Understanding mileage reimbursement in Washington State is key for ensuring fair compensation and compliance. The rules can vary depending on whether you're a state employee or work in the private sector, with additional local ordinances like Seattle's adding another layer.

This guide aims to clarify Washington's mileage reimbursement landscape, the standard rates often used, and how modern tools can make tracking and calculation straightforward.

Washington Mileage Reimbursement Rate

Washington State does not have a single, universally mandated mileage reimbursement rate that applies to all employers across the state. The applicable rate or reimbursement practice often depends on employment type (state vs. private) and location (e.g., Seattle).

For State Employees

Washington State employees are covered by RCW 43.03.060. Under this law, the mileage rate for using a privately-owned vehicle (POV) for official business is set by the Washington State Office of Financial Management (OFM). This rate is determined when POV use is more advantageous or economical to the state and generally aligns with or does not exceed the current IRS standard business rate. For example, the IRS standard business rate for 2025 is 70 cents per mile.

For Private Sector Employees

For private sector employees outside of specific locales like Seattle, there isn't a state law mandating a specific mileage reimbursement rate. However, employers often use the standard mileage rates set by the IRS as a reliable benchmark. This practice helps in fair compensation and can be important for complying with the Washington Minimum Wage Act (WMWA), which requires that unreimbursed expenses do not cause an employee's effective wage to fall below the state minimum.

The standard IRS mileage rates for 2025 are:

- Business Use: 70 cents per mile

- Medical/Moving: 21 cents per mile (Note: The deduction for moving expenses is generally only available for active-duty members of the U.S. Armed Forces)

- Charitable: 14 cents per mile

Here's a look at the recent standard business mileage rates commonly used in Washington as a benchmark:

Using the current IRS standard rate is a common approach for Washington employers in the private sector to ensure fairness and to help meet their obligations under wage laws.

Washington Mileage Reimbursement Calculator

This calculator simplifies determining your mileage reimbursement. Here’s how:

- Choose the Tax Year: Select the relevant year for your calculation (e.g., 2025, 2024). The calculator will apply the appropriate IRS standard mileage rates for that year.

- Input Your Mileage: Enter the total miles driven for business, medical/moving, and charitable purposes in the respective fields.

- Get Your Results: Click the "Calculate" button to see the estimated reimbursement amount based on your mileage and the selected year's standard rates.

This tool is beneficial for both employees tracking their travel expenses and employers needing to calculate reimbursements.

Calculate

Results

Some Important Washington Mileage Reimbursement Laws

Washington's legal framework for mileage reimbursement has distinct rules for state employees and considerations for private sector employers, including the influential Washington Minimum Wage Act and specific city ordinances.

Washington Mileage Reimbursement Code for State Employees

This law, Revised Code of Washington (RCW) 43.03.060, specifically addresses mileage allowances for state officials and employees. Key aspects include:

- Official Business: It applies when state employees must travel using their privately-owned vehicle (POV) for official duties.

- Advantageous to State: POV use must be deemed more advantageous or economical than using a common carrier or a state-owned vehicle.

- Rate Setting: The mileage rate is established by the state's Director of Financial Management. This rate cannot exceed a threshold set by the U.S. Treasury Department (typically the IRS standard rate) that would trigger additional substantiation requirements.

Mileage Reimbursement for Private Sector Employees

For those working in the private sector in Washington, the rules are different:

Washington Minimum Wage Act

While Washington State doesn't have a direct law compelling all private employers to reimburse mileage, the WMWA plays a crucial role. Employers must ensure that any unreimbursed necessary business expenses, such as mileage for required work travel, do not cause an employee's effective earnings to fall below Washington's state minimum wage.

Since Washington's minimum wage is significantly higher than the federal minimum, this is a key consideration for employers.

Seattle's Local Ordinance on Expense Reimbursement

It's important to be aware of local laws. The City of Seattle has an ordinance that requires employers within its jurisdiction to reimburse employees for all necessary job-related expenses. This is similar to California's state-wide mandate and means Seattle-based employers must cover costs like mileage if incurred for work.

Common Practice for Private Employers

Many private employers in Washington, even outside Seattle, choose to reimburse mileage at the current IRS standard rate. This is considered a best practice for fairness, employee retention, and helps ensure compliance with the WMWA.

What is the WAC 16-240-050?

Washington Administrative Code (WAC) 16-240-050 deals with "Calculating travel time, mileage and per diem." This specific regulation details how certain state departments (likely the Department of Agriculture, based on statutory references) charge applicants for services when department personnel need to travel.

- Context-Specific: It applies to billing external parties for the travel costs of state employees performing official duties like inspections.

- Reference to OFM Rate: Significantly, WAC 16-240-050(2)(c) states that the mileage rate charged to these applicants is based on the "state of Washington office of financial management private vehicle mileage reimbursement rate." This underscores the Office of Financial Management's role in setting an official state POV rate, which is also referenced in RCW 43.03.060 for state employee reimbursement.

