Navigating the ins and outs of mileage reimbursement can seem complex, but it's a crucial aspect of managing business expenses for employers and ensuring fair compensation for employees in Arizona. Whether you're an accountant, a small business owner, or an employee who drives for work, understanding Arizona's approach to mileage rates and relevant laws is key.

While Arizona doesn't have a blanket law compelling all private employers to reimburse for mileage in every situation, there are important considerations, especially concerning minimum wage laws and specific scenarios like workers' compensation.

This guide will walk you through the essential details, helping you stay compliant and informed.

Arizona Business Mileage Reimbursement Rate

For 2025, the Internal Revenue Service (IRS) has set the standard mileage rate for business use at 70 cents per mile. This rate was 67 cents per mile in 2024. Many private employers in Arizona choose to use the current IRS standard rate for reimbursing employees who use their personal vehicles for business purposes. This is a common practice because:

- It's a widely accepted benchmark.

- Reimbursements up to the IRS standard rate are generally non-taxable for the employee and tax-deductible for the employer.

- It simplifies calculations and policy-making.

It's important to note that the State of Arizona itself sets a mileage reimbursement rate for state government employees. As of January 27, 2025, this rate is 67 cents per mile. While this rate is mandatory for state employees, private employers are not legally bound to use it for general business mileage, but it often serves as another reference point.

Here are the mileage reimbursement rates in Arizona, published under Section 5095 of the State of Arizona Accounting Manual (SAAM).

Some Important Arizona Mileage Reimbursement Laws

While Arizona doesn't have a single, overarching law that mandates private employers to reimburse for all business-related mileage, there are several legal considerations and specific statutes that employers and employees should be aware of:

1. Arizona's Fair Wages and Healthy Families Act

This act establishes Arizona's minimum wage, which is $14.70 per hour as of January 1, 2025 (up from $14.35 in 2024).

The critical point here is that an employer's failure to reimburse necessary business expenses, such as mileage, cannot effectively reduce an employee's earnings below this state minimum wage for the hours worked in a given pay period.

If unreimbursed mileage costs dip an employee's "take-home" pay below the minimum wage threshold for their hours worked, it could be considered a violation.

2. Federal Fair Labor Standards Act (FLSA)

Similar to the state minimum wage law, the FLSA requires that employees receive at least the federal minimum wage (currently $7.25 per hour) "free and clear."

If unreimbursed business expenses (including mileage) reduce an employee’s earnings below the federal minimum wage, the employer may be required to make up the difference.

3. Workers' Compensation - Travel for Medical Treatment (ARS 23-1062)

Arizona law (specifically ARS 23-1062) does mandate mileage reimbursement in a specific situation: when an employee who has suffered a work-related injury needs to travel more than 25 miles (one way from their residence) to obtain medical examination or treatment.

Employers are required to reimburse for this travel. The reimbursement rate for this is often aligned with the rate set for state employees.

4. No General Mandate for Private Employers

Outside of the minimum wage protection and the specific workers' compensation scenario, private employers in Arizona generally have the discretion to set their own mileage reimbursement policies or choose not to reimburse for mileage.

However, offering mileage reimbursement is a common and good business practice for attracting and retaining employees and covering legitimate business costs incurred by them.

Arizona Mileage Reimbursement Law vs. Federal Law

The primary federal law that intersects with mileage reimbursement (though indirectly) is the Fair Labor Standards Act (FLSA).

FLSA

- As mentioned, the FLSA mandates that employees receive at least the federal minimum wage ($7.25 per hour) for all hours worked, free and clear of business expenses that primarily benefit the employer.

- If an Arizona employee's unreimbursed mileage expenses cause their effective hourly rate to drop below this federal minimum, the employer must reimburse enough to bring them back up to at least the federal minimum.

- This applies even if their wage is above Arizona's state minimum but falls below the federal minimum due to expenses.

Arizona Law

- Arizona's Fair Wages and Healthy Families Act sets a higher minimum wage ($14.70 per hour in 2025) than the federal FLSA. Therefore, in Arizona, the more stringent state minimum wage is usually the primary benchmark.

- If unreimbursed mileage drops an employee's earnings below either the state or federal minimum wage (whichever is applicable and higher for their situation), a violation may occur. Arizona also has the specific ARS 23-1062 concerning workers' compensation travel.

IRS Regulations

- While not "law" in the same sense as the FLSA or state statutes, IRS regulations provide the standard mileage rates (e.g., 70 cents per mile for business in 2025).

- These rates are for tax deduction purposes and are often used as a safe harbor for non-taxable reimbursement amounts. Following IRS guidelines for an "accountable plan" ensures that reimbursements are not considered taxable income for the employee.

In essence, federal law (FLSA) provides a baseline wage floor. Arizona law provides its own, higher minimum wage floor and has specific rules for workers' compensation travel. IRS guidelines offer a framework for the amount and tax treatment of mileage reimbursement, which many Arizona employers adopt for practical reasons.

