In New Mexico, ensuring employees are fairly compensated for using their personal vehicles for business is a key aspect of sound employment practice.

While New Mexico doesn't dictate a universal reimbursement mandate for all private businesses, understanding the interplay of federal standards and state-specific rules is essential for both employers and employees navigating travel expenses.

The cornerstone for calculating mileage reimbursement is often the rate announced by the Internal Revenue Service (IRS). Looking ahead to 2025, the IRS has established the standard rate for business-related vehicle use at 70 cents per mile. This is an adjustment from the 67 cents per mile rate effective in 2024.

For private companies in New Mexico, adopting the IRS standard rate is a common approach, though not legally compelled across the board. This preference is often due to:

- The IRS rate offers a clear, nationally recognized basis for reimbursement.

- Payments made under an accountable plan at or below this federal rate typically carry tax advantages, being non-taxable for the recipient and deductible for the payer.

As of January 1, 2025, the key IRS standard mileage rates are:

- 70 cents per mile for business use of a vehicle.

- 21 cents per mile for medical or moving purposes (note: the deduction for moving expenses is currently limited to active-duty members of the U.S. Armed Forces).

- 14 cents per mile driven in service of charitable organizations.

Other relevant rates in New Mexico include:

- New Mexico State Employee Rate: State agencies in New Mexico typically adhere to the current IRS standard mileage rate for reimbursing state employees who use their private vehicles for official duties. Thus, for 2025, this rate is 70 cents per mile.

- Workers' Compensation Medical Travel: The New Mexico Workers' Compensation Administration (WCA) stipulates the mileage reimbursement rate for injured workers needing to travel for authorized medical care. This rate is set at 70 cents per mile, effective January 1, 2025 (up from 67 cents per mile in 2024).

For historical context, here are the IRS standard business mileage rates from recent years:

New Mexico Mileage Reimbursement Calculator

Determine your potential mileage reimbursement quickly with our straightforward New Mexico Mileage Reimbursement Calculator.

How to Use the Calculator:

- Select the correct tax year: Choose the year for which you're calculating reimbursement (e.g., 2025, 2024), as the applicable IRS rates can change.

- Input your business miles: Enter the total number of miles driven for business purposes using your personal vehicle.

- Calculate your reimbursement: The calculator will automatically apply the official IRS standard mileage rate for the selected year and display your estimated reimbursement amount.

This tool offers a clear estimate based on federal standard rates, useful for both employees logging travel and businesses managing these expenses.

Calculate

Results

Some Important New Mexico Mileage Reimbursement Laws

While New Mexico does not impose a blanket requirement on all private employers to reimburse for mileage, specific state statutes and overarching federal laws create a framework that employers must navigate:

New Mexico Minimum Wage Act

Effective January 1, 2023, New Mexico's state minimum wage is $12.00 per hour. This is a critical baseline.

Employers must ensure that unreimbursed work-related expenses, such as mileage, do not effectively reduce an employee's pay below this state minimum for the hours worked.

A tipped minimum wage of $3.00 per hour also applies, provided tips bring the total to the standard minimum.

Workers' Compensation Regulations

Under the New Mexico Workers' Compensation Act, employees are entitled to reimbursement for mileage incurred when traveling to and from authorized medical services for work-related injuries. The WCA sets this rate, which is 70 cents per mile for 2025.

Absence of General Private Employer Mandate

Beyond the minimum wage considerations and workers' compensation rules, New Mexico law generally leaves mileage reimbursement policies to the discretion of private employers.

Thus, clear company policies are essential for managing expectations and ensuring fairness.

State Government Travel Policies

New Mexico, like other states, has established policies for reimbursing its own employees for official travel, generally aligning with the IRS standard business rate.

These public sector rules, while not directly applicable to private businesses, reflect a standard of accountability.

New Mexico Mileage Reimbursement Law vs. Federal Law

The landscape of mileage reimbursement in New Mexico is shaped by both its own state-level provisions and overriding federal laws. Here’s a look at how they interact:

Fair Labor Standards Act (FLSA)

The FLSA stands as the key federal law. Its core principle influencing mileage is the requirement that an employee's wages must not fall below the federal minimum wage ($7.25 per hour) after accounting for any unreimbursed business expenses they've covered.

If driving costs for work effectively diminish an employee’s pay to below this federal floor, the employer is obligated to make up the difference.

New Mexico's State Laws

These laws present a somewhat different picture:

- The state has its own Minimum Wage Act, setting the hourly rate at $12.00 – significantly above the federal level. This means employers in New Mexico must primarily ensure that unreimbursed expenses don't violate this higher state threshold.

- New Mexico law explicitly mandates mileage reimbursement for workers' compensation-related medical travel at a rate tied to the IRS standard.

- State employee travel is also generally reimbursed at the prevailing IRS rate.

