In Maine, a state known for its strong worker protection laws, navigating mileage reimbursement requires attention to both state-specific mandates on expense reimbursement and federal guidelines.

For businesses and employees throughout Maine, a clear understanding of these rules is essential for ensuring lawful and fair compensation when personal vehicles are used for work purposes.

While federal IRS rates provide a common benchmark, Maine has its own legal framework to consider. For 2025, the Internal Revenue Service (IRS) has established the standard mileage rate for business travel at 70 cents per mile. This is an update from the 67 cents per mile rate applicable in 2024.

Maine law (26 M.R.S.A. § 629) requires employers to reimburse employees for necessary expenditures incurred in the discharge of their duties. While this law doesn't set a specific mileage rate, using the IRS rate can be a way to meet this obligation if it reasonably covers actual costs. Many employers use the IRS rate because:

- It provides a clear, nationally recognized, and often generous basis for reimbursement, likely covering "necessary expenditures."

- Reimbursements under an accountable plan at or below this federal rate are typically non-taxable for employees and deductible for employers.

As of January 1, 2025, the key IRS standard mileage rates are:

- 70 cents per mile for business use of a vehicle.

- 21 cents per mile for medical or moving purposes (note: the deduction for moving expenses is currently limited to active-duty members of the U.S. Armed Forces).

- 14 cents per mile driven in service of charitable organizations.

Other relevant rates in Maine include:

- Maine State Employee Rate: The State of Maine, through the Office of the State Controller, sets the mileage reimbursement rate for state employees using personal vehicles for official duties. Effective November 1, 2024, this rate is 54 cents per mile. Users should verify the current rate for subsequent fiscal years, as this may be updated.

- Workers' Compensation Medical Travel: Maine law requires reimbursement for reasonable travel expenses for injured employees to obtain authorized medical treatment. This rate typically aligns with the state employee rate, which was 54 cents per mile effective November 1, 2024.

For historical context, here are the IRS standard business mileage rates from recent years:

Maine Mileage Reimbursement Calculator

Easily calculate your potential mileage reimbursement with our Maine Mileage Reimbursement Calculator.

How to Use the Calculator:

- Select the correct tax year: Choose the year for which you're calculating reimbursement (e.g., 2025, 2024), as the applicable IRS rates can change.

- Input your business miles: Enter the total number of miles driven for business purposes using your personal vehicle.

- Calculate your reimbursement: The calculator will automatically apply the official IRS standard mileage rate for the selected year and display your estimated reimbursement amount.

This tool provides a quick estimate based on federal standards, helping both employees and employers in Maine manage travel expenses.

Calculate

Results

Some Important Maine Mileage Reimbursement Laws

Maine stands out with specific legal requirements regarding employee expenses, alongside wage and workers' compensation laws that influence mileage reimbursement practices:

1. Maine Law on Reimbursement of Employee Expenses (26 M.R.S.A. § 629)

This is a key statute in Maine. It mandates that employers must reimburse their employees for "all necessary expenditures or losses incurred by the employee as a direct result of discharging the duties of the employee on behalf of the employer".

This means if driving a personal vehicle is a necessary part of an employee's job, the employer is required to cover those costs.

While the law doesn't prescribe a specific mileage rate, the reimbursement must cover the necessary expenses. Using the IRS rate can be a method to fulfill this if it accurately reflects costs.

2. Maine Minimum Wage Law

Maine's statewide minimum wage is $14.65 per hour as of January 1, 2025, and is subject to annual adjustments based on the CPI. Some cities, like Portland, have higher local minimums (Portland was $16.30/hour as of Jan 1, 2025).

Unreimbursed necessary business expenses, such as mileage, cannot reduce an employee's effective earnings below the applicable (state or city) minimum wage.

3. Workers' Compensation

Maine law ensures that employees injured during their employment are reimbursed for reasonable travel expenses to get necessary medical care.

The rate for this typically follows the state employee mileage rate (54 cents per mile as of November 1, 2024).

4. State Employee Travel Regulations

The State of Maine has established procedures and a specific rate (54 cents per mile for FY25) for reimbursing its own employees for official travel.

Maine Mileage Reimbursement Law vs. Federal Law

When it comes to mileage reimbursement in Maine, the state's own laws on expense reimbursement and its higher minimum wage create a distinct environment compared to relying solely on federal standards.

Fair Labor Standards Act (FLSA)

The FLSA dictates that employee wages must not drop below the federal minimum wage ($7.25 per hour) after accounting for unreimbursed business expenses. If driving costs for work push an employee's effective pay below this federal baseline, the employer must cover the difference.

Maine's State Laws

The state laws add more specific obligations and higher standards:

- Direct Expense Reimbursement Mandate (26 M.R.S.A. § 629): Unlike federal law or many other states, Maine law explicitly requires employers to pay for necessary job-related expenses incurred by employees. This is a stronger and more direct requirement than just ensuring the minimum wage isn't violated by such expenses.

