For any finance team, the discovery of an error in an expense report triggers a familiar, frustrating chain of events: stop the approval, contact the employee, wait for a correction, and restart the process. These aren't just minor inconveniences; they are significant drains on your company's resources.

Each mistake, whether it's a simple typo or a missing receipt, consumes your team's valuable time and can lead to real financial losses.

A manual expense management process is inherently prone to human error. If your team is constantly bogged down fixing mistakes instead of focusing on strategic financial oversight, it's a clear sign that your process itself is the problem.

The Hidden Costs of Manual Expense Reports

A manual, spreadsheet-based expense reporting process is a breeding ground for inaccuracies. These errors aren't just isolated incidents; they are systemic flaws that create tangible financial and operational burdens on the business.

The High Cost and Ripple Effect of Manual Errors

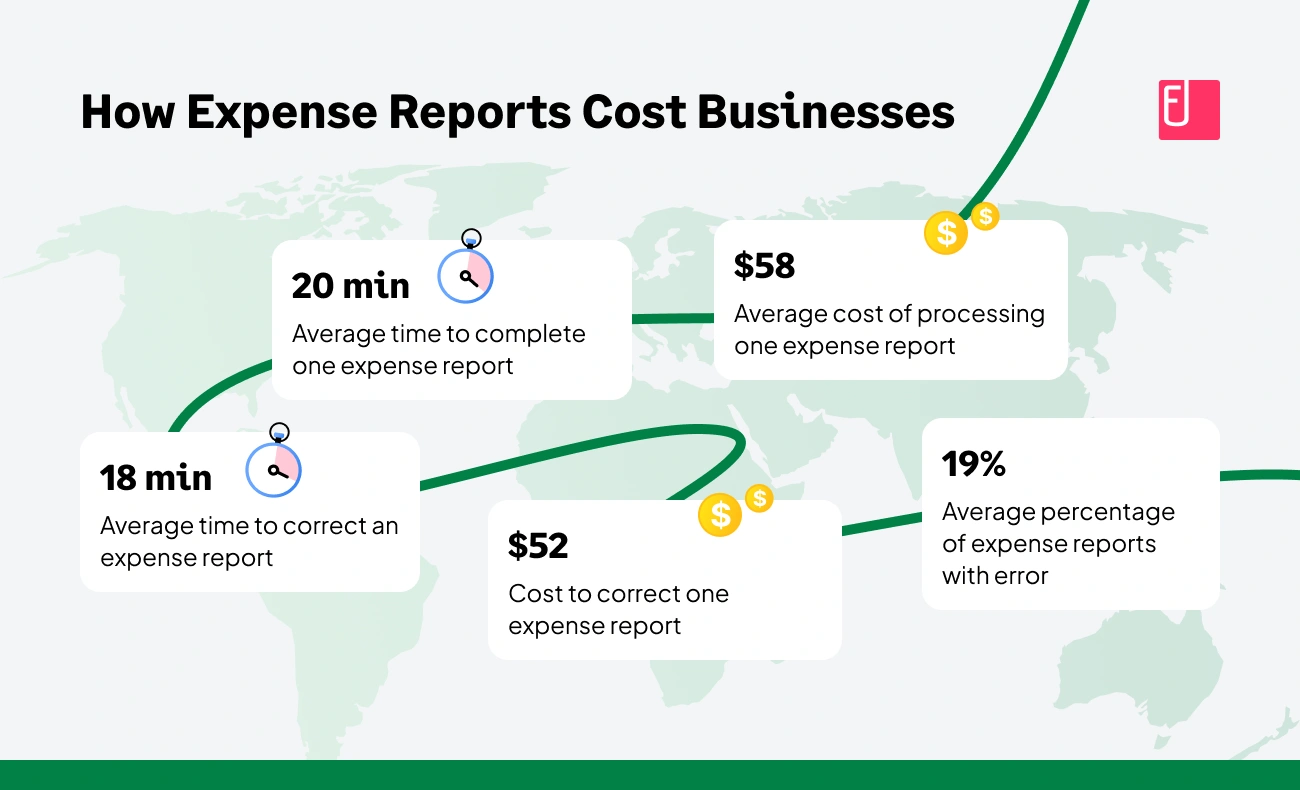

By its very nature, manual data entry is vulnerable to human error. Research consistently shows that one in five manual reports contains a mistake, and fixing it adds $50 per report in direct processing costs. These aren't just simple typos; they are often critical data integrity issues:

- Incorrect GL Coding: An employee mistakenly codes a marketing dinner under the Sales department GL, throwing off both departmental budgets.