IRS Regulations

These federal guidelines establish the standard mileage rates (like the 70 cents per mile for business use in 2025) primarily for tax calculation purposes.

While these aren't laws forcing employers to pay that specific amount, they are crucial. When an employer reimburses at or below these rates under an accountable plan, the money is generally not taxable income for the employee and is a deductible business expense for the employer.

This tax implication makes the IRS rates a very common and practical benchmark for New Mexico businesses.

In summary, for New Mexico employers, state law dictates a higher minimum wage that must be protected from unreimbursed expenses. Specific state rules govern workers' compensation travel. Federal law (FLSA) provides a baseline wage protection, while IRS rules offer a widely adopted, tax-efficient method for calculating reimbursement amounts.

How Sage Expense Management (formerly Fyle) Can Automate Mileage Tracking

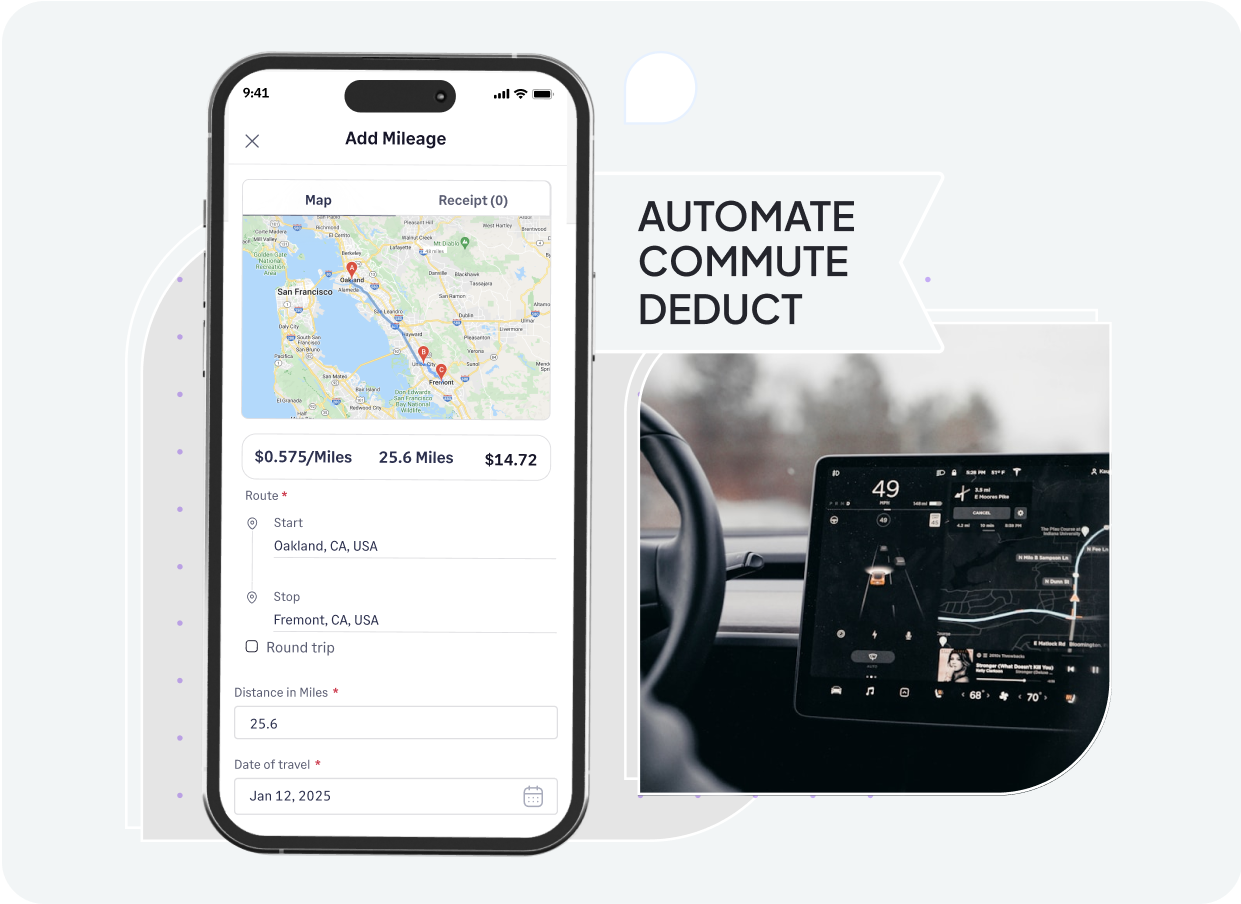

Transform your company's mileage reimbursement from a tedious chore into a streamlined process. Sage Expense Management offers New Mexico businesses a modern, automated platform designed for accuracy, compliance, and significant time savings.

