In New Jersey, where robust labor laws and a high state minimum wage shape the employment landscape, understanding mileage reimbursement practices is vital.

While direct state mandates for private employers are evolving, federal standards and specific state rates for public employees and workers' compensation provide important context for businesses and individuals in New Jersey.

The benchmark most frequently turned to for calculating business mileage reimbursement is the annual rate issued by the Internal Revenue Service (IRS). For the calendar year 2025, the IRS has designated the standard rate for business use of a personal vehicle at 70 cents per mile. This reflects an increase from the 67 cents per mile rate applicable in 2024.

Although no current overarching New Jersey statute compels all private sector employers to adopt this specific IRS rate for every situation (pending potential legislative changes), many businesses find it a practical standard due to:

- Its status as a widely accepted and reasonable measure for reimbursement.

- The tax advantages associated with an accountable plan, where reimbursements at or below this federal rate are generally non-taxable to the employee and deductible for the employer.

As of January 1, 2025, the key IRS standard mileage rates are:

- 70 cents per mile for business use of a vehicle.

- 21 cents per mile for medical or moving purposes (note: the deduction for moving expenses is currently limited to active-duty members of the U.S. Armed Forces).

- 14 cents per mile driven in service of charitable organizations.

For historical context, here are the IRS standard business mileage rates from recent years:

New Jersey Mileage Reimbursement Calculator

Estimate your mileage reimbursement with ease using our New Jersey Mileage Reimbursement Calculator.

How to Use the Calculator:

- Select the correct tax year: Choose the year for which you're calculating reimbursement (e.g., 2025, 2024), as the applicable IRS rates can change.

- Input your business miles: Enter the total number of miles driven for business purposes using your personal vehicle.

- Calculate your reimbursement: The calculator will automatically apply the official IRS standard mileage rate for the selected year and display your estimated reimbursement amount.

This tool is designed to provide a quick estimate based on federal standard rates, serving as a useful reference for both employees and employers.

Calculate

Results

Some Important New Jersey Mileage Reimbursement Laws

The legal framework for mileage reimbursement in New Jersey for private employers is shaped by existing wage and hour laws, specific provisions for workers' compensation, and potential future legislation:

1. New Jersey State Wage and Hour Law

New Jersey's minimum wage for most employers is $15.49 per hour as of January 1, 2025. This high state minimum is a crucial factor.

Employers must ensure that any unreimbursed work-related expenses, including mileage for business use of a personal vehicle, do not effectively reduce an employee's earnings below this statutory minimum for the hours worked.

Specific rates apply to seasonal, small (fewer than 6 employees), agricultural, and tipped employees.

2. Workers' Compensation

New Jersey law provides that employees injured in the course of their employment are entitled to reimbursement for necessary travel expenses incurred to receive authorized medical care.

The specific rate is determined by the Division of Workers' Compensation.

3. No Current General Mandate for Private Employers

As of mid-2024, there is no comprehensive New Jersey statute that broadly requires all private employers to reimburse employees for business-related mileage at a specific rate, or for all "necessary expenditures".

Company policy, therefore, largely dictates general mileage reimbursement practices.

4. State Employee Travel Regulations

The State of New Jersey has specific regulations setting the mileage reimbursement rate for its own employees at 35 cents per mile (as of Jan 2024).

New Jersey Mileage Reimbursement Law vs. Federal Law

When considering mileage reimbursement in New Jersey, it’s a blend of robust state-level wage protections and overarching federal standards.

Fair Labor Standards Act (FLSA)

A key FLSA principle is that an employee’s earnings must not fall below the federal minimum wage ($7.25 per hour) after deducting unreimbursed business expenses like mileage.

If such expenses reduce an employee's effective pay below this federal floor, the employer must compensate for the difference.

New Jersey's State Laws

The state laws are often more stringent:

- The state's minimum wage for most workers is $15.49 per hour, significantly higher than the federal rate. This means the primary concern for New Jersey employers is ensuring that unreimbursed expenses don't violate this higher state minimum wage.

- As mentioned, New Jersey has specific rules for workers' compensation travel and a distinct, lower rate for its state employees.

IRS Regulations

if an employer uses an accountable plan and reimburses at or below these IRS rates, the reimbursement is generally non-taxable to the employee and a deductible expense for the business.

This practical aspect makes IRS rates a common choice for many New Jersey businesses seeking a clear and tax-efficient reimbursement method.

