Understanding mileage reimbursement in Mississippi is essential for businesses aiming for fair employee compensation and for employees who use their personal vehicles for work.

While Mississippi's regulations differ from some states with explicit mandates, there are key federal guidelines and state-specific rules, particularly concerning workers' compensation, that everyone should be aware of.

This guide will help accountants, SMB owners, and employees in Mississippi navigate mileage rates, understand the legal landscape, and simplify the reimbursement process.

Mississippi Business Mileage Reimbursement Rate

The most commonly referenced rate for business mileage reimbursement across the United States, including Mississippi, is the one set annually by the Internal Revenue Service (IRS). For 2025, the IRS standard mileage rate for business use is 70 cents per mile. This rate was 67 cents per mile in 2024.

Private employers in Mississippi are not legally required by a specific state law to use the IRS rate (or any rate) for general business mileage. However, many opt to use the IRS standard rates because:

- They provide a recognized and reasonable benchmark for reimbursement.

- Reimbursements made at or below the IRS rate, under an accountable plan, are generally non-taxable to the employee and tax-deductible for the employer.

As of January 1, 2025, the key IRS standard mileage rates are:

- 70 cents per mile for business use of a vehicle.

- 21 cents per mile for medical or moving purposes (note: the deduction for moving expenses is currently limited to active-duty members of the U.S. Armed Forces).

- 14 cents per mile driven in service of charitable organizations.

For historical context, here are the IRS standard business mileage rates from recent years:

Mississippi Mileage Reimbursement Calculator

Take the guesswork out of your mileage reimbursement calculations with our easy-to-use Mississippi Mileage Reimbursement Calculator.

How to Use the Calculator:

- Choose the Tax Year: Select the correct year for your calculation (e.g., 2025, 2024), as IRS rates may vary annually.

- Enter Your Business Miles: Input the total business miles driven using your personal vehicle.

- See Your Estimate: The calculator will use the appropriate IRS standard mileage rate for the selected year to show you the estimated reimbursement amount.

This tool is designed for both employees tracking their travel and employers calculating payouts, ensuring clarity based on federal standard rates.

Calculate

Results

Some Important Mississippi Mileage Reimbursement Laws

In Mississippi, the approach to mileage reimbursement for private employers is primarily governed by federal law and specific state regulations for certain situations, rather than a broad state mandate for all business mileage.

1. No State-Specific General Mandate

Mississippi does not have a state law that requires private employers to reimburse employees for the use of their personal vehicles for general business purposes.

2. Federal Fair Labor Standards Act (FLSA)

This is a critical consideration. Mississippi adheres to the federal minimum wage of $7.25 per hour, as it does not have its own state minimum wage law.

Under the FLSA, employers must ensure that any unreimbursed business expenses incurred by an employee (such as mileage) do not cause their effective hourly wage to fall below this $7.25 federal minimum for any given workweek.

If such expenses do reduce pay below the minimum, the employer is obligated to reimburse at least enough to cover the shortfall.

3. Mississippi Workers' Compensation Act

This act mandates that employees who suffer work-related injuries are entitled to reimbursement for reasonable travel expenses incurred to obtain medical services.

As mentioned, the Mississippi Workers' Compensation Commission (MWCC) sets this rate, which is 70 cents per mile as of January 1, 2025.

4. Employer Policy is Key

Given the absence of a general state mandate, the employer's own established policy on mileage reimbursement becomes very important. A clear, consistently applied policy benefits both the employer and employees.

Mississippi Mileage Reimbursement Law vs. Federal Law

When it comes to mileage reimbursement in Mississippi, here’s how state and federal considerations interact:

Federal Law (FLSA)

The Fair Labor Standards Act is the main federal law influencing this area in Mississippi.

Its core impact is ensuring that unreimbursed business mileage (or any other work-related cost borne by the employee) doesn't cause an employee's pay to drop below the federal minimum wage of $7.25 per hour. Mississippi employers must adhere to this.

Mississippi Law

- Mississippi does not have its own minimum wage law, defaulting to the federal rate.

- It does have a specific requirement under its Workers' Compensation Act for employers to reimburse injured employees for travel to obtain medical treatment at a rate set by the MWCC.

IRS Regulations

The IRS provides the standard mileage rates (70 cents for business in 2025) used for federal tax purposes. While not laws that mandate reimbursement by employers, these rates are critical.

If an employer in Mississippi chooses to reimburse using these rates under an "accountable plan," the reimbursement is typically not counted as taxable income for the employee and is deductible for the employer. This makes using IRS rates a common and practical approach.

So, for Mississippi employers, the FLSA's minimum wage protection is a key federal constraint, state law specifically addresses workers' compensation medical travel, and IRS rules guide the common practice and tax implications of reimbursement.

