In Rhode Island, where state labor laws often provide protections beyond federal minimums, understanding the landscape for mileage reimbursement is key for both employers and their teams.

While Rhode Island aligns its public sector and workers' compensation travel reimbursement with established federal rates, private businesses must also consider the implications of the state's robust minimum wage.

The nationally recognized benchmark for these travel expense calculations is usually the standard mileage rate issued by the Internal Revenue Service (IRS). For the year 2025, the IRS has set this rate for business use of a personal vehicle at 70 cents per mile. This is an update from the 67 cents per mile rate that was in effect for 2024.

Private employers in Rhode Island are not directly required by a specific state statute to use the IRS rate for all business-related travel. However, adopting this federal standard is a widespread practice for several practical reasons:

- It offers a clear, consistent, and nationally accepted basis for reimbursement, simplifying policy creation.

- When payments are made through an accountable plan at or below the IRS rate, they are generally not considered taxable income for the employee and are deductible for the employer.

As of January 1, 2025, the key IRS standard mileage rates are:

- 70 cents per mile for business use of a vehicle.

- 21 cents per mile for medical or moving purposes (note: the deduction for moving expenses is currently limited to active-duty members of the U.S. Armed Forces).

- 14 cents per mile driven in service of charitable organizations.

Other relevant rates in Rhode Island include:

- Rhode Island State Employee Rate: State of Rhode Island employees who use their personal vehicles for official state duties are reimbursed at the prevailing IRS standard mileage rate for business use. Consequently, for 2025, this rate is 70 cents per mile.

- Workers' Compensation Medical Travel: Injured employees in Rhode Island are entitled to reimbursement for reasonable actual costs of travel to obtain necessary medical services, as per RIGL § 28-33-41. In practice, this mileage reimbursement typically aligns with the IRS standard business rate, meaning it would be 70 cents per mile for 2025.

For historical context, here are the IRS standard business mileage rates from recent years:

Rhode Island Mileage Reimbursement Calculator

Quickly calculate your potential mileage reimbursement with our Rhode Island Mileage Reimbursement Calculator.

How to Use the Calculator:

- Select the correct tax year: Choose the year for your calculation (e.g., 2025, 2024), as IRS rates can change annually.

- Input your business miles: Enter the total miles driven for business purposes using your personal vehicle.

- Calculate your reimbursement: The calculator will apply the official IRS standard mileage rate for the chosen year to display your estimated reimbursement.

This tool provides a straightforward estimate based on federal standard rates, useful for managing travel expenses in Rhode Island.

Calculate

Results

Some Important Rhode Island Mileage Reimbursement Laws

While Rhode Island does not have a single statute mandating a specific mileage reimbursement rate for all private employers, several state laws and federal guidelines create a framework for how these expenses should be handled:

1. Rhode Island Minimum Wage Act (RIGL § 28-12-3)

Rhode Island's minimum wage is $15.00 per hour effective January 1, 2025. This is a crucial factor. Employers must ensure that unreimbursed work-related expenses, such as mileage, do not effectively reduce an employee's pay below this state minimum for hours worked.

The tipped minimum wage is $3.89 per hour, provided tips bring the total earnings to the standard minimum wage.

2. Workers' Compensation (RIGL § 28-33-41; § 28-36-15)

State law requires that employees injured on the job be reimbursed for reasonable actual costs of travel to secure necessary medical services. This reimbursement typically follows the current IRS standard mileage rate.

3. Wage Payment Laws (RIGL § 28-14)

While not specifically mandating mileage reimbursement, Rhode Island's laws on wage payment generally restrict employers from making deductions from wages for business expenses that are for the primary benefit of the employer, especially if such deductions would reduce an employee's earnings below the state minimum wage.

4. State Employee Travel Policies

The State of Rhode Island has established policies for its own employees, reimbursing them for official travel in personal vehicles at the current IRS standard business rate. This sets a local precedent for fair reimbursement.

Rhode Island Mileage Reimbursement Law vs. Federal Law

The approach to mileage reimbursement in Rhode Island is characterized by strong state-level wage protections that often surpass federal minimums, while federal IRS rates remain a key benchmark for the amount of reimbursement.

Fair Labor Standards Act (FLSA)

The FLSA is the foundational federal law. It ensures that an employee’s earnings do not fall below the federal minimum wage ($7.25 per hour) after accounting for unreimbursed business expenses like mileage.

If such costs effectively reduce an employee's pay below this federal baseline, the employer must cover the shortfall.

Rhode Island's State Laws

The state laws however, provide a more protective environment in several respects:

- The state's minimum wage ($15.00 per hour in 2025) is substantially higher than the federal rate. Therefore, Rhode Island employers must primarily ensure that unreimbursed driving expenses do not violate this higher state minimum wage.

