Starting an eCommerce business is challenging but rewarding. While selling online is easier than a physical store, you may also have more competition. Additionally, this business model requires technical know-how and a good understanding of the digital landscape.

One of the most important steps is to learn how to make a website that appeals to customers and search engines. One option is to use a low-code/no-code website builder, which eliminates the need for coding. All you need to do is drag and drop your content, product photos, and web pages where you want them to be.

It is also essential to set a budget and avoid common financial mistakes. For example, many entrepreneurs carry too much inventory, which drives their costs up. Others end up losing money simply because they undervalue their products.

In this blog, we’ve compiled a list of all the financial mistakes you can avoid when starting your online store. Read on to find out!

Underestimating Your Startup Costs

Online stores often involve lower costs than brick-and-mortar businesses. However, you still need to understand and anticipate your expenses, including those that may not be obvious initially.

Typical startup costs include:

- Product development and research

- Business insurance, licenses, and permits

- Market research expenses

- Shipping and packaging

- Payment processing fees

- Marketing and advertising

- Accounting software

- Inventory management software

- Employee wages

- Domain registration and hosting

- Website maintenance

- Legal assistance

How much you'll spend depends on your business structure, what you sell online, and other factors.

For example, you won't need to invest in product development and research if you start a dropshipping business. That's great, but you still need to factor in the cost of web hosting, marketing, business permits, and more.

Running an online store also requires access to specific tools, and the costs can add up quickly. At the very least, you'll need a reliable customer relationship management (CRM) system, marketing tools, and business tools, such as accounting software.

Apart from that, it may be necessary to carry different types of insurance, depending on what you're going to sell and whether or not you'll hire people.

For instance, companies selling electronics, cosmetics, or other physical products may benefit from product liability insurance. If you have employees, you're legally required to carry workers’ compensation insurance and disability coverage.

You also need to consider the cost of utilities, office supplies, and computer equipment, such as a quality webcam, printers, and hard drives. These recurring operating expenses can run into hundreds of dollars per month.

Also Read:

Setting the Wrong Price

Many startup founders believe that selling below market value will give them a competitive advantage. Unfortunately, nothing could be further from the truth.

Underpricing your products may diminish their perceived value, which can affect sales. This approach can also reflect poorly on your brand, making it harder to scale up the business later on.

Overpricing isn't better, either. If you go this route, potential customers may lose interest in your offering and your customer satisfaction index might reduce drastically.