How Sage Expense Management (formerly Fyle) Can Automate Mileage Tracking

For businesses in Mississippi, relying on manual mileage logs, collecting paper receipts, and cross-referencing changing rates can be a time-consuming and error-prone ordeal. Sage Expense Management offers an intelligent and automated approach to mileage tracking, ensuring compliance and efficiency.

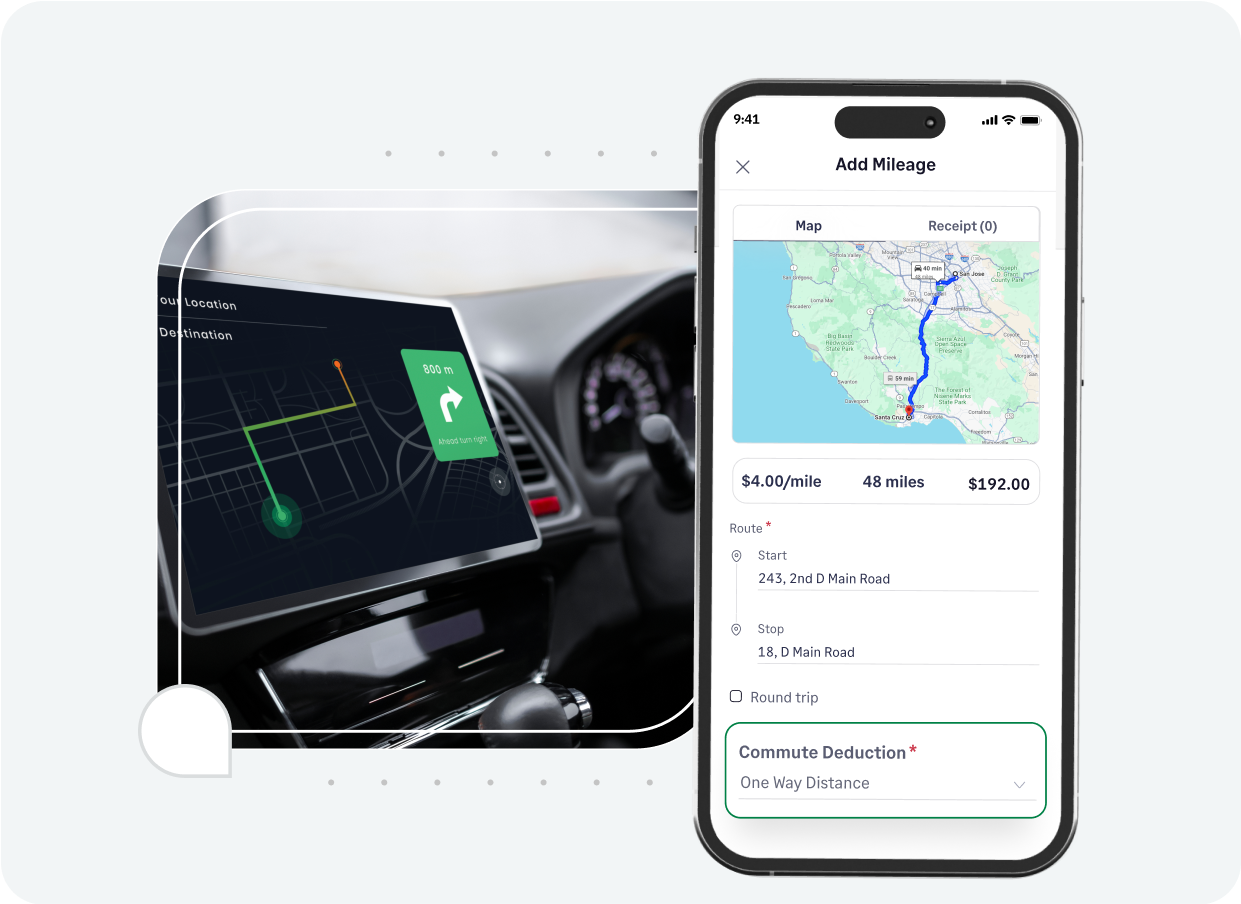

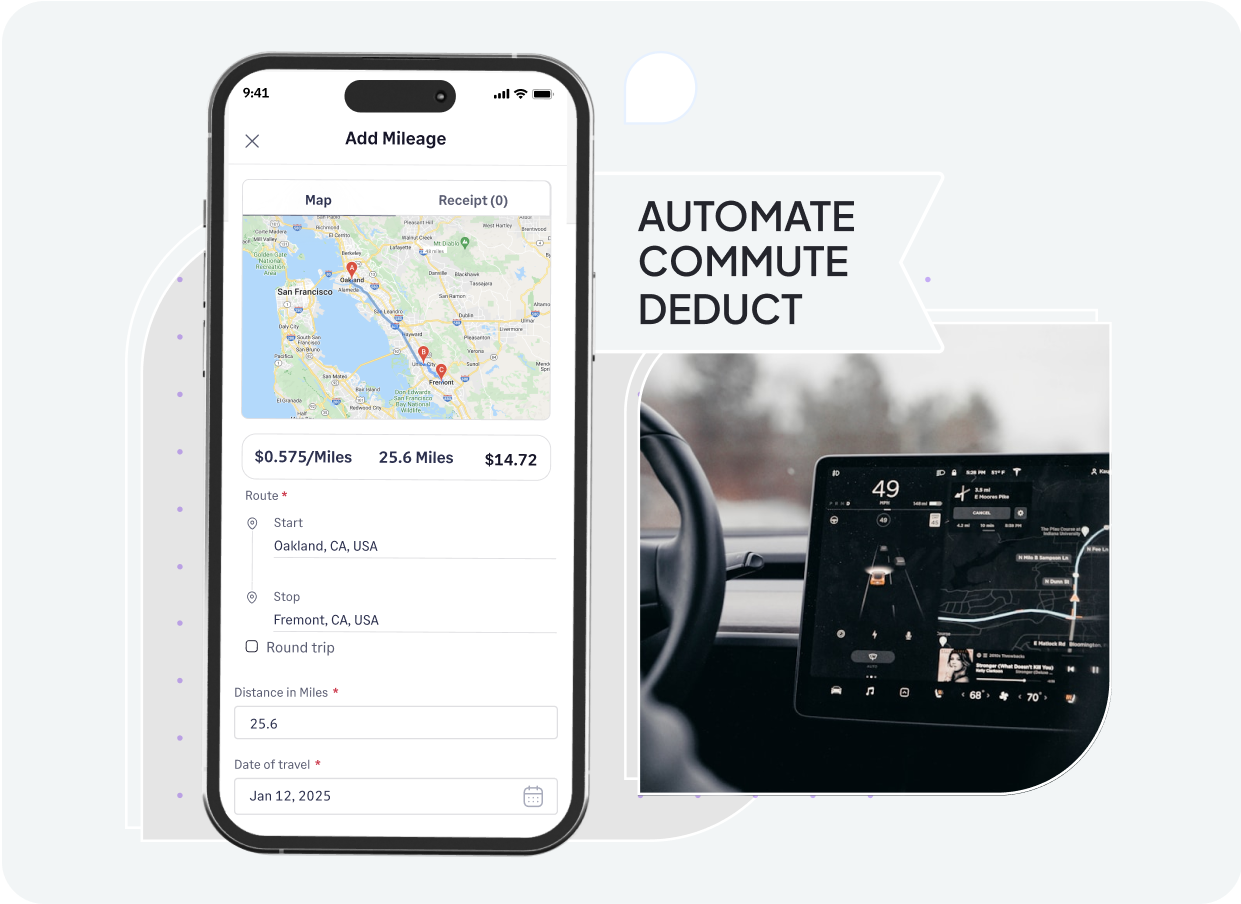

- GPS-enabled distance capture: We leverage Google Maps to provide precise calculation of miles driven. Employees simply enter their starting point, any interim stops, and their destination, and we accurately compute the travel distance, eliminating manual calculations and odometer readings.

- Customizable rate management: Whether your company uses the current IRS standard rates, the Mississippi state employee rate for certain scenarios, or has unique internal rates, we allow finance teams to easily configure and manage these rates within the system, applying them automatically to claims.

- Effortless commute mileage handling: Sage Expense Management helps in clearly distinguishing and managing non-reimbursable commute miles. By setting home and office locations, businesses can implement policies to deduct commute distances accurately, aiding in compliance, particularly with IRS rules.

- Automate repetitive journeys: Employees who frequently travel the same routes can set up recurring mileage claims. This feature drastically cuts down on data entry time for regular trips, whether they occur daily, weekly, or monthly, enhancing employee productivity.

- Built-in policy checks: Define your organization's specific mileage reimbursement policies within Sage Expense Management. Set limits on distances, maximum claim amounts, or require specific documentation. We will automatically check submissions against these rules, flagging violations and ensuring compliance before reports reach approvers.

- Direct accounting sync: Say goodbye to manual data entry into your accounting software. We offer seamless integrations with popular platforms like QuickBooks, Xero, and NetSuite. Approved mileage expenses flow directly, reducing errors and saving valuable finance team hours.

- Swift ACH reimbursements: For U.S.-based companies, we enable the direct reimbursement of mileage claims to employees via ACH. This completes the expense cycle quickly, ensuring employees receive their payments promptly and conveniently.

By adopting Sage Expense Management, Mississippi companies can modernize their mileage tracking, reduce administrative burdens, maintain accurate records, and ensure their reimbursement process is both compliant and efficient.