In Wyoming, where business often requires travel across wide-open spaces, understanding the standards for mileage reimbursement is a practical necessity. While Wyoming’s own laws defer to federal wage standards, its public sector and workers' compensation practices directly align with IRS rates, setting a clear precedent for fair compensation when employees use personal vehicles for work.

The primary national benchmark for these travel expense calculations is the standard mileage rate issued by the Internal Revenue Service (IRS). For the year 2025, the IRS has set this rate for business use of a personal vehicle at 70 cents per mile. This is an increase from the 67 cents per mile rate that was effective for 2024.

Private employers in Wyoming are not specifically required by a state statute to use this IRS rate for all general business travel. However, adopting this federal standard is a widespread practice for several important reasons:

- It provides a clear, consistent, and nationally recognized basis for reimbursement calculations.

- When payments are made through an accountable plan at or below the IRS rate, they are generally not considered taxable income for the employee and are deductible as a business expense for the employer.

As of January 1, 2025, the key IRS standard mileage rates are:

- 70 cents per mile for business use of a vehicle.

- 21 cents per mile for medical or moving purposes (note: the deduction for moving expenses is currently limited to active-duty members of the U.S. Armed Forces).

- 14 cents per mile driven in service of charitable organizations.

Other relevant rates in Wyoming include:

- Wyoming State Employee Rate: The State of Wyoming, through a Governor's memo, establishes the mileage reimbursement rate for state employees using private vehicles for official state business. This rate is aligned with the current IRS standard business rate. Therefore, effective January 1, 2025, this rate is 70 cents per mile (it was 67 cents per mile in 2024).

- Workers' Compensation Medical Travel: Injured employees in Wyoming are entitled to reimbursement for reasonable travel expenses to obtain necessary medical treatment for work-related injuries. The mileage reimbursement rate for this purpose is generally the same as the rate allowed for state employees, meaning it will be 70 cents per mile for 2025.

For historical context, here are the IRS standard business mileage rates from recent years:

Wyoming Mileage Reimbursement Calculator

Quickly estimate your mileage reimbursement with our straightforward Wyoming Mileage Reimbursement Calculator.

How to Use the Calculator:

- Select the correct tax year: Choose the year for your calculation (e.g., 2025, 2024), as IRS rates are subject to annual updates.

- Input your business miles: Enter the total miles driven for business purposes using your personal vehicle.

- Calculate your reimbursement: The calculator will apply the official IRS standard mileage rate for the chosen year to provide your estimated reimbursement amount.

This tool offers a clear estimate based on federal standards, valuable for both those submitting and those processing mileage claims in Wyoming.

Calculate

Results

Some Important Wyoming Mileage Reimbursement Laws

While Wyoming does not have a specific state law requiring all private employers to reimburse for general business mileage at a set rate, several state and federal regulations influence employer responsibilities:

1. Wyoming minimum wage law

This is a unique situation. Wyoming state law sets a minimum wage of $5.15 per hour. However, federal law (the FLSA) requires a higher rate of $7.25 per hour. Because federal law requires that the higher rate be paid, the effective minimum wage for nearly all employees in Wyoming is $7.25 per hour. A critical point is that any unreimbursed business expenses an employee is required to incur, such as mileage, should not cause their effective hourly earnings to fall below this applicable minimum wage.

2. Workers' compensation

State law ensures that employees injured on the job are reimbursed for reasonable travel expenses, including mileage, to obtain necessary medical care. The mileage rate for this is linked to the state employee travel reimbursement rate, which aligns with the IRS standard (70 cents per mile for 2025).

3. Absence of general private employer reimbursement mandate

Beyond ensuring minimum wage compliance and fulfilling workers' compensation obligations, Wyoming law does not generally compel private employers to reimburse for mileage at a particular rate. Therefore, specific company policies often guide these practices.

4. State employee travel regulations

Wyoming has a clear policy, established via a Governor's memo, of reimbursing its state employees for official travel in personal vehicles at the current IRS standard rate. This sets a strong precedent for fair reimbursement within the state's public sector.

Wyoming Mileage Reimbursement Law vs. Federal Law

In Wyoming, the legal landscape for mileage reimbursement is heavily guided by federal law and standards, a fact reflected in the state's own minimum wage applicability and official travel policies.

Fair Labor Standards Act (FLSA)

The FLSA is the dominant federal law in this context, establishing the national minimum wage at $7.25 per hour.

A core principle of the FLSA is that an employee's wages must not effectively be reduced below this federal minimum by unreimbursed business expenses that primarily benefit the employer, such as mileage costs.

If such expenses were to erode an employee's net pay below this federal floor for the hours worked, the employer must provide sufficient reimbursement to cover the difference.

Wyoming's State Laws

Wyoming's own legal framework largely defers to or aligns with these federal standards:

- The state's minimum wage is $5.15 per hour, but this applies only to a small number of employers not covered by the FLSA. For most businesses, the effective minimum wage is the federal rate of $7.25 per hour. This means that ensuring compliance with the FLSA's minimum wage requirements regarding unreimbursed expenses is the primary consideration for nearly all Wyoming employers.

