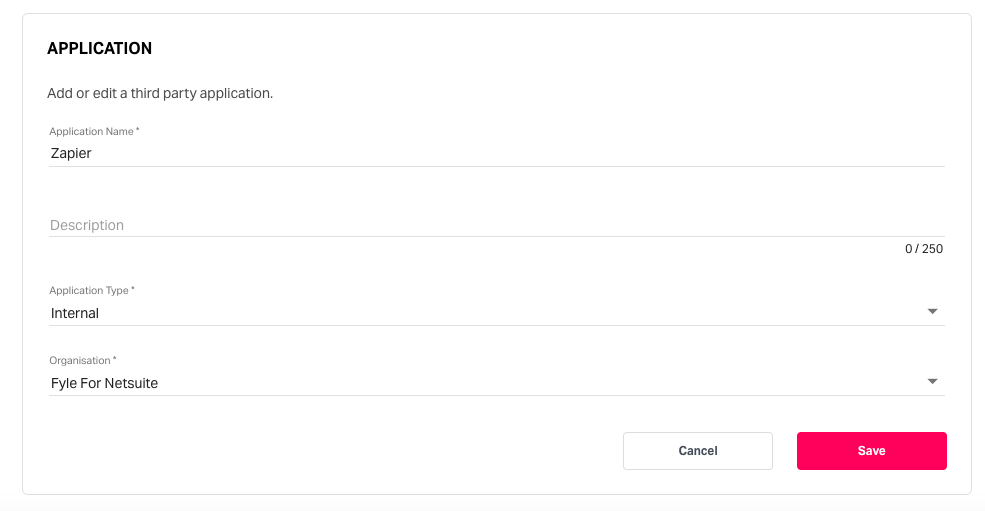

You can also build custom apps for your business using our well-documented APIs.

Get complete control and visibility with Fyle.

Choosing Fyle as your expense management platform allows you to specify how business expenses are tracked and managed in your organization. We believe that your account is truly yours to control and should be flexible and scalable enough to accommodate your varying business needs. Schedule a demo with us to learn how Fyle can automate your expense management process.