- Transposition Errors: A transaction for $89.50 is accidentally entered as $98.50, a small but costly mistake that multiplies across hundreds of reports.

- Miscategorization: A purchase is labeled as Office Supplies when it should be Software, leading to inaccurate spend analysis.

Wasted Time and Frustration Across the Organization

The cost of an error extends far beyond the finance department. The correction cycle is a productivity black hole for the entire organization. What should be a five-minute approval easily becomes a 30-minute productivity sinkhole involving at least two employees.

Multiplied across dozens or hundreds of reports each month, this translates into a massive, hidden drain on company-wide efficiency and a source of constant frustration.

Duplicate Submissions

In a manual system that relies on human memory, duplicate submissions are inevitable. An employee might accidentally submit an e-receipt from their email and later submit the physical receipt from their wallet for the same purchase.

Without an automated system to cross-reference entries, these duplicates can easily slip through, leading to direct financial losses from over-reimbursements. This also creates an opening for potential fraud, as the lack of systemic checks makes it easier to submit the same expense multiple times deliberately.

Compliance Risks from Incomplete Data

A missing receipt isn't just a nuisance; it's a critical compliance failure. During an IRS or internal audit, every business expense must be substantiated. A missing receipt for a significant purchase means an incomplete audit trail and a potential disallowed tax deduction, turning a compliance oversight into a direct financial penalty.

The time your team spends chasing employees for documentation is immense, but failing to provide it to an auditor costs your company credibility and money.

Why Errors Hit Different Industries Harder

While all businesses suffer from manual errors, the consequences are uniquely damaging in specific sectors where data accuracy is paramount.

Construction

In construction, precise job costing is the key to profitability. A single coding error assigning a lumber purchase to Project A instead of Project B doesn't just skew one budget; it skews two.

This leads to inaccurate client billing, potential disputes over invoices, and a completely flawed analysis of which projects are profitable. Project managers end up making critical decisions based on bad data, putting the entire company's margins at risk.

Non-Profit

For non-profits, financial integrity is directly linked to their ability to operate. They rely on fund accounting, meaning every expense must be meticulously tracked against a specific restricted grant or unrestricted operational fund.

An incorrect grant code is not just a bookkeeping error; it's a violation of the legal agreement with a donor. This can lead to disastrous audit findings, damage to the organization's reputation, and jeopardize future funding.

- Also Read: What is Bookkeeping and why is it important?

IT & Tech

Fast-growing tech companies live on data. They need precise tracking of recurring SaaS subscriptions and cloud spending to understand their departmental burn rate and operational efficiency.

A simple coding error that gets repeated monthly can significantly distort budget analysis and prevent leaders from accurately calculating key metrics like Customer Acquisition Cost (CAC). For public or pre-IPO companies, these internal control weaknesses are a major Sarbanes-Oxley (SOX) compliance concern.

Mid-Market

As companies scale into the mid-market, the volume of transactions multiplies exponentially. The manual processes that were once manageable have become a major operational bottleneck.

The cumulative impact of hundreds of small errors drains thousands of dollars and hundreds of hours from the finance team each month, preventing them from focusing on the strategic financial planning needed to support the company's growth.

How Sage Expense Management (formerly Fyle) Eliminates Expense Report Errors

Sage Expense Management is designed to remove human error from the equation by automating the entire expense reporting process, ensuring data is accurate from the point of purchase all the way to your general ledger.