- Wyoming law explicitly links its state employee mileage reimbursement rate and, consequently, its workers' compensation medical travel rate, to the current IRS standard rate. This demonstrates a comprehensive state-level adoption of the federal benchmark for official and mandated travel reimbursements.

IRS Regulations

The standard mileage rates issued by the Internal Revenue Service (e.g., 70 cents per mile for business in 2025) are primarily established for federal income tax purposes. These are not laws that legally obligate all employers to reimburse at that specific amount.

However, their practical importance is very significant. When a Wyoming employer uses an accountable plan and reimburses at or below these IRS rates, the reimbursement is typically not considered taxable income for the employee and is a deductible expense for the business.

The state's decision to align its own official rates with the IRS further solidifies the utility and widespread acceptance of this standard within Wyoming.

In summary, for Wyoming employers, the federal FLSA and the federal minimum wage provide the primary wage floor that must be protected from being diminished by unreimbursed business expenses.

The state's practice of aligning its public sector and workers' compensation mileage rates directly with the IRS standard further reinforces these federal figures as the predominant benchmark for reasonable and tax-efficient reimbursement practices across the state.

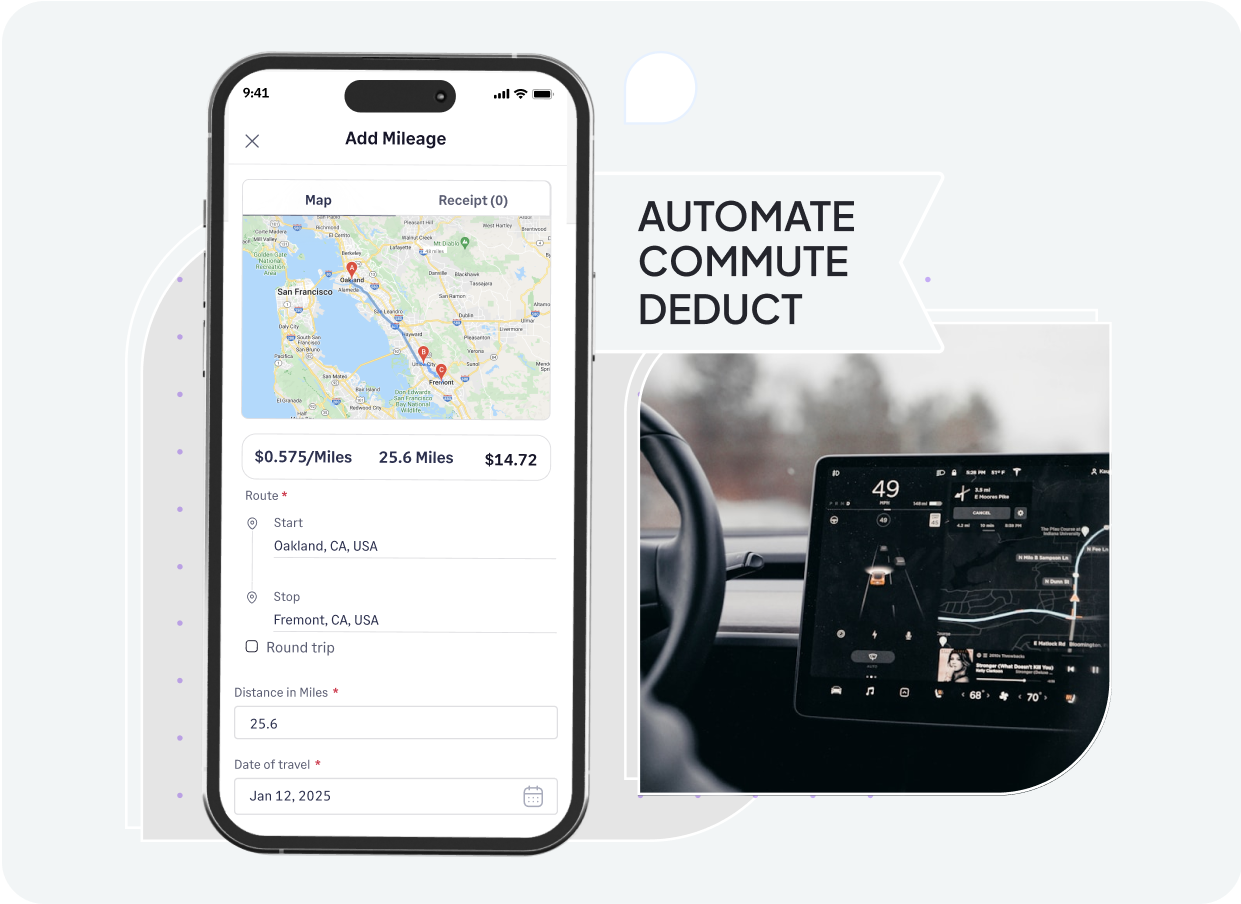

How Sage Expense Management (formerly Fyle) Can Automate Mileage Tracking

Simplify your mileage reimbursement process in Wyoming with Sage Expense Management's mileage tracking app. Our platform helps businesses ensure accuracy, save valuable time, and maintain compliance with state and federal guidelines.

