In Nevada, understanding mileage reimbursement involves looking at federal guidelines, specific state rules for certain situations like workers' compensation, and the general practices adopted by employers.

For businesses and employees in Nevada, knowing these rates and rules is key to fair compensation and compliance.

The most frequently referenced standard for business mileage reimbursement is the rate set by the Internal Revenue Service (IRS). For the year 2025, the IRS has announced the standard mileage rate for business use at 70 cents per mile. This rate was 67 cents per mile for 2024.

While Nevada private employers are not generally mandated by a specific state law to use the IRS rate for all business mileage, many choose to do so because:

- It offers a clear, widely accepted benchmark.

- Reimbursements under an accountable plan at or below this rate are typically non-taxable for employees and deductible for employers.

As of January 1, 2025, the key IRS standard mileage rates are:

- 70 cents per mile for business use of a vehicle.

- 21 cents per mile for medical or moving purposes (note: the deduction for moving expenses is currently limited to active-duty members of the U.S. Armed Forces).

- 14 cents per mile driven in service of charitable organizations.

Other relevant rates in Nevada include:

- Nevada State Employee Rate: The State of Nevada sets its own mileage reimbursement rate for state employees using personal vehicles for official business. For 2025, this rate is 70 cents per mile, aligning with the IRS business rate.

- Workers' Compensation Medical Travel: Nevada law requires reimbursement for necessary travel for medical treatment or evaluation related to a work injury if the travel meets certain distance thresholds. The rate for this is set by the Division of Industrial Relations and was 70 cents per mile as of Jan 1, 2025. This rate may be subject to periodic updates.

For historical context, here are the IRS standard business mileage rates from recent years:

Nevada Mileage Reimbursement Calculator

Simplify your mileage reimbursement calculations with our user-friendly Nevada Mileage Reimbursement Calculator.

How to Use the Calculator:

- Select the correct tax year: Choose the year for which you're calculating reimbursement (e.g., 2025, 2024), as the applicable IRS rates can change.

- Input your business miles: Enter the total number of miles driven for business purposes using your personal vehicle.

- Calculate your reimbursement: The calculator will automatically apply the official IRS standard mileage rate for the selected year and display your estimated reimbursement amount.

This tool provides a quick and accurate estimate, beneficial for both employees needing to claim expenses and employers processing those claims.

Calculate

Results

Some Important Nevada Mileage Reimbursement Laws

While Nevada doesn't have a single law mandating mileage reimbursement for all private-sector employees in every instance, several state laws and federal regulations influence how employers should handle these expenses:

1. Nevada Minimum Wage Law

Nevada's minimum wage is $12.00 per hour (effective July 1, 2024).

Crucially, any unreimbursed business expenses required of an employee, such as mileage for using a personal vehicle for work, should not cause their effective hourly earnings to fall below this state minimum wage for the hours worked in a pay period.

If it does, the employer could be in violation of Nevada's wage and hour laws.

2. Workers' Compensation (NRS 616C.245 & NAC 616C.153)

Nevada law mandates that injured employees are entitled to reimbursement for reasonable travel expenses to and from places of medical treatment or evaluation for a work-related injury, provided the travel is 20 miles or more one way, or aggregates 40 miles or more in a week.

The mileage rate for this is set by the Administrator of the Division of Industrial Relations (70 cents per mile as of Jan 1st, 2025).

3. No General Mandate for Private Employers

Outside the context of ensuring minimum wage compliance and the specific requirements for workers' compensation, there isn't a broad Nevada statute compelling private employers to reimburse for general business mileage at a specific rate or in all situations where a personal vehicle is used for work.

Company policy, therefore, plays a significant role in determining reimbursement practices.

Nevada Mileage Reimbursement Law vs. Federal Law

Understanding the interplay between Nevada's state laws and federal laws is essential for proper mileage reimbursement:

Federal Law (FLSA):

The Fair Labor Standards Act (FLSA) is the primary federal law affecting this area. It mandates that employees receive at least the federal minimum wage ($7.25 per hour) "free and clear" of any business expenses incurred primarily for the employer's benefit.

If a Nevada employee's unreimbursed mileage costs effectively reduce their pay below this federal threshold (even if they are still above Nevada's higher minimum wage), the employer must provide sufficient reimbursement to meet the federal minimum wage.

However, since Nevada's minimum wage is higher, compliance with the state minimum usually ensures compliance with the federal minimum in this regard.

Nevada State Law

- Nevada's minimum wage law provides a higher wage floor ($12.00 per hour) than the federal FLSA.