How Sage Expense Management (formerly Fyle) Can Automate Mileage Tracking

Manually logging miles, deciphering handwritten notes, and ensuring compliance with either IRS rates or your company's policy can be a significant drain on time for both employees and finance teams in Arizona. Sage Expense Management offers a modern, automated solution to transform your mileage tracking and reimbursement process.

Here’s how we simplify mileage tracking and ensures accuracy:

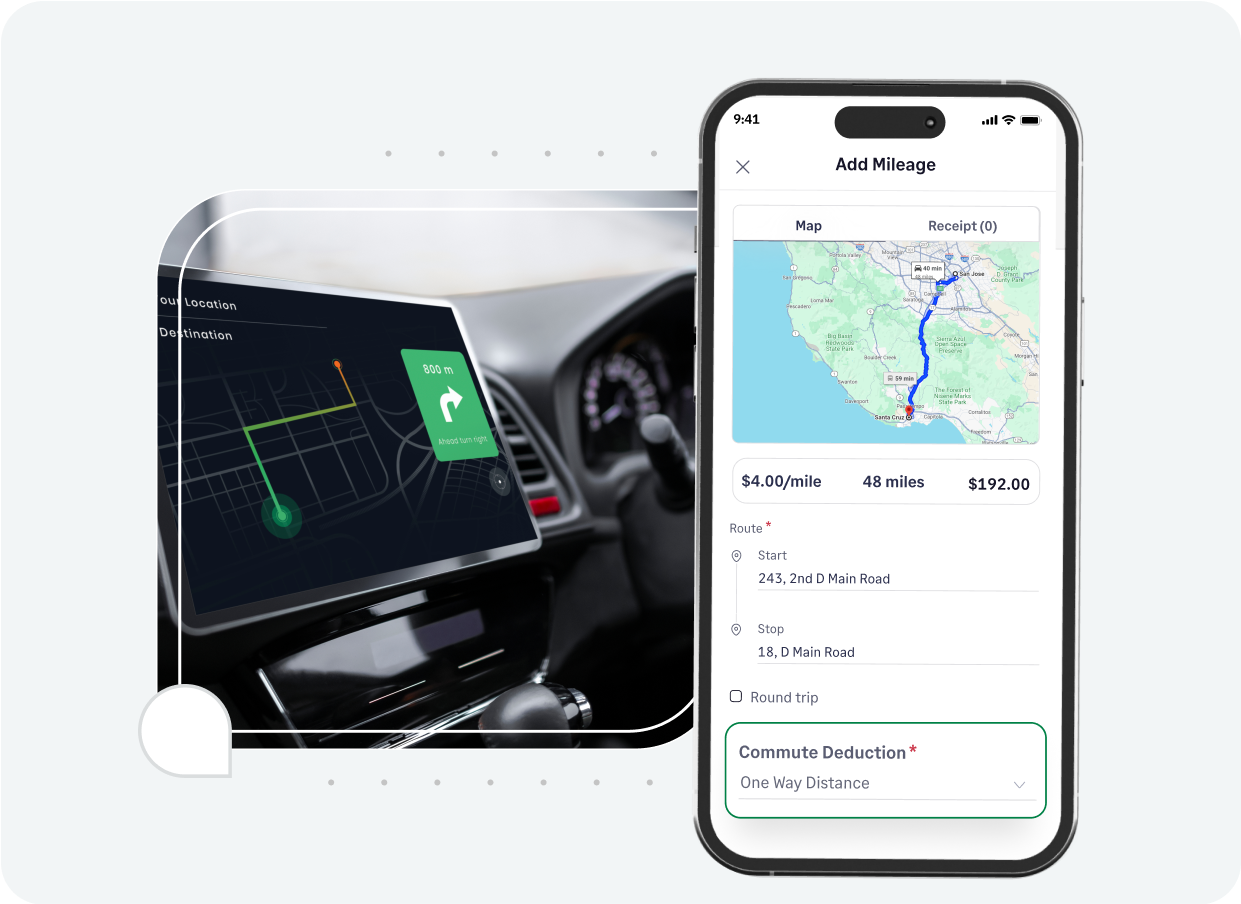

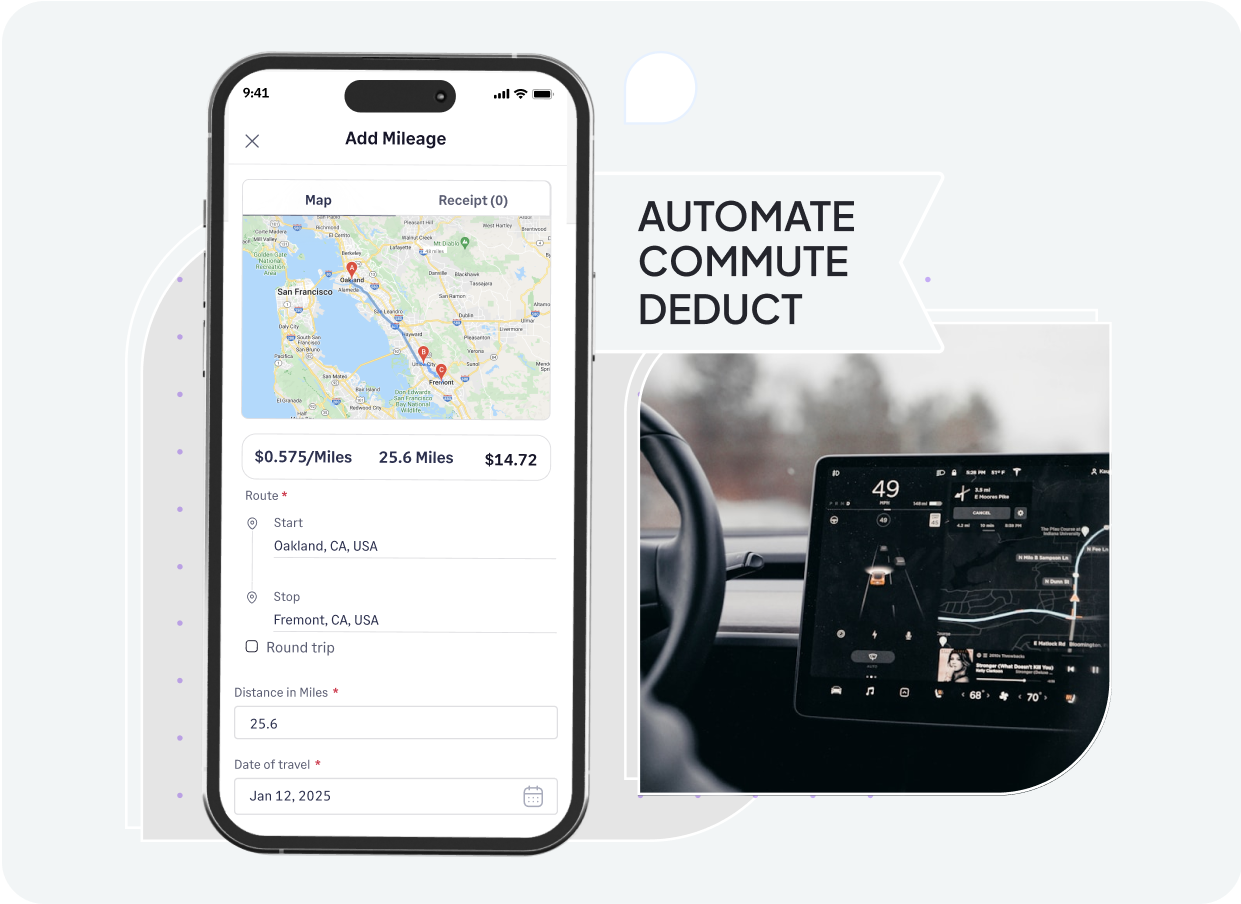

- Precise GPS-powered tracking: We utilize Google Maps integration to automatically and accurately calculate the distance traveled when employees input their start, stop, and end locations. This eliminates guesswork and potential inaccuracies from manual logging, ensuring you have reliable data for reimbursement.

- Flexible rate configuration: Finance teams can effortlessly set up custom mileage rates. Whether you adhere to the annual IRS standard rates, Arizona's state employee rate for specific contexts, or unique company-defined rates for different vehicle types (cars, trucks, etc.), Sage Expense Management accommodates your policy.

- Simplified commute deductions: Managing commute mileage, which is generally not reimbursable, is straightforward. Employees can input their home and work locations, and we can automatically calculate and help manage one-way or two-way commute deductions, with options to make these deductions mandatory, ensuring IRS-compliant calculations.