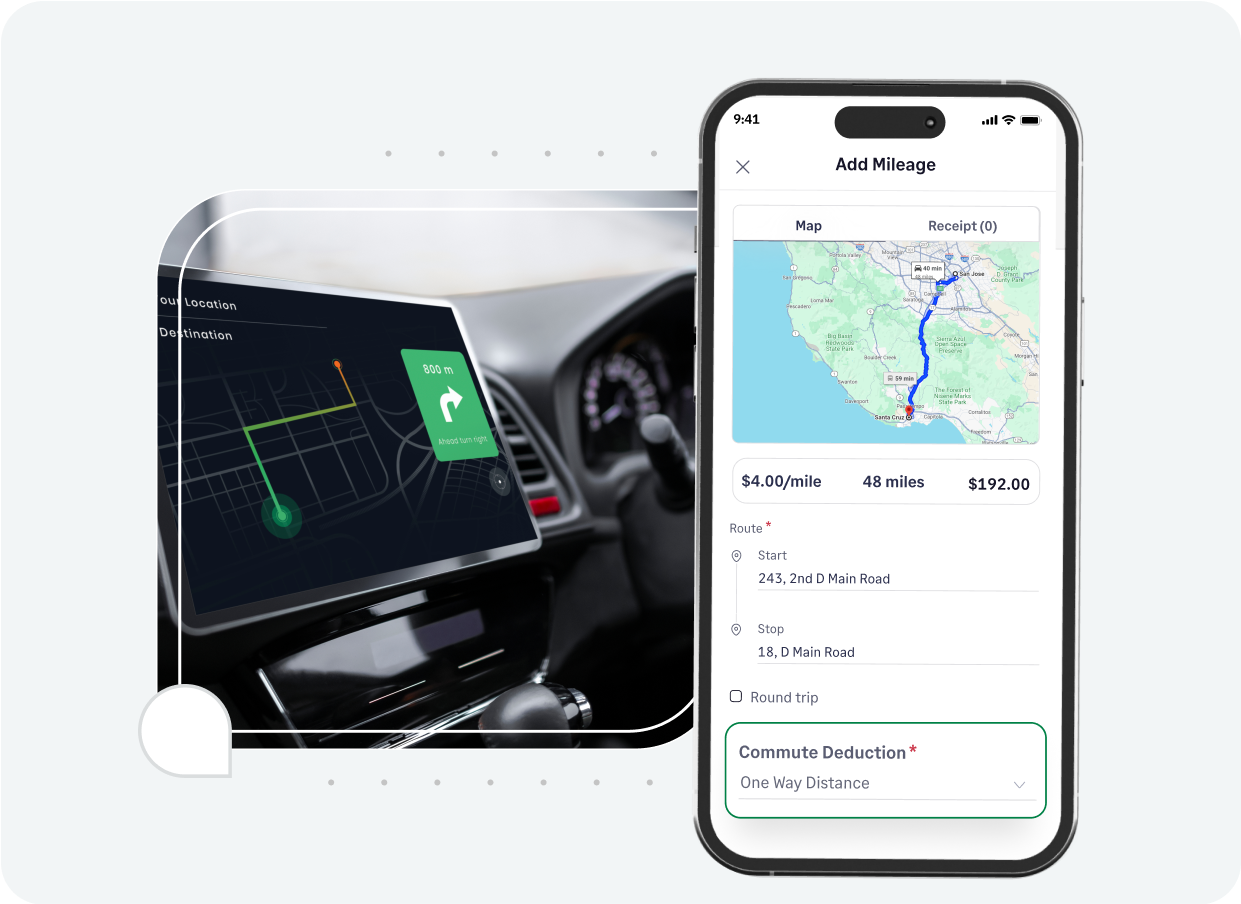

- GPS-powered mileage recording for reliability: Captures travel distances precisely using Google Maps, providing accurate and verifiable logs for every business trip.

- Flexible rate management for Wyoming: Easily supports IRS standards, Wyoming's state-aligned rates, or your unique company figures, applied automatically to claims.

- Clear tracking of commute vs. business miles: Defines home and work locations to help accurately distinguish and deduct non-reimbursable personal commute travel.

- Automated claims for frequent travel: Allows employees with regular routes to set them up once, streamlining future mileage submissions and reducing manual work.

- Built-in policy adherence for control: Embeds your company's expense guidelines to proactively flag any claims that may deviate from established rules or spending limits.

- Seamless data sync with accounting software: Connects directly with popular systems like QuickBooks, Xero, and NetSuite, for effortless synchronization of approved expenses.

- Efficient ACH payments for reimbursement (US only): Offers fast and direct deposit for approved employee mileage claims, improving the payment cycle and employee satisfaction.

Sage Expense Management empowers Wyoming businesses to manage their mileage expenses with modern efficiency, providing a better, more transparent experience for their teams.