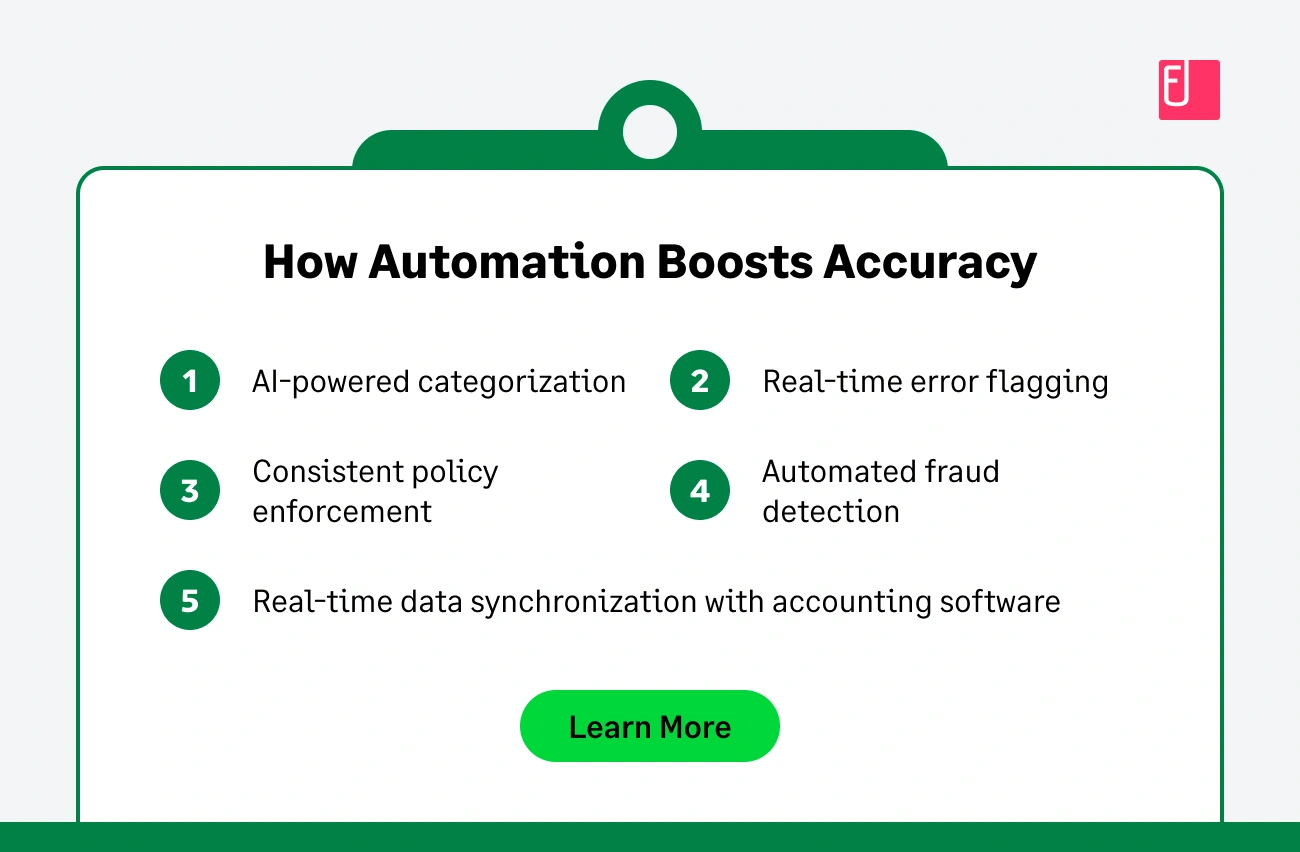

AI-Powered Data Extraction

Sage Expense Management uses sophisticated Optical Character Recognition (OCR) technology to automatically read and extract critical data from receipt photos, including the merchant name, amount, date, currency, and tax details with incredibly high accuracy. This eliminates manual keying, preventing typos and data entry errors at the source.