Washington Mileage Reimbursement Law vs Federal Law

Understanding the interplay between Washington's rules and federal law (primarily the Fair Labor Standards Act - FLSA) is important:

- Washington state employees: Have specific rights to mileage reimbursement under RCW 43.03.060, with rates set by the OFM.

- Washington private sector employees (statewide): No direct state reimbursement mandate, but the Washington Minimum Wage Act (WMWA) offers protection by ensuring net earnings don't fall below the state minimum wage due to unreimbursed expenses. Washington's minimum wage is considerably higher than the federal rate.

- Washington private sector employees (Seattle): Mandated reimbursement for necessary expenses under a city ordinance.

- Federal Law (FLSA): Requires that unreimbursed expenses do not drop an employee's pay below the federal minimum wage. For many Washington employees, the WMWA provides a more relevant and higher baseline.

In essence, while federal law provides a baseline, Washington's own Minimum Wage Act and specific local ordinances like Seattle's often set a higher standard for consideration regarding employee expenses.

How Sage Expense Management (formerly Fyle) Can Automate Mileage Tracking

Whether you're ensuring compliance with OFM rates for state-related work, managing expenses under Seattle's ordinance, adhering to the Washington Minimum Wage Act, or simply following best practices using IRS rates, Sage Expense Management offers robust automation for mileage tracking.