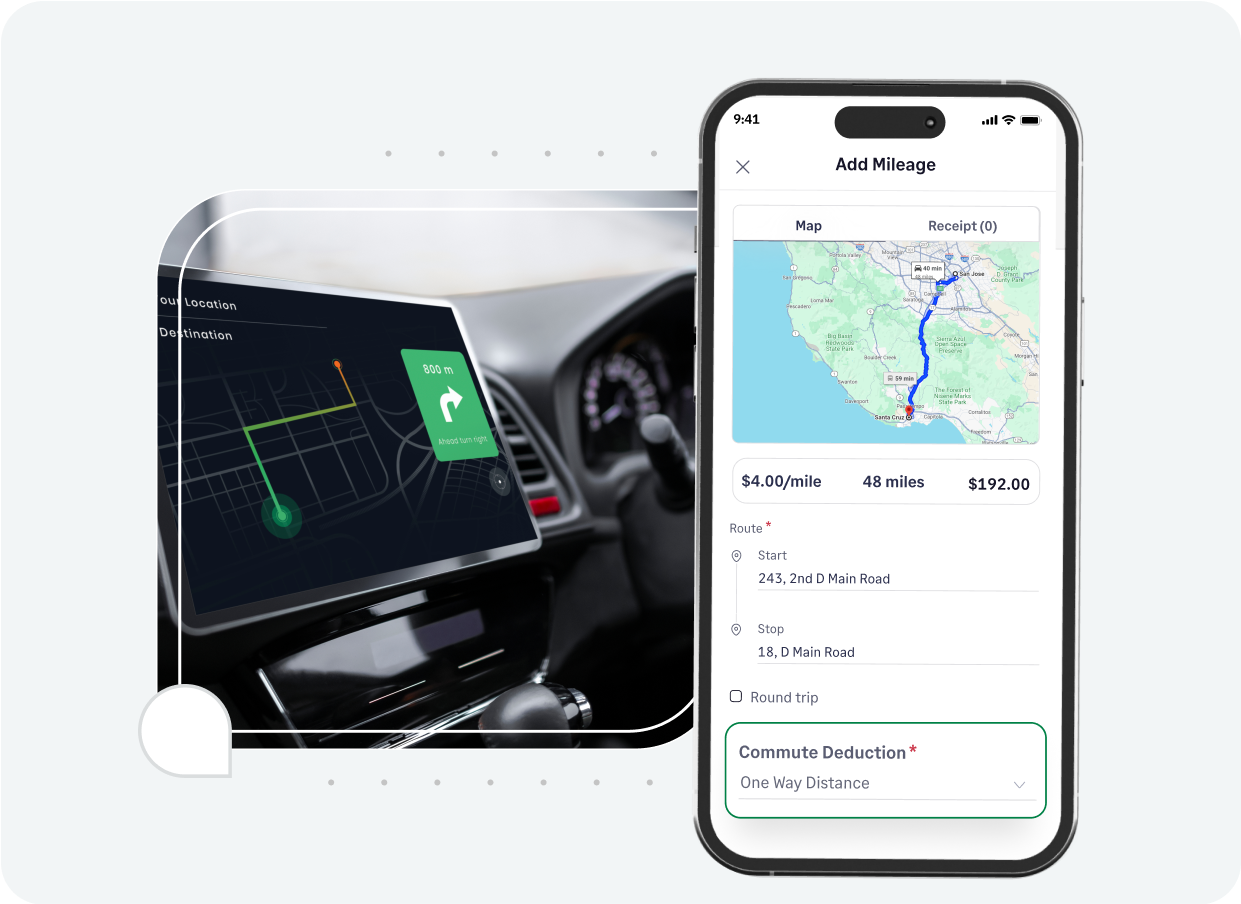

- Pinpoint mileage with GPS: We use reliable Google Maps data to automatically and accurately log business miles, removing the burden of manual tracking.

- Apply correct rates, every time: Configure IRS standards, state-specific figures, or unique company rates within our platform; the system then applies the right one automatically.

- Clearly manage commute mileage: Help employees distinguish between personal commute and reimbursable business travel by setting primary work and home locations for accurate deductions.

- Simplify recurring journey claims: For staff with regular travel routes, we enable a "set it and forget it" approach to recurring mileage, automating claim creation.

- Automated policy checks: Integrate your company’s travel and expense rules into Sage Expense Management, which then proactively identifies and flags submissions that don't align.

- Integrate smoothly with accounting systems: Sage Expense Management ensures approved mileage data flows directly into popular accounting software like QuickBooks, Xero, or NetSuite, minimizing manual data handling.

- Speed up reimbursements via ACH (US only): Facilitate faster reimbursement for your team by paying approved mileage claims directly through ACH.

Leverage Sage Expense Management to bring efficiency and precision to mileage expense management across your New Mexico operations.