In Kentucky, navigating mileage reimbursement requires an understanding of federal guidelines, specific state rules for public employees and workers' compensation, and common practices among private employers.

For businesses and employees in Kentucky, knowing these rates and rules is crucial for ensuring fair compensation and maintaining compliance.

The most widely recognized standard for business mileage reimbursement is the rate established annually by the Internal Revenue Service (IRS). For the year 2025, the IRS has set the standard mileage rate for business use at 70 cents per mile. This rate was 67 cents per mile in 2024.

While private employers in Kentucky are not generally mandated by a specific state law to use the IRS rate for all business-related mileage, many choose this standard because:

- It provides a clear and accepted benchmark for reimbursement.

- Reimbursements made under an accountable plan at or below the IRS rate are typically non-taxable for employees and tax-deductible for employers.

It’s important to note that the Commonwealth of Kentucky sets a specific mileage reimbursement rate for its state employees who use personal vehicles for official business. This rate is subject to quarterly adjustments based on fuel costs.

The key rates to be aware of are:

Some Important Kentucky Mileage Reimbursement Laws

While Kentucky doesn't have a statewide law mandating mileage reimbursement for all private-sector employees in every instance, several state laws and federal regulations influence how employers should handle these expenses:

1. Kentucky Minimum Wage Law

Kentucky's minimum wage is $7.25 per hour, which aligns with the federal minimum wage.

A critical point for employers is that any unreimbursed business expenses an employee is required to incur, such as mileage for using a personal vehicle for work, should not cause their effective hourly earnings to fall below this minimum wage threshold for the hours worked in a pay period.

If it does, the employer could be in violation of both Kentucky and federal wage laws.

2. Workers' Compensation

As noted, Kentucky law ensures that employees injured on the job receive reimbursement for necessary travel to obtain medical treatment and rehabilitation services.

Employers are required to cover these costs at a rate approved by the Office of the Controller.

3. No General Mandate for Private Employers

Kentucky law does not obligate private employers to offer mileage reimbursement for general business use of personal vehicles.

Therefore, a company's internal policy plays a significant role. However, many employers choose to reimburse as a good business practice and to avoid potential minimum wage complications.

4. Public Employee Expense Regulations:

Kentucky Revised Statutes (like KRS 64.710 and KRS 44.060) and associated administrative regulations (like 200 KAR 2:006) govern how public officers and state employees are reimbursed for official travel and expenses, emphasizing that allowances must be specifically provided for and regulated.

These ensure transparency and fairness tied to actual costs, such as fuel prices. While not binding on private employers, these regulations highlight a framework for accountable expense management.

Kentucky Mileage Reimbursement Law vs. Federal Law

Understanding the interplay between Kentucky's state context and federal laws is essential for proper mileage reimbursement:

Federal Law (FLSA)

The Fair Labor Standards Act (FLSA) is the primary federal law affecting this area. It mandates that employees receive at least the federal minimum wage ($7.25 per hour) "free and clear" of any business expenses incurred primarily for the employer's benefit.

If a Kentucky employee's unreimbursed mileage costs effectively reduce their pay below this federal threshold, the employer must provide sufficient reimbursement to meet the minimum wage.

Since Kentucky's minimum wage is the same as the federal rate, compliance with one generally ensures compliance with the other in this regard.

Kentucky State Law

- Kentucky's minimum wage law mirrors the federal rate of $7.25 per hour.

- Specific provisions mandate mileage reimbursement for travel related to workers' compensation medical treatment.

- Detailed regulations exist for the reimbursement of state employees, which are adjusted quarterly based on factors like fuel costs.

IRS Regulations

The IRS sets the standard mileage rates (e.g., 70 cents/mile for business in 2025) for tax purposes. These rates are not legal mandates for employers to reimburse but are crucial for determining the non-taxable amount of reimbursement under an accountable plan.

Using these rates helps ensure that reimbursements aren't considered taxable income for employees and are deductible for employers.

In Kentucky, federal and state minimum wage laws provide a foundational wage floor. State law specifically addresses workers' compensation travel and sets distinct rules for public sector employees.

IRS guidelines then offer a practical framework for the amount and tax treatment of reimbursements, widely adopted by Kentucky employers for simplicity and tax compliance.