- Automated recurring trips: For employees who travel the same routes regularly, we allow them to set up recurring mileage claims—daily, weekly, or monthly. This fantastic time-saver removes the need for repetitive manual entries, reducing errors and effort.

- Robust policy enforcement: Embed your company's mileage reimbursement policies directly. You can create rules and constraints based on employee levels, departments, distance limits, or maximum claimable amounts. This proactive approach helps ensure that every submitted mileage claim is compliant with your internal guidelines and IRS rules before it even reaches approvers.

- Seamless accounting integration: Sage Expense Management integrates smoothly with leading accounting platforms such as NetSuite, QuickBooks (Online and Desktop), Xero, and more. Once mileage reports are approved, the data flows directly into your accounting system, eliminating manual data entry, reducing errors, and freeing up your finance team for more strategic activities.

- Direct employee reimbursements (ACH): For businesses in the US, we facilitates direct reimbursement of approved mileage claims to employees via ACH, ensuring timely payments and a complete, end-to-end expense management cycle right within the platform.

By choosing Sage Expense Management, Arizona businesses can move beyond cumbersome spreadsheets and manual processes, saving valuable hours, enhancing compliance, and ensuring employees are reimbursed accurately and efficiently for their business travel.

Ready to streamline your mileage reimbursement in Arizona?