- Specific provisions under Nevada Revised Statutes and Administrative Code mandate mileage reimbursement for travel related to workers' compensation medical treatment under certain conditions.

IRS Regulations

The IRS sets the standard mileage rates (e.g., 70 cents/mile for business in 2025) for tax purposes.

These rates are not legal mandates for employers to reimburse but are crucial for determining the non-taxable amount of reimbursement under an accountable plan.

Using these rates helps ensure that reimbursements aren't considered taxable income for employees and are deductible for employers.

In Nevada, the state minimum wage law provides a key wage floor. State law specifically addresses workers' compensation travel. IRS guidelines then offer a practical framework for the amount and tax treatment of reimbursements, widely adopted by Nevada employers.

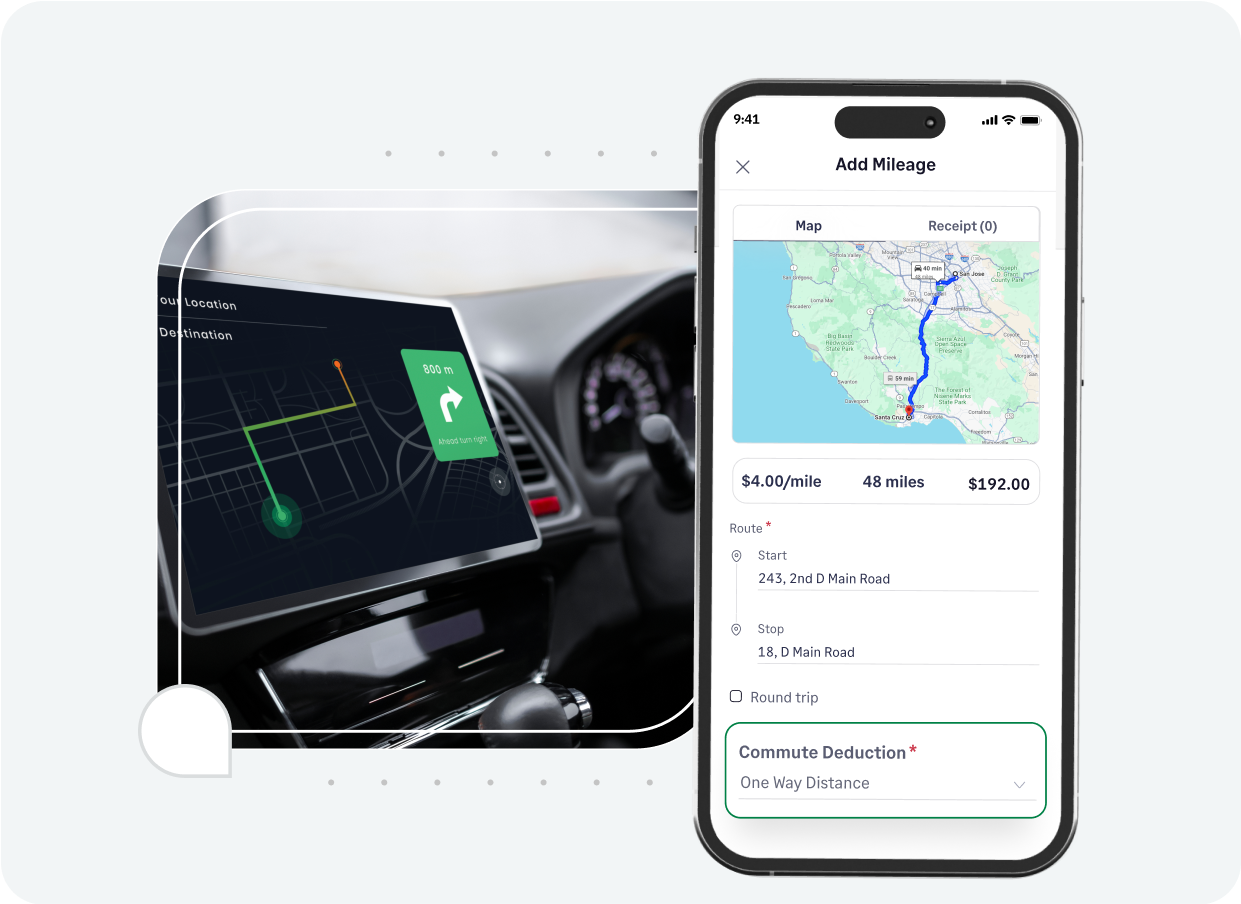