- Higher State Minimum Wage: Maine's minimum wage ($14.65 per hour in 2025, with local variations) is substantially above the federal rate. This state rate is the primary floor that must be protected from being eroded by unreimbursed business expenses.

- Specific State Rates: Maine sets its own rate for state employee travel and, by extension, often for workers' compensation medical travel, which is currently lower than the IRS standard rate.

IRS Regulations

The IRS provides the standard mileage rates (e.g., 70 cents/mile for business in 2025) mainly for federal tax purposes. These are not laws requiring employers to pay that exact amount.

However, in Maine, if an employer chooses to use a mileage rate to satisfy the "necessary expenditures" requirement of 26 M.R.S.A. § 629, the IRS rate is often seen as a reasonable and easily justifiable figure that also offers tax advantages under an accountable plan.

In summary, Maine law (26 M.R.S.A. § 629) directly obligates employers to cover necessary work-related expenses, including mileage.

The state's high minimum wage provides an additional layer of protection. While the FLSA offers a federal baseline, Maine's specific requirements are more controlling for employers in the state. IRS rates offer a practical method for calculation and tax compliance.

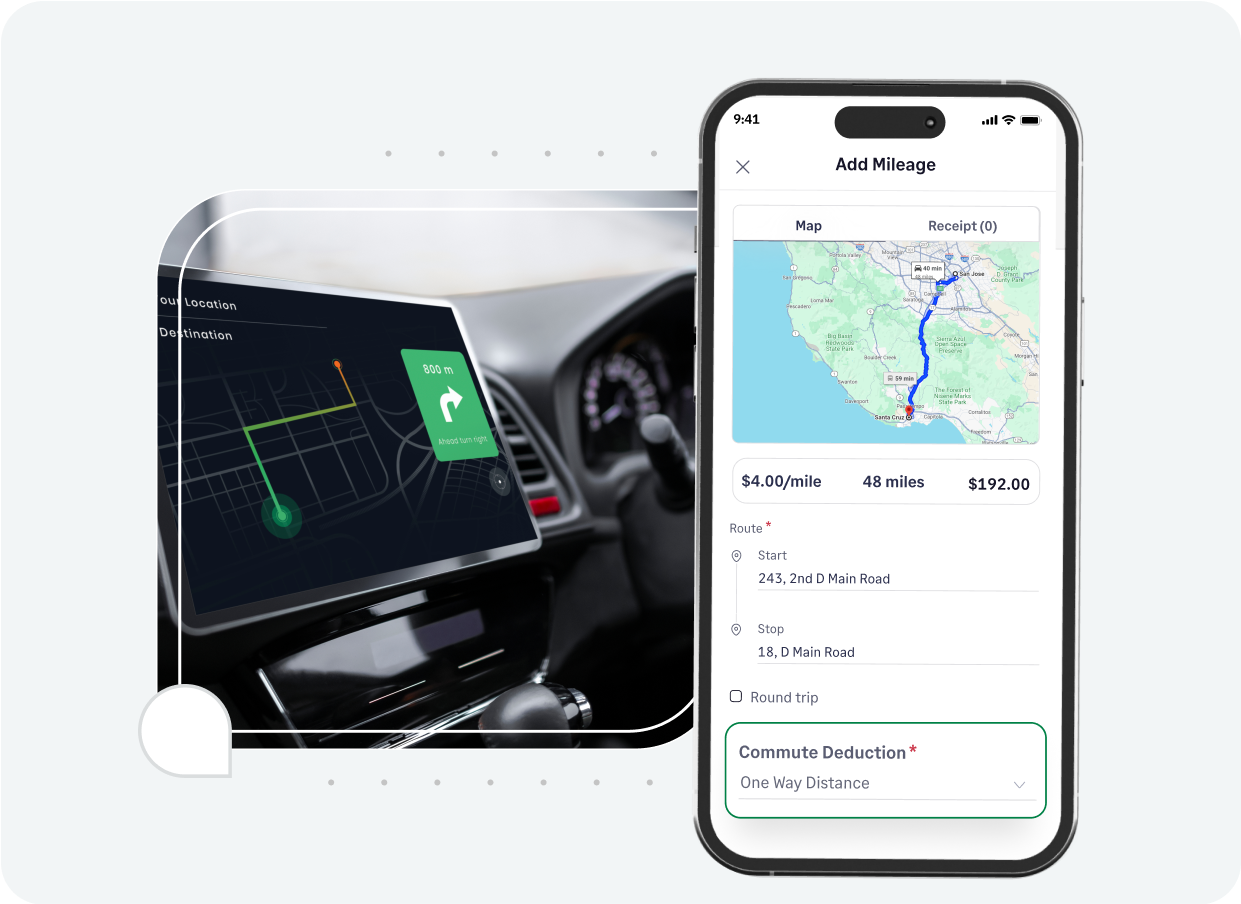

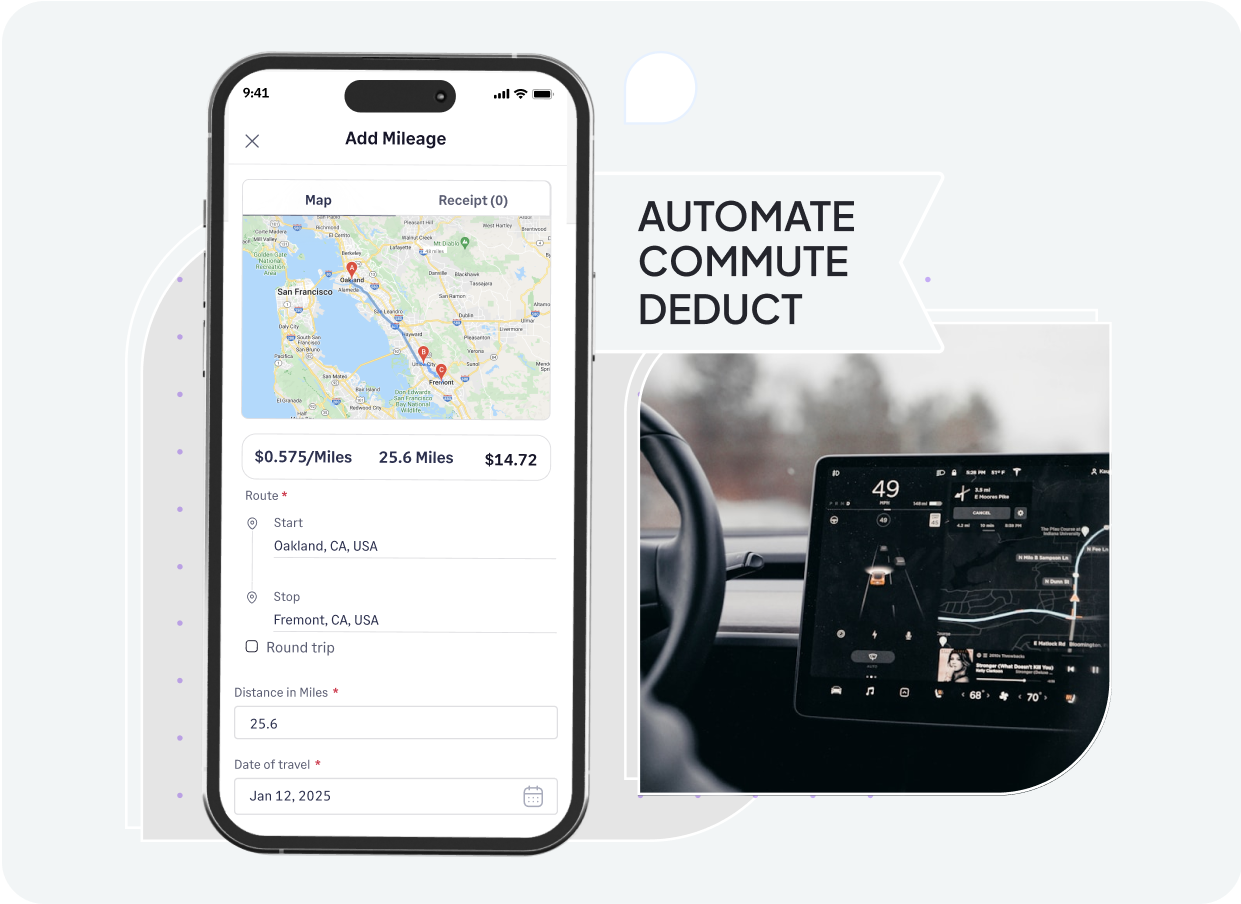

How Sage Expense Management (formerly Fyle) Can Automate Mileage Tracking

Simplify how your Maine business handles mileage reimbursement with Sage Expense Management's intelligent automation. Ensure compliance with state laws on expense reimbursement and save significant time for your team.

- Automated and accurate mileage logs: Utilizes GPS via Google Maps to precisely record travel distances, ensuring necessary expenses are properly documented.

- Flexible rate management for Maine: Configure IRS rates, the Maine state employee rate, or custom figures to align with your reimbursement policy and state requirements.

- Track business vs. personal travel: Helps differentiate and manage non-reimbursable commute mileage by setting primary work and home addresses.

- Streamlined claims for regular journeys: Enables employees to set up recurring mileage claims for routine travel, reducing repetitive data entry.

- Policy integration for compliance: Embed your company’s expense guidelines into Sage Expense Management to automatically check submissions and ensure adherence to necessary expenditure rules.

- Direct sync with accounting software: Connects with popular platforms like QuickBooks, Xero, and NetSuite, transferring approved mileage data seamlessly.

- Efficient ACH payment processing (US only): Offers ACH transfers for quick and direct reimbursement of approved employee mileage claims.

Sage Expense Management provides Maine companies with the tools to manage mileage efficiently, meet state obligations for necessary expense reimbursement, and maintain accurate records.