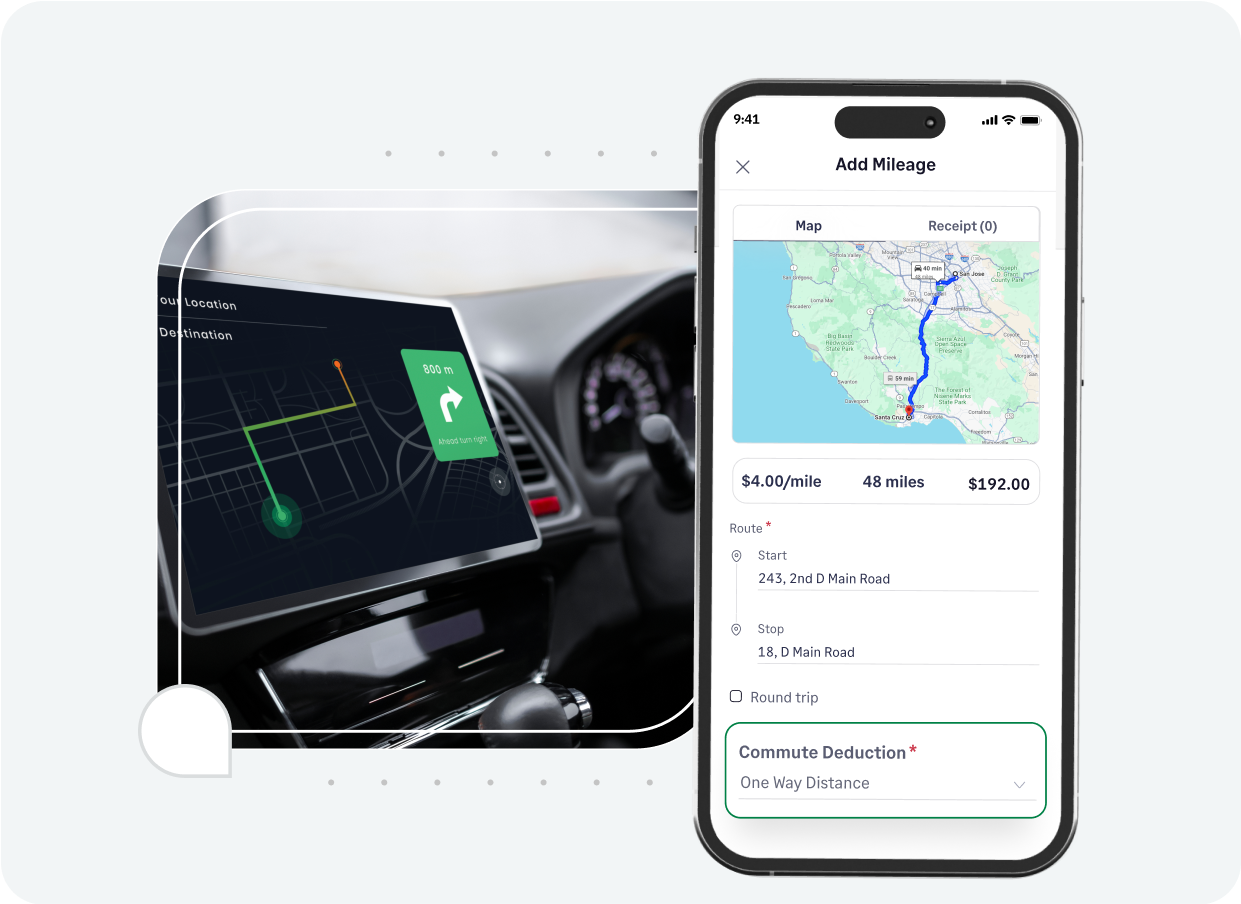

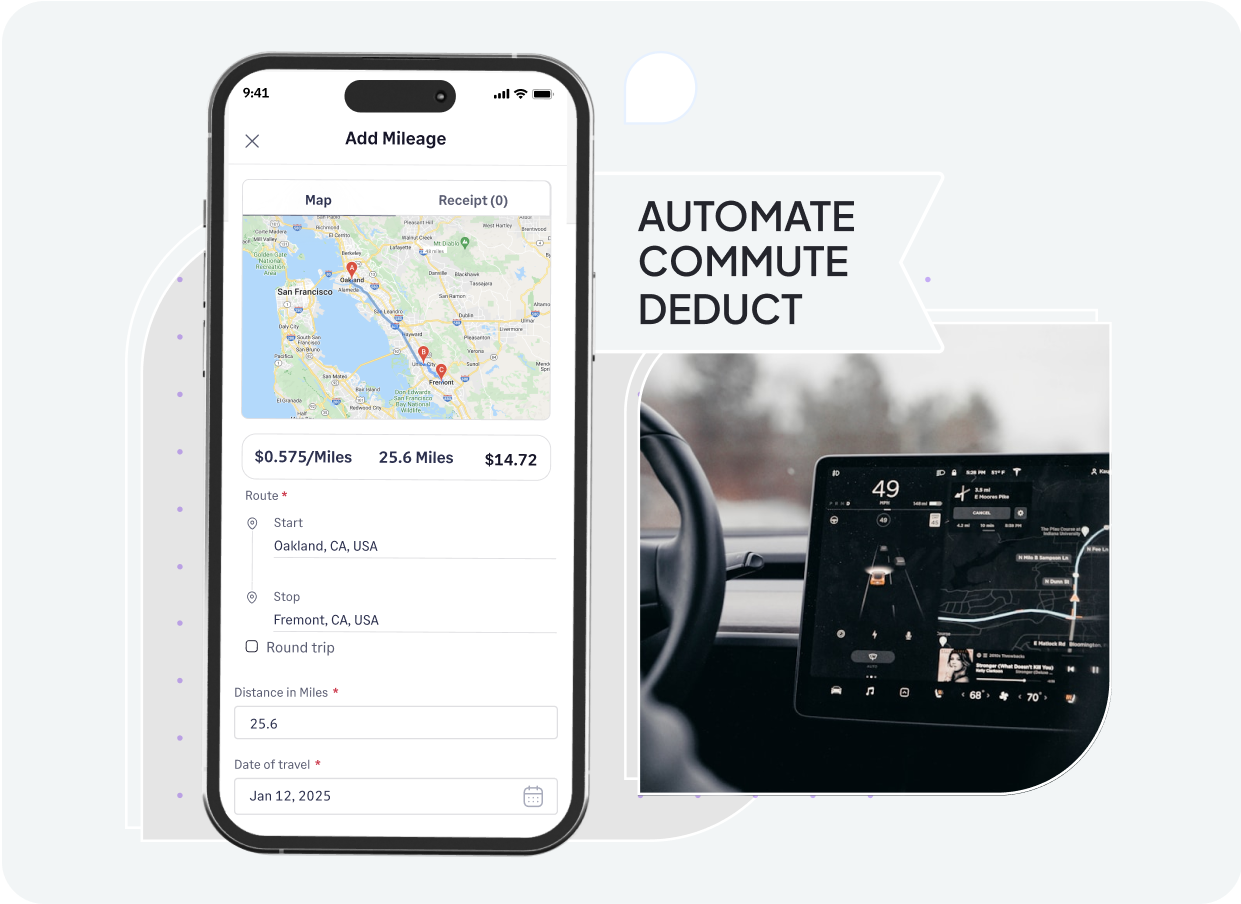

How Sage Expense Management (formerly Fyle) Can Automate Mileage Tracking

Say goodbye to cumbersome mileage logs and complex reimbursement calculations. Sage Expense Management offers Kentucky businesses an intelligent, automated platform to manage mileage expenses with precision and ease.

- GPS-powered mileage tracking: Ensures accurate mileage logs by automatically calculating travel distances using Google Maps.

- Configurable rate management: Allows setup of IRS, state-specific, or custom rates that are applied automatically.

- Easy commute mileage exclusion: Helps accurately deduct non-reimbursable daily commute distances.

- One-click recurring trips: Automates claims for frequently traveled routes, saving significant employee time.

- Proactive policy enforcement: Checks submissions against your company's rules, flagging violations upfront.

- Direct accounting sync: Integrates with QuickBooks, Xero, and NetSuite, for seamless data flow.

- Fast ACH reimbursements (US only): Enables quick and direct payment of approved mileage claims.

With Sage Expense Management, Kentucky companies can enhance efficiency, ensure compliance, and simplify mileage reimbursement for everyone involved.