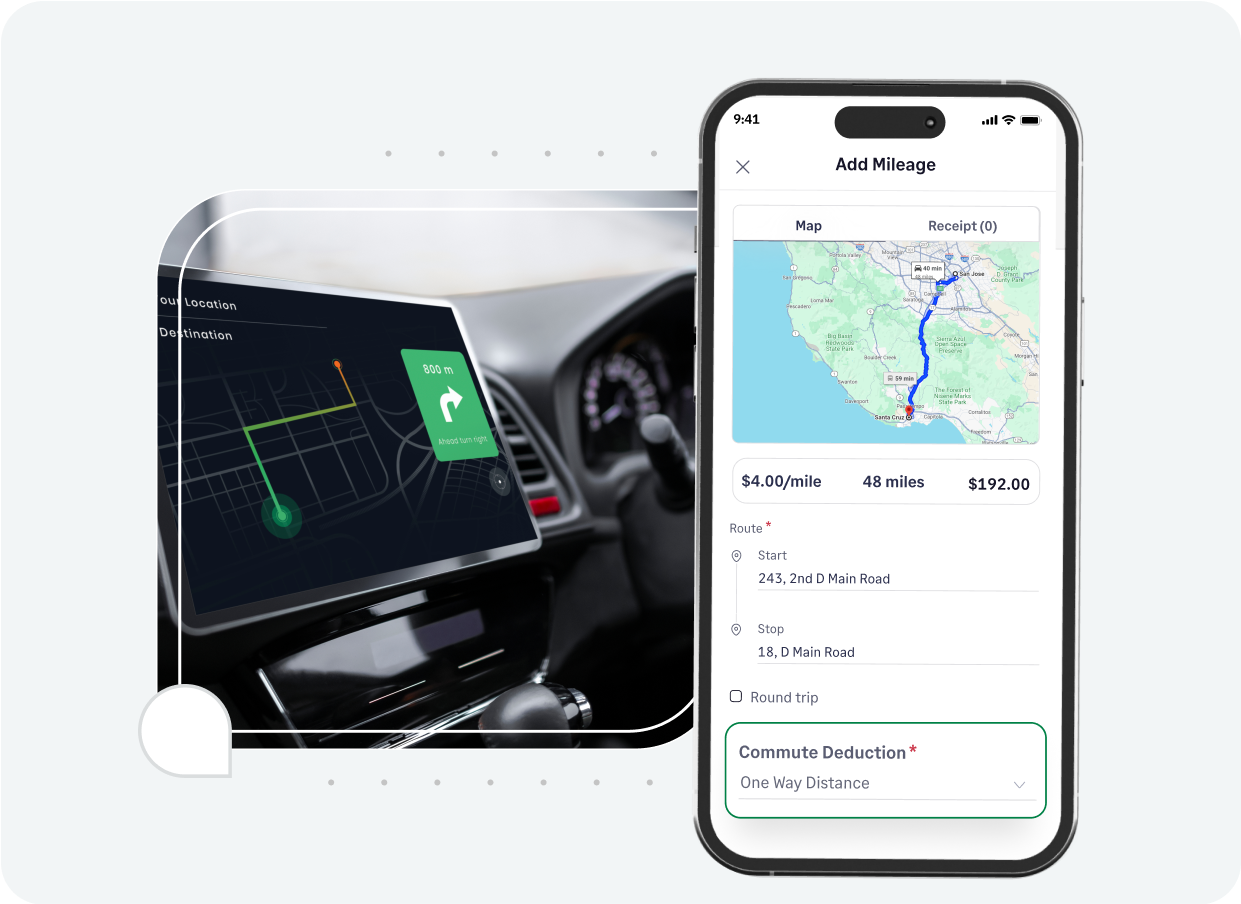

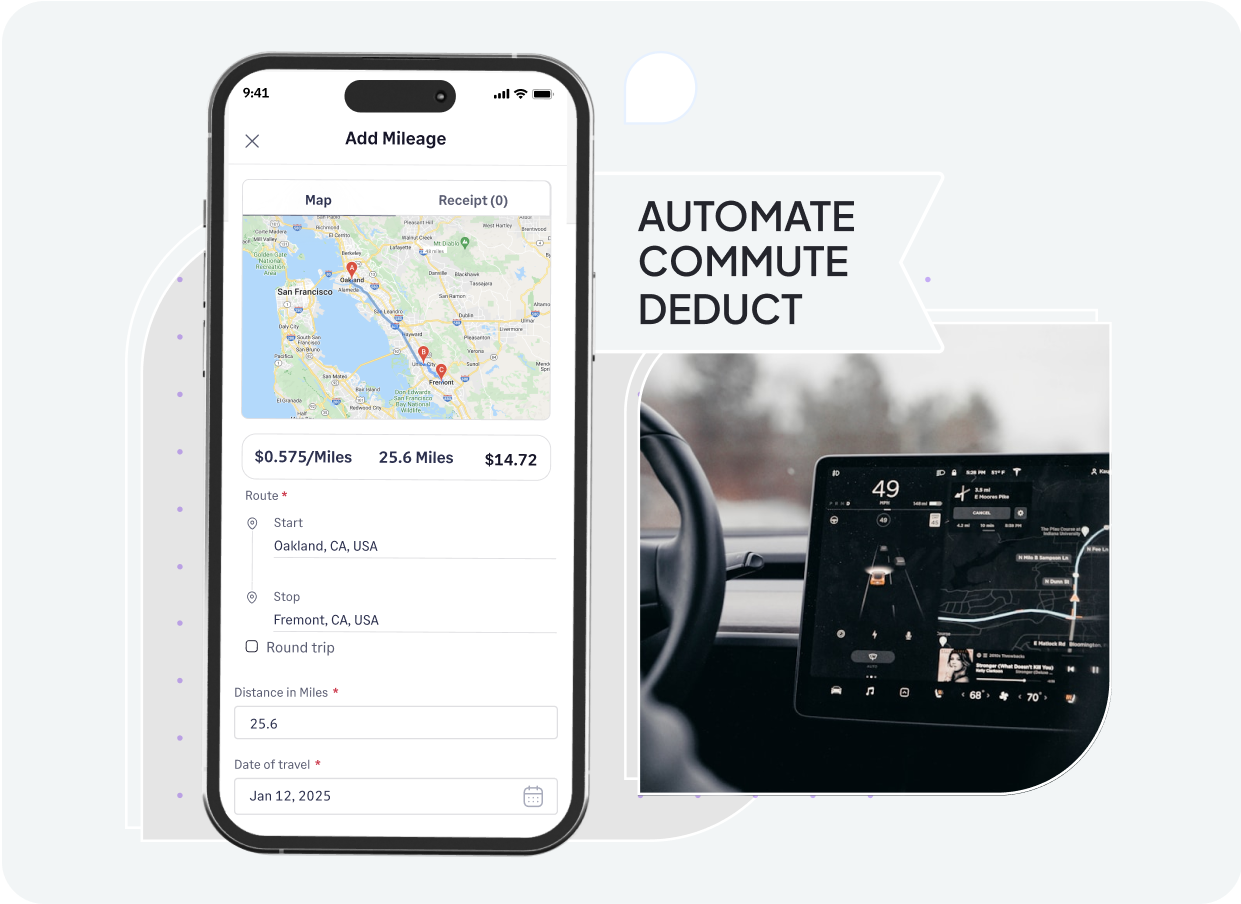

- Precise distance capture: We use Google Maps for accurate mileage logging. Employees can easily input start, stop, and end locations, and we calculates the travel distance automatically, minimizing errors and the need for manual trip logs.

- Flexible rate management: Configure Sage Expense Management with the appropriate rates—be it the current IRS standard rate (70 cents per mile for business in 2025), specific OFM rates for state business, or custom company rates. Calculations are then handled automatically.

- Support for commute deductions: If your policy requires deducting normal commute mileage before reimbursement, we can manage these calculations effortlessly, ensuring accuracy and compliance.

- Enforce travel policies: Integrate your company’s mileage and travel policies. This helps ensure that all submitted claims adhere to established guidelines, which is particularly useful for meeting WMWA obligations or Seattle’s specific requirements.

- Streamlined accounting: Sage Expense Management offers direct integrations with leading accounting systems like QuickBooks, NetSuite, and Xero. This eliminates manual data entry, reduces errors, and makes the reconciliation process much smoother for finance teams.

- Prompt employee reimbursements: With our ACH capabilities (available in the US), businesses can reimburse employees for approved mileage claims quickly and directly through the platform.

By leveraging Sage Expense Management, businesses in Washington can simplify mileage tracking and reimbursement, ensure compliance with applicable state and local regulations, and empower their teams to focus on more strategic tasks.