Understanding mileage reimbursement is essential for both employers and employees in Arkansas when personal vehicles are utilized for business-related travel.

While Arkansas has its own set of labor laws, including a minimum wage higher than the federal standard, it's important to know how these apply to mileage expenses and how federal guidelines often play a practical role.

This guide will cover common mileage rates used in Arkansas, relevant legal considerations for private employers, and how Sage Expense Management can simplify your mileage tracking and reimbursement processes.

Arkansas Mileage Reimbursement Rate

For private employers in Arkansas, it's crucial to understand that state law does not mandate a specific mileage reimbursement rate. There isn't a legislated per-mile amount that companies are legally required to pay employees for using their personal vehicles for work.

Despite this, many businesses throughout Arkansas choose to use the standard mileage rates published annually by the Internal Revenue Service (IRS) as a reliable benchmark. This is a widely adopted practice for several key reasons:

- It offers a nationally recognized standard that is calculated to reflect the average costs associated with operating a vehicle for business purposes, including fuel, maintenance, insurance, and depreciation.

- Reimbursements made at or below the current IRS standard business rate are generally non-taxable income for the employee, provided that proper and accurate records are maintained.

- It provides a consistent and transparent method for compensating employees fairly for the business use of their personal vehicles.

As of January 1, 2025, the key IRS standard mileage rates are:

- 70 cents per mile for business use of a vehicle.

- 21 cents per mile for medical or moving purposes (note: the deduction for moving expenses is currently limited to active-duty members of the U.S. Armed Forces).

- 14 cents per mile driven in service of charitable organizations.

For historical context, here are the IRS standard business mileage rates from recent years:

It is important to note that the State of Arkansas has its own mileage reimbursement rules and rates for state government employees, which are set by the Department of Finance and Administration.

These state employee policies do not apply to private-sector businesses. Similarly, specific statutes like Arkansas Code § 11-9-206 regarding travel for Workers' Compensation Commission members are also not applicable to general private employment.

Arkansas Mileage Reimbursement Calculator

Need to quickly estimate your mileage reimbursement? Our Mileage Reimbursement Calculator can assist you.

Using the Mileage Reimbursement Calculator is simple:

- Choose the tax year for which you want to calculate the reimbursement. Our calculator uses the IRS standard mileage rates applicable for that year, as these are a common benchmark in Arkansas.

- Input the total business miles driven. The calculator will then provide an estimated reimbursement amount, offering a helpful figure for both employees and employers in Arkansas.

Calculate

Results

Some Important Arkansas Mileage Reimbursement Laws

While Arkansas doesn't set a specific mileage reimbursement rate for private companies, certain labor laws are important to consider:

1. No State-Mandated Rate

Arkansas law does not require private employers to reimburse employees for mileage at a specific rate.

2. Arkansas Minimum Wage Law is Key

This is the most crucial legal consideration. Employers must ensure that any unreimbursed business-related expenses, such as mileage for work-related travel in an employee's personal vehicle, do not cause an employee's effective hourly wage to fall below the Arkansas minimum wage.

- The Arkansas minimum wage is currently $11.00 per hour (effective since January 1, 2021).

- If an employee incurs driving expenses that are primarily for the benefit of the employer, and these costs (when factored into their weekly earnings and hours worked) reduce their pay to less than $11.00 per hour, the employer could be in violation of state wage laws and the federal Fair Labor Standards Act (FLSA).

3. Deductions from Wages

The Arkansas Department of Labor provides guidance on permissible deductions from wages. Generally, deductions that are not required by law or agreed to in writing by the employee (under specific conditions) are illegal.

Requiring employees to bear significant unreimbursed business travel costs could be viewed as effectively reducing their earned wages, especially if it impacts their minimum wage.

4. Adherence to Company Policy/Agreements

If an employer establishes a policy or enters into an agreement to reimburse employees for mileage, they are generally expected to honor that commitment.

Arkansas's Wage Payment Law requires employers to pay all earned wages according to their agreements.

5. Record-Keeping

While Arkansas law might not prescribe a specific format for mileage logs for private employers, maintaining accurate and contemporaneous records is a best practice and essential for:

- Employers: To substantiate any reimbursement amounts paid and to have records in case of a wage and hour inquiry.

- Employees: To justify reimbursement requests according to company policy and for personal tax purposes if applicable. IRS guidelines generally require logs to include dates of travel, business purpose, miles driven, and locations.

Arkansas Mileage Reimbursement Law vs Federal Law

Understanding the relationship between Arkansas's approach and federal law provides additional clarity:

Federal Law (FLSA)

- The FLSA does not explicitly mandate mileage reimbursement by private employers.

- Its primary role in this context is ensuring that unreimbursed work-related expenses do not illegally reduce an employee's wages below the federal minimum wage ($7.25 per hour).

Arkansas State Law

- No Specific Reimbursement Statute: Arkansas, similar to federal law, does not have its own law compelling private employers to reimburse mileage at a specific rate.