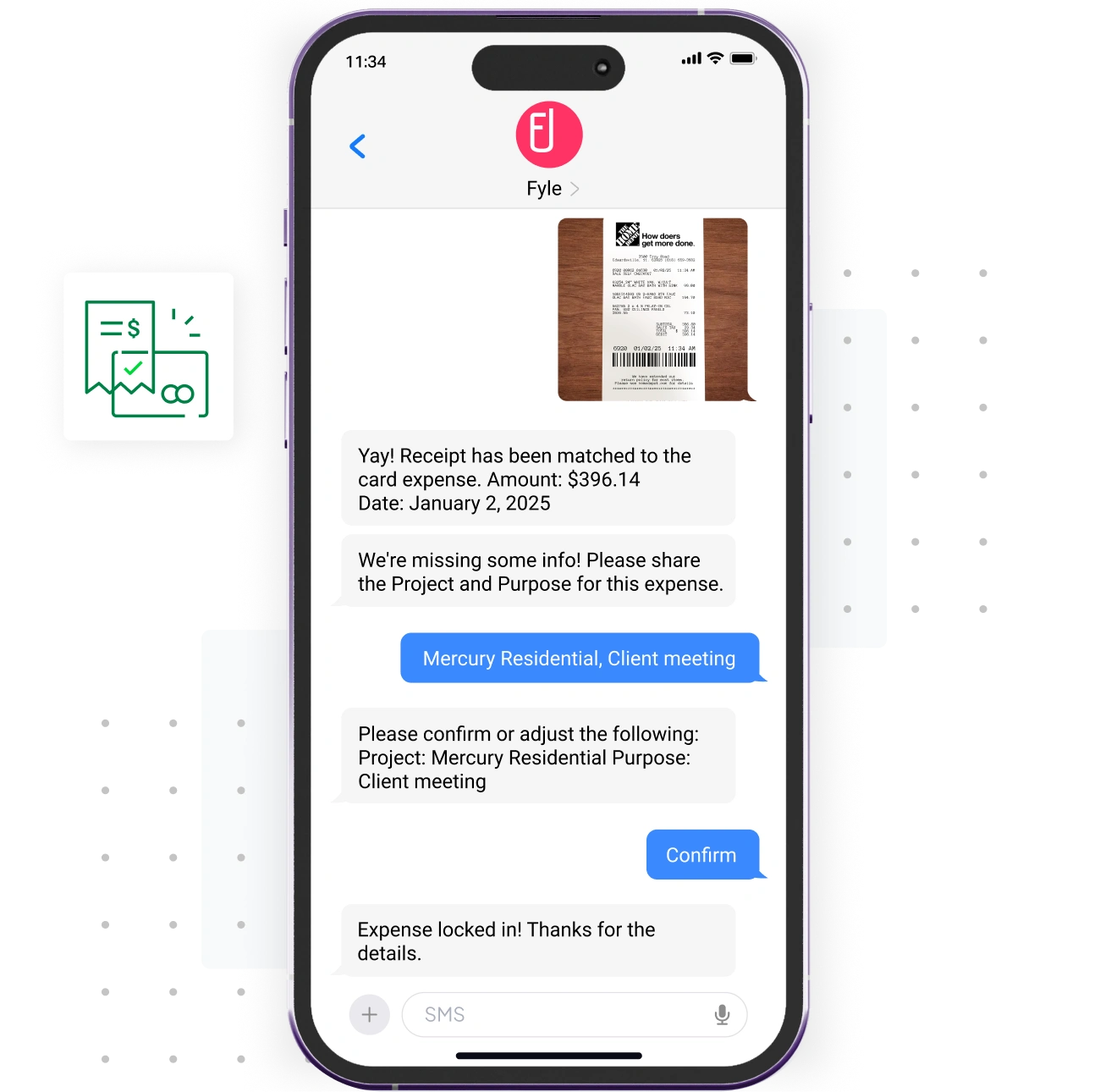

Real-Time Credit Card Feeds

Sage Expense Management syncs directly with major credit card networks such as Visa and Mastercard to pull transaction data the moment a card is swiped. Our platform automatically matches receipts to the corresponding card transactions in seconds, slashing manual effort and reducing a process that takes hours to just minutes.

This serves as the 100% accurate source of truth, ensuring the transaction amount and merchant information are perfect and can't be altered by human error.

Automated Duplicate Detection

Our platform acts as a crucial safety net by automatically cross-referencing every new submission against past expenses. It flags potential duplicates based on matching amounts, dates, and merchants, alerting approvers before an overpayment occurs and preventing both accidental errors and potential fraud.