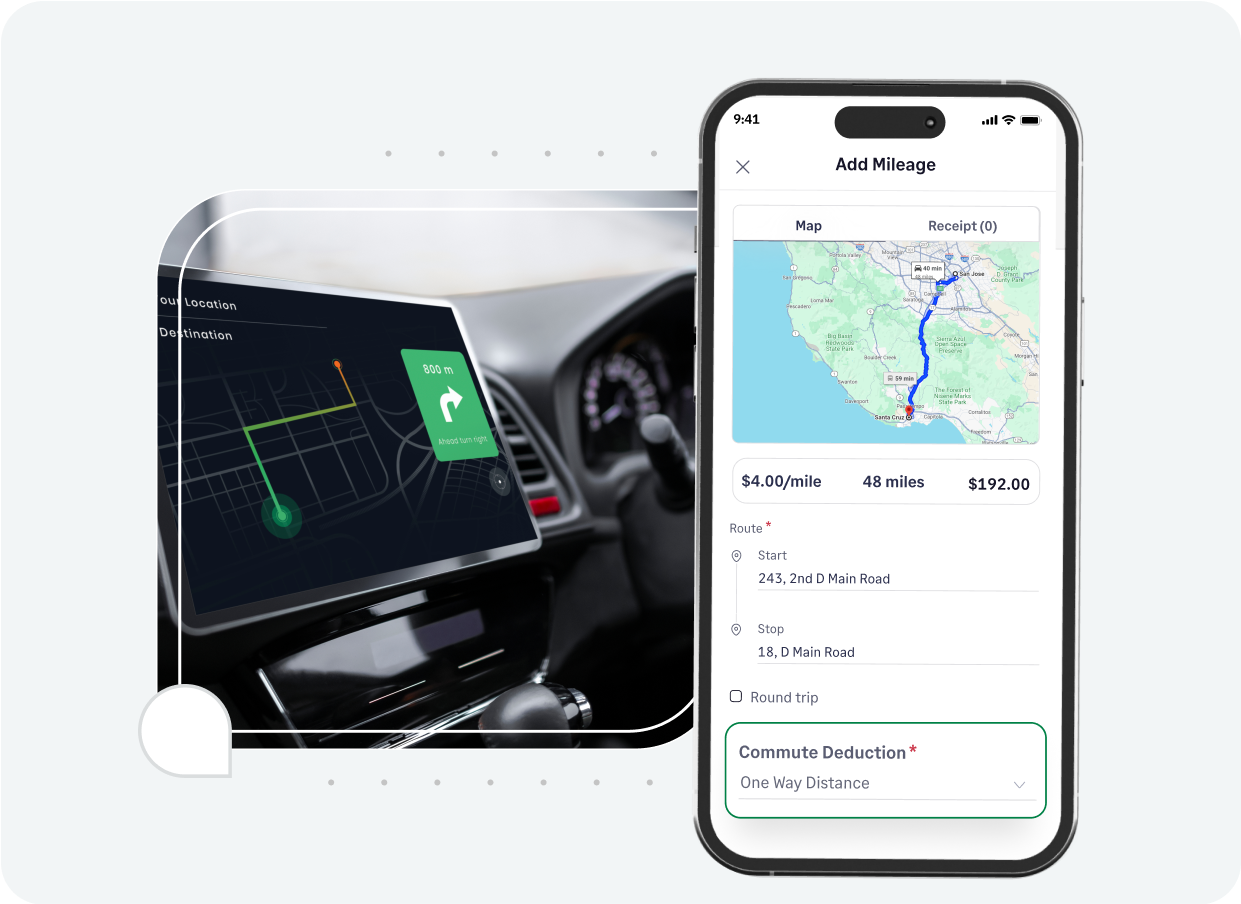

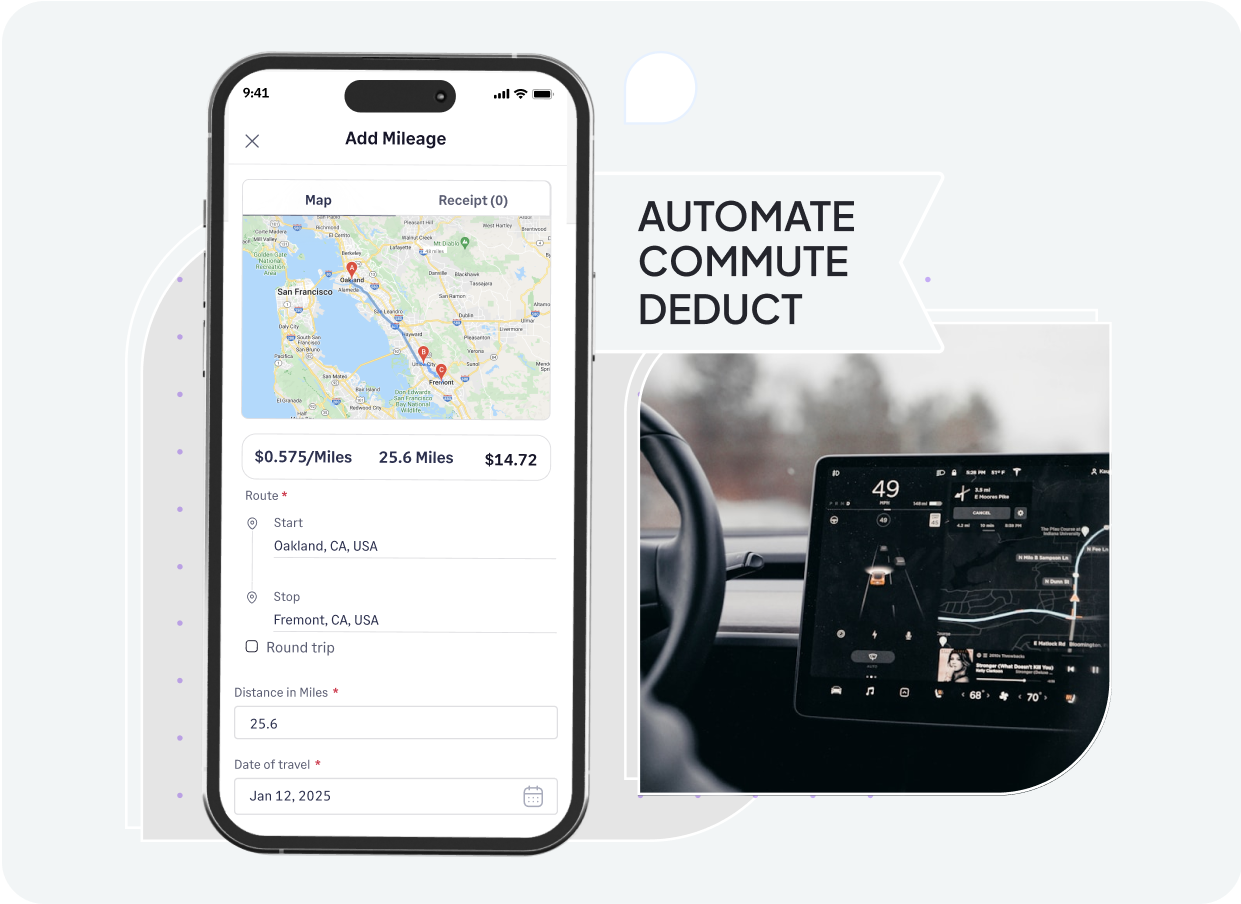

How Sage Expense Management (formerly Fyle) Can Automate Mileage Tracking

Navigating mileage logs and reimbursement policies can be complex. Sage Expense Management offers New Jersey businesses an advanced, automated system to manage travel expenses with enhanced precision and significantly reduced administrative effort.

- Reliable GPS-based mileage recording: Automatically captures journey distances using Google Maps, ensuring logs are accurate and complete.

- Smart rate application for compliance: Configure IRS figures, specific state rates, or unique company rates; We apply the correct one to each claim.

- Clear distinction for commute travel: Helps your team easily identify and deduct personal commute mileage by setting primary work and home addresses for fair calculations.

- Streamlined claims for regular routes: Employees with frequent, similar trips can use our recurring mileage function to automate submissions after an initial setup.

- Built-in checks for policy alignment: Embed your organization's travel and expense guidelines into Sage Expense Management to proactively catch and flag any submissions that deviate from set policies.

- Effortless sync with accounting platforms: Sage Expense Management ensures approved mileage and expense data flows directly into accounting systems like QuickBooks, Xero, or NetSuite, cutting down on manual input.

- Quicker reimbursements via ACH (US only): Expedite the payment process for your team by reimbursing approved mileage claims directly through ACH transfers.

Sage Expense Management empowers New Jersey companies to handle mileage reimbursements with greater accuracy, maintain compliance more easily, and free up valuable time for all involved.