- Rhode Island law explicitly provides for reimbursement of travel costs for workers' compensation medical care, with the rate typically aligning with IRS standards.

- State employee travel reimbursement is also directly tied to the IRS standard rate.

IRS Regulations

The IRS regulations that establish standard mileage rates (e.g., 70 cents per mile for business in 2025) are principally for federal income tax purposes. They don't legally mandate that employers pay this specific amount.

However, their practical influence is significant. When a Rhode Island employer uses an accountable plan and reimburses at or below these IRS rates, the reimbursement is generally non-taxable to the employee and a deductible expense for the business.

This tax efficiency makes the IRS rates a common and advisable standard for calculating reimbursements.

In summary, Rhode Island's high state minimum wage is the primary safeguard ensuring employees are not unfairly burdened by business mileage costs. Federal law (FLSA) provides a national minimum standard.

Specific state rules address workers' comp travel, and the state's own practices for its employees reinforce the IRS rate as a benchmark. IRS guidelines then offer a widely used, tax-advantaged method for determining the amount of reimbursement.

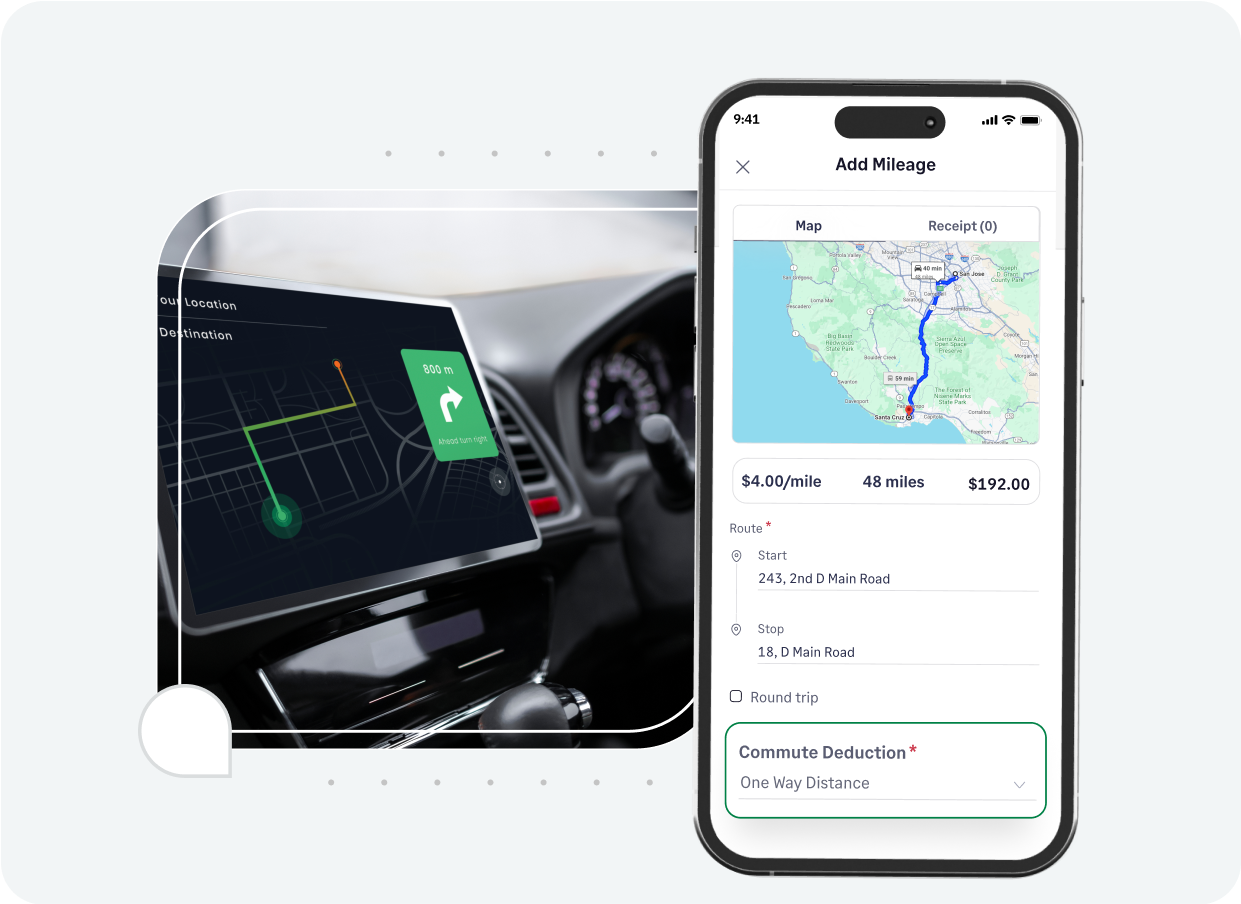

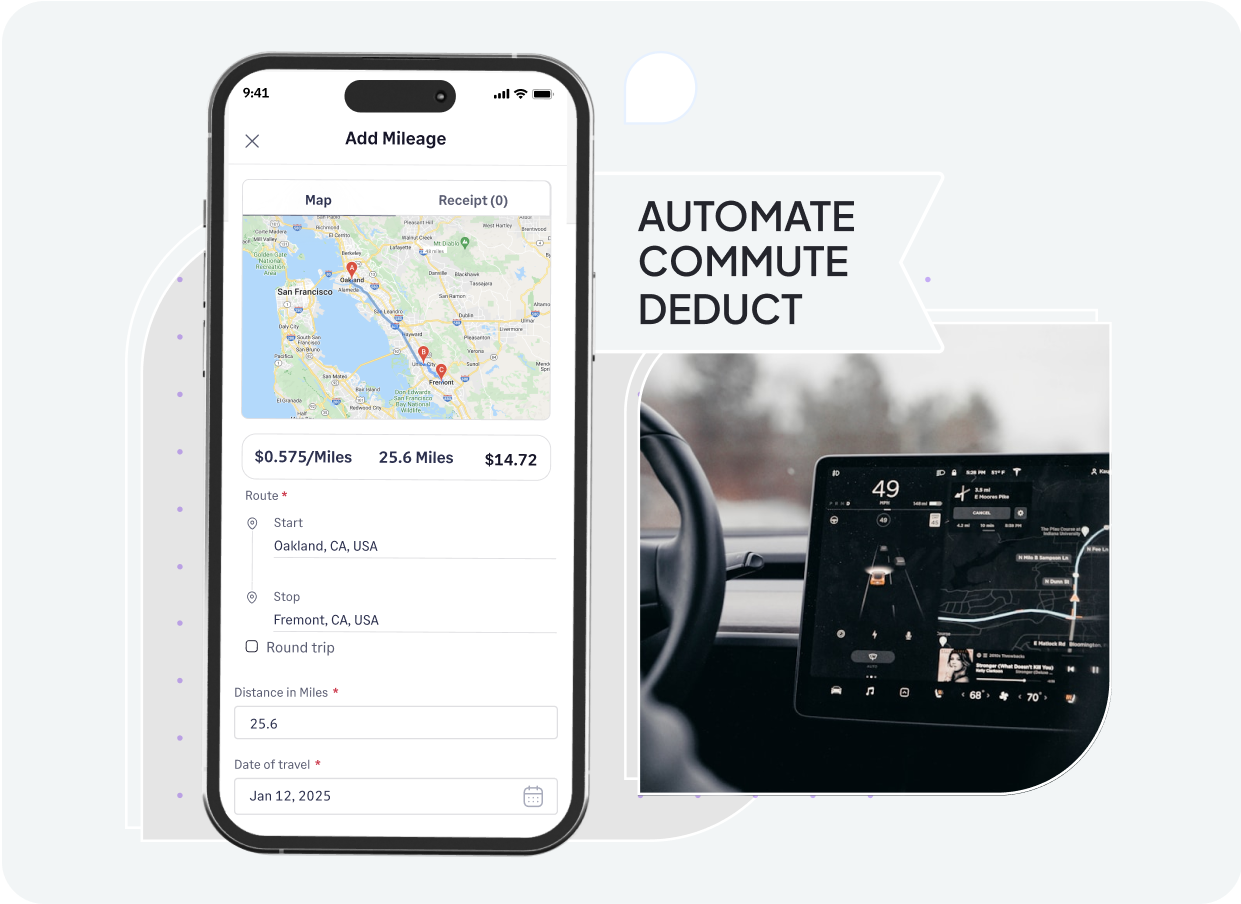

How Sage Expense Management (formerly Fyle) Can Automate Mileage Tracking

Streamline your mileage reimbursement process in Rhode Island with Sage Expense Management's mileage tracking app. Our platform helps businesses save time, improve accuracy, and ensure compliance effortlessly.

- GPS-powered mileage logging: Accurately captures travel distances with Google Maps, providing reliable data for every trip.

- Flexible rate configuration: Supports IRS standards, Rhode Island's state-aligned rates, or unique company figures, applied automatically to claims.

- Clear commute mileage distinction: Easily defines home/work locations to accurately deduct non-reimbursable personal travel.

- Automated recurring trip setup: Allows employees to set up frequent routes once for automatic future mileage claim submissions.

- Integrated policy enforcement: Embeds your company's expense rules to proactively flag claims that don't meet established guidelines.

- Direct sync with accounting software: Connects seamlessly with popular systems like QuickBooks, Xero, and NetSuite, reducing manual data work.

- Prompt ACH reimbursements (US only): Offers fast and direct payment for approved employee mileage claims.

Sage Expense Management empowers Rhode Island businesses to manage mileage expenses efficiently, fostering compliance and providing a better experience for all users.