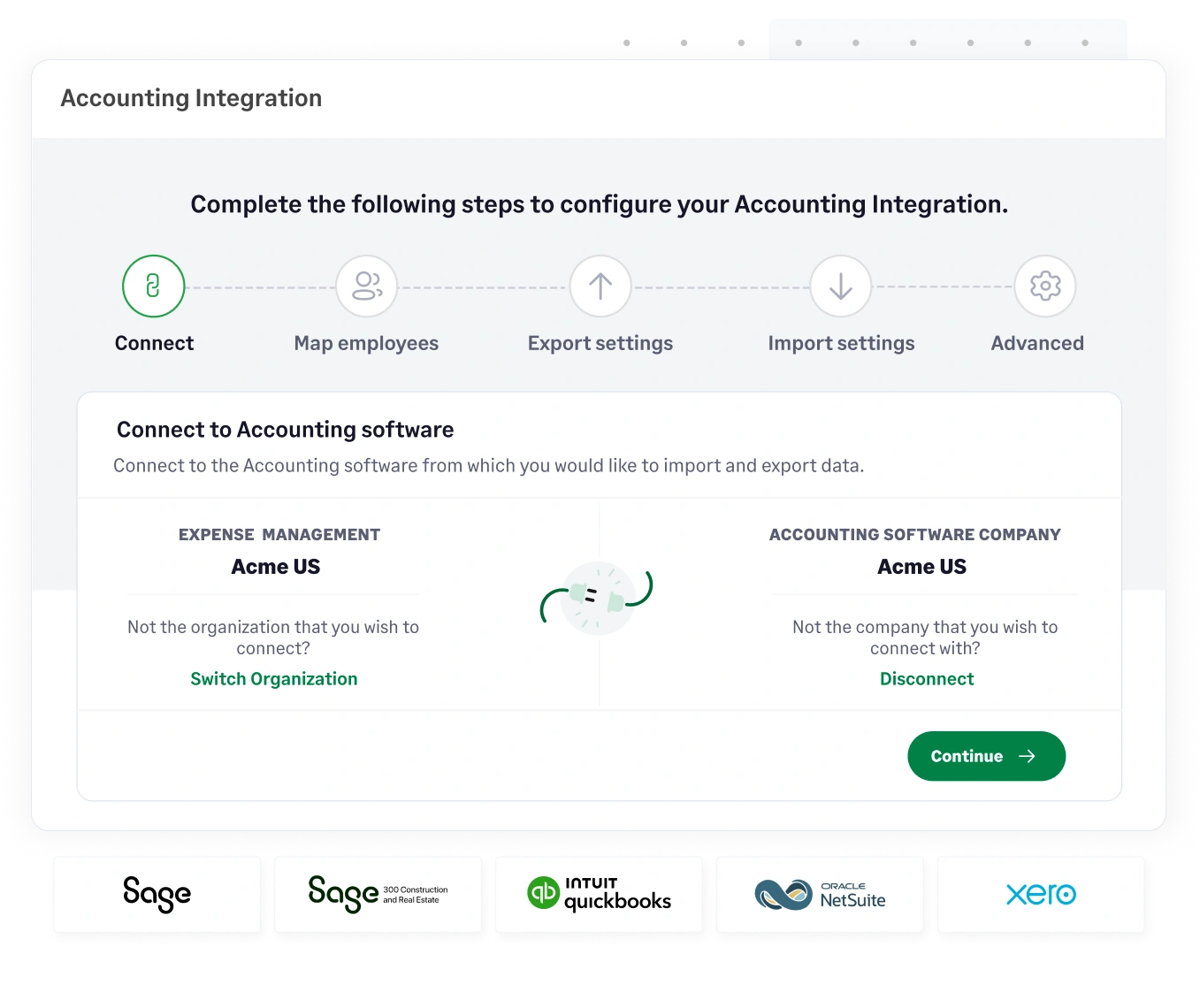

Direct Accounting Integrations

Sage Expense Management eliminates the final and most common point of failure: manual data transfer. Our deep, two-way integrations seamlessly sync with QuickBooks, Sage Intacct, NetSuite, and other systems.

We import your chart of accounts so employees code expenses correctly from the start, and then export fully verified data directly into your general ledger, guaranteeing end-to-end data integrity.

From Fixing Errors to Driving Strategy

Manual processes guarantee a frustrating and expensive cycle of mistakes, corrections, and wasted time. This reactive workflow traps your finance team in a low-value administrative loop, preventing them from contributing strategically.

Automated expense management with Sage Expense Management completely flips the script. By ensuring data is accurate from the start, you empower your finance professionals to move from reactive error correction to proactive financial strategy. They can finally focus on analyzing spend trends, optimizing budgets, and providing the critical insights that drive smart business decisions.

.jpg)