- Higher State Minimum Wage Protection: Arkansas's minimum wage of $11.00 per hour is significantly higher than the federal minimum wage. This means the threshold at which unreimbursed expenses could become problematic is higher in Arkansas, offering greater protection to ensure employees' actual earnings meet this state standard.

- Enforcement of Promised Benefits: Arkansas law ensures that employers pay wages and other compensation that has been promised or is due to employees according to their employment agreement.

IRS Guidelines

- These are federal tax guidelines, not laws that force private employers to reimburse.

- They define the rate at which mileage reimbursements are generally non-taxable to employees. This is why many Arkansas employers, like those nationally, use the IRS rates as a standard for their reimbursement policies.

In Arkansas, the legal landscape for private employers concerning mileage reimbursement is primarily shaped by the state's own minimum wage laws, which exceed federal levels, rather than specific state mandates on reimbursement rates.

However, any promises made regarding reimbursement should be upheld.

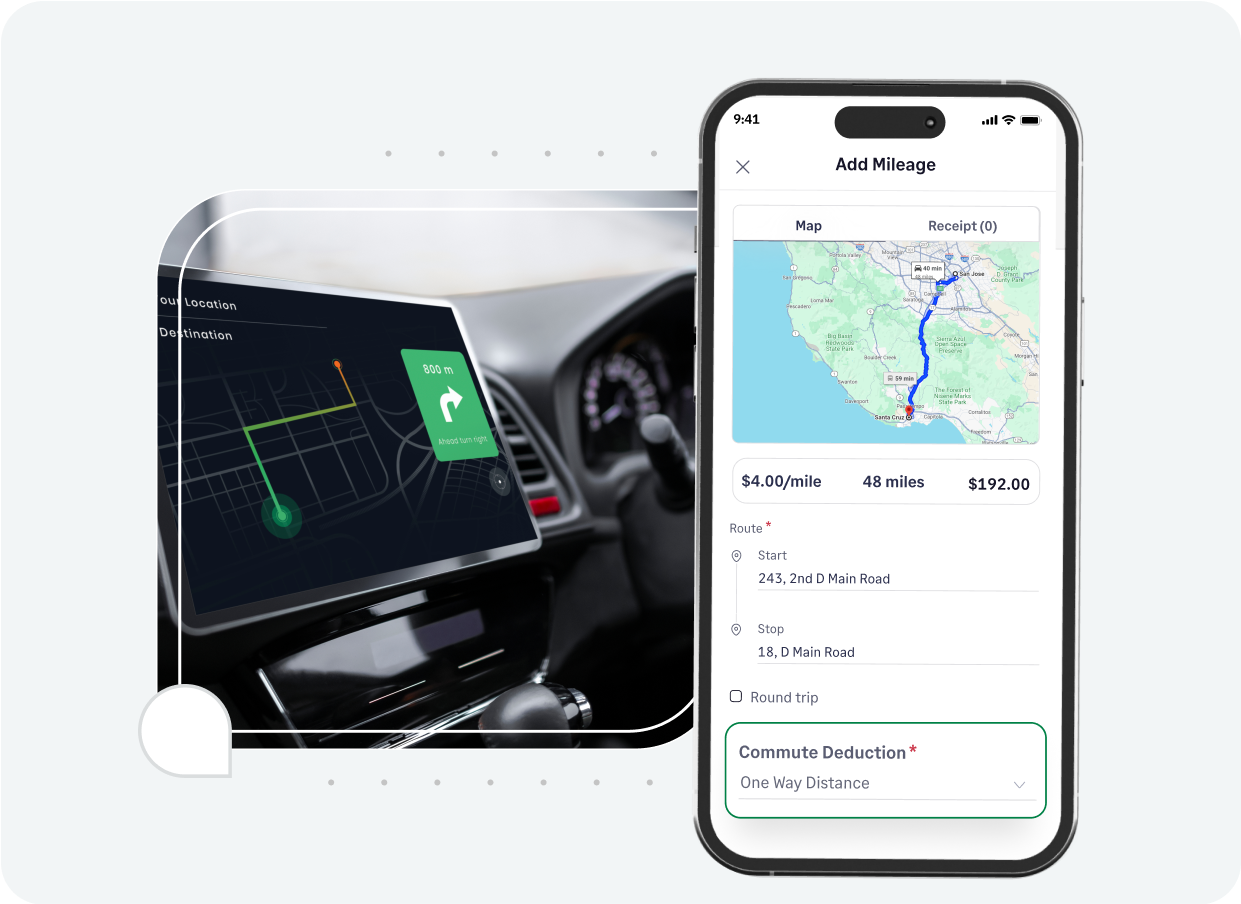

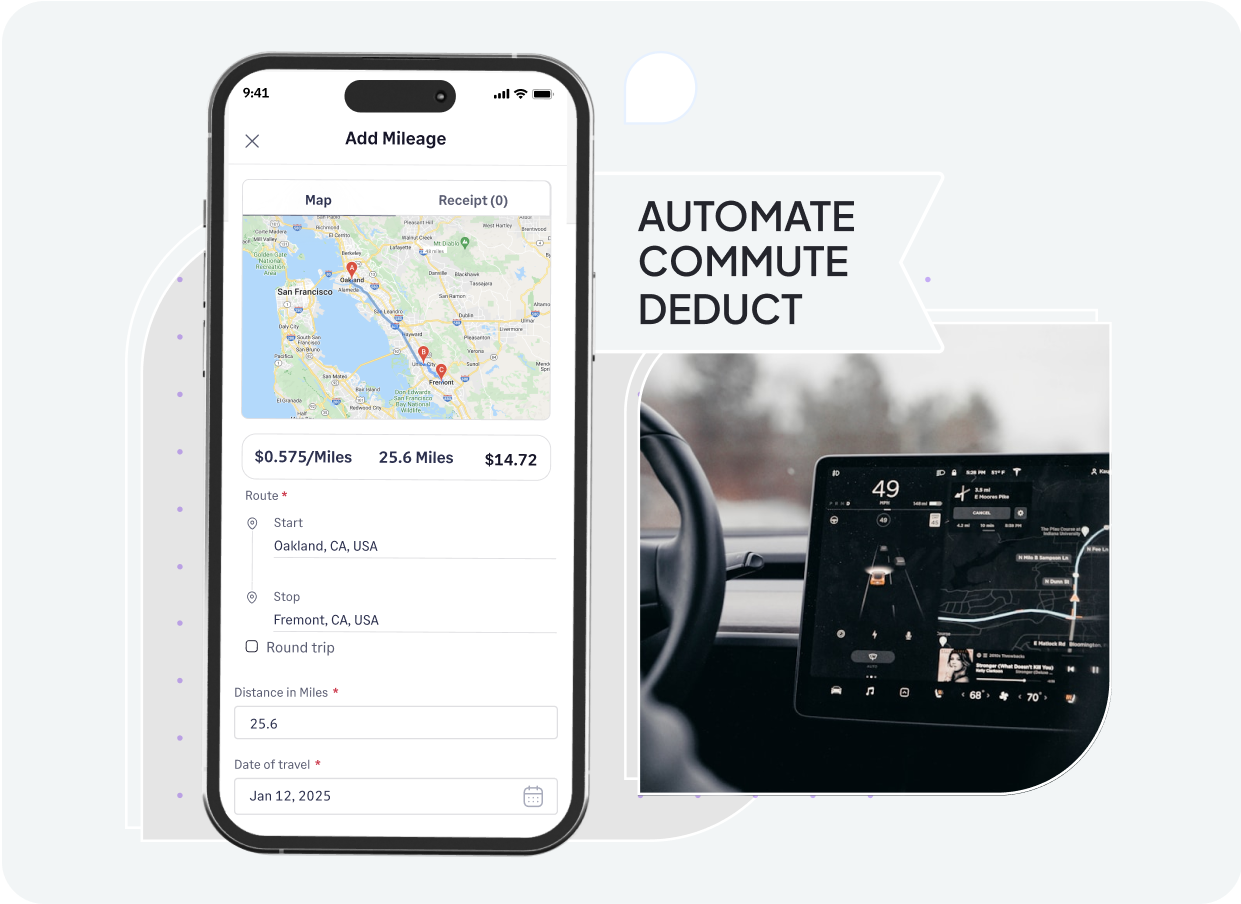

How Sage Expense Management (formerly Fyle) Can Automate Mileage Tracking

Sage Expense Management offers an intelligent, automated solution to simplify tracking business mileage and reimbursement for businesses across Arkansas.

- Mileage tracking simplified: We integrate with Google Maps, providing precise mileage calculations for all work-related travel, giving you confidence in your reimbursements.

- Compliance with the state laws: By providing accurate mileage logs, we help businesses maintain the records required to demonstrate that employee earnings comfortably meet or exceed the state's minimum wage of $11.00 per hour, even after accounting for vehicle use for company purposes.

- Eliminate manual effort and save time: Free up your employees from the hassle of manual logs and complicated spreadsheets. Our mobile app allows for effortless mileage tracking on the go. Employees can even submit expenses through familiar tools like Gmail or text message, streamlining the entire process.

- Scales with your business needs: If your company chooses to set a specific reimbursement rate - IRS standard or a custom rate - we offer the customization to adapt to your business’s policies.

- Powerful accounting integrations: Sage Expense Management connects with accounting software like QuickBooks, Xero, NetSuite, and more. This ensures that mileage expense data flows seamlessly and accurately into your financial systems, simplifying reconciliation for your business operations.

- Reimburse employees without any delay: Automated approval workflows and timely reminders mean that mileage reports are submitted and processed on time, ensuring your employees receive their reimbursements without unnecessary delays.

Don't let outdated mileage tracking methods slow down your Arkansas business. See how Sage Expense Management can bring new levels of efficiency, accuracy, and ease to your mileage reimbursement procedures.