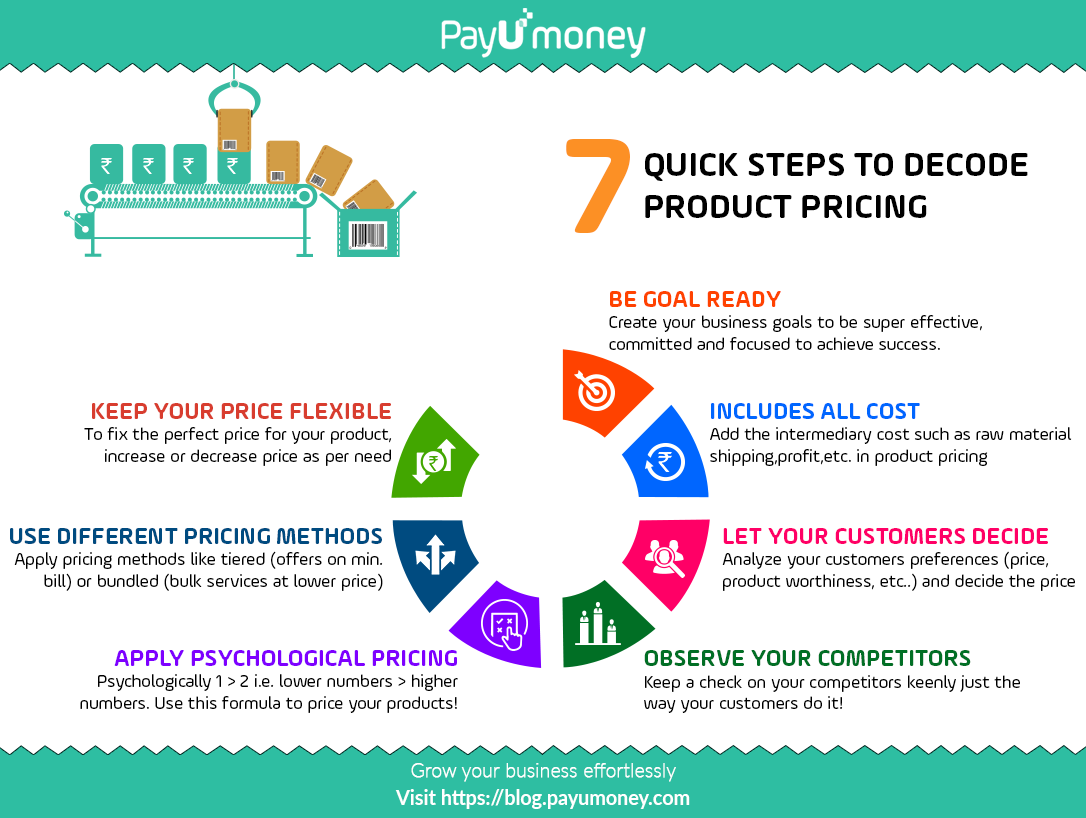

Given these aspects, it's crucial to research the market, your target audience, and other vendors in your niche before choosing a pricing strategy.

For example, customer research can help you determine how much potential buyers are willing to pay for your products. Sure, you can set a slightly higher price than your competitors, but you'll have to develop a strong value proposition.

Harvard Business School Online offers these questions to help you develop a strong value proposition:

Ask yourself:

- What is my brand offering?

- What job does the customer hire my brand to do?

- What companies and products compete with my brand to do this job for the customer?

- What sets my brand apart from those competitors?

Overspending on Website Development

Website design directly impacts customer satisfaction, loyalty, and trust. If done right, it can set your brand apart and drive conversions.

The problem is that most web developers and designers charge thousands of dollars. Additionally, you might end up overspending on bells and whistles that don't directly contribute to sales.

Your best bet is to choose a web designer or a website builder with customizable templates and do the legwork yourself.

You could create an online store without writing any code, depending on the platform used. Plus, you can list unlimited products, accept online payments, add your branding, and set up a blog.

Not Making a Business Plan

Starting and running an online store is no different than operating a traditional business. You still need to conduct market research, define your audience, and set realistic financial goals, among other aspects.

With that in mind, draft a business plan that reflects your vision. This document should include detailed information about your target market, competitors, products and services, business expenses, legal requirements, etc.

Skipping this step can make it difficult to anticipate financial risks and allocate resources effectively. In the worst-case scenario, you might run out of money before making your first sale.

Go one step further and create a financial plan for your small business. This way, you’ll better predict and mitigate risks, manage your cash flow, and avoid unnecessary expenses.

Overstocking Inventory

Another common financial mistake is holding too much inventory.

Not only does overstocking reduce the available cash flow, but it can also increase storage and handling costs. Additionally, your products may expire or become obsolete.

To avoid these issues:

- Keep an eye on both economic and market trends.

- Most importantly, use a robust inventory management system to monitor the status of products.

- Conduct inventory audits at least once a year, track changes in demand, and adjust stock levels as needed.

Alternatively, team up with a third-party logistics provider who can handle warehousing, packaging, and shipping. This option works best for online stores selling physical products nationwide or internationally.

Choosing the Wrong Business Structure

One of the first steps to starting an online store is choosing a business structure.

This aspect will influence what you pay in taxes and your profits. It also determines how you’ll secure funding and how much liability you have.

Generally, it's best to register an eCommerce business as a sole proprietorship, general partnership, or limited liability company (LLC). The right choice depends on your long-term goals and the types of products you plan to sell.

Take sole proprietorships, for example.

This option is suitable for online stores and other businesses without employees. Not only is it more convenient and requires less paperwork than a partnership or LLC, but it also gives you complete control over the company.

The downside is that you can be held liable for everything the company does. Therefore, a sole proprietorship is not ideal for those selling highly regulated products, medical devices, or other goods that may pose safety risks.

Additionally, securing funding as a sole proprietor can be challenging, at the very least.

Ignoring Cash Flow Management

Good cash flow management allows you to make sound financial decisions and allocate resources where they're needed most. At the same time, it makes it easier to manage debt and mitigate operational risks.

Ignoring this aspect could kill your small business. In fact, 38% of startups end up closing their doors because they run out of cash.

One important reason is their inability to manage cash flow, which can lead to overstocking or understocking, missed opportunities, and excessive debt.

The solution? Set a budget, track your profits and losses, and perform regular cash flow forecasts. Also, optimize your accounts payable and receivable to gain better insight into your finances.

Also Read:

Turn Your eCommerce Business into a Success

When you're a startup, it's easy to make financial mistakes that could easily become a disaster. Now, you're still learning the ropes and determining what works and what doesn't.

On the positive side, there are steps you can take to manage your finances better.

Consider using high-quality software to track your revenue and expenses. Leverage these insights to optimize resource allocation, inventory management, and operational costs.

Finally, remember that building a successful online store takes time. Start small, experiment with different pricing models, and get creative with your marketing. Track the results so you can focus your efforts where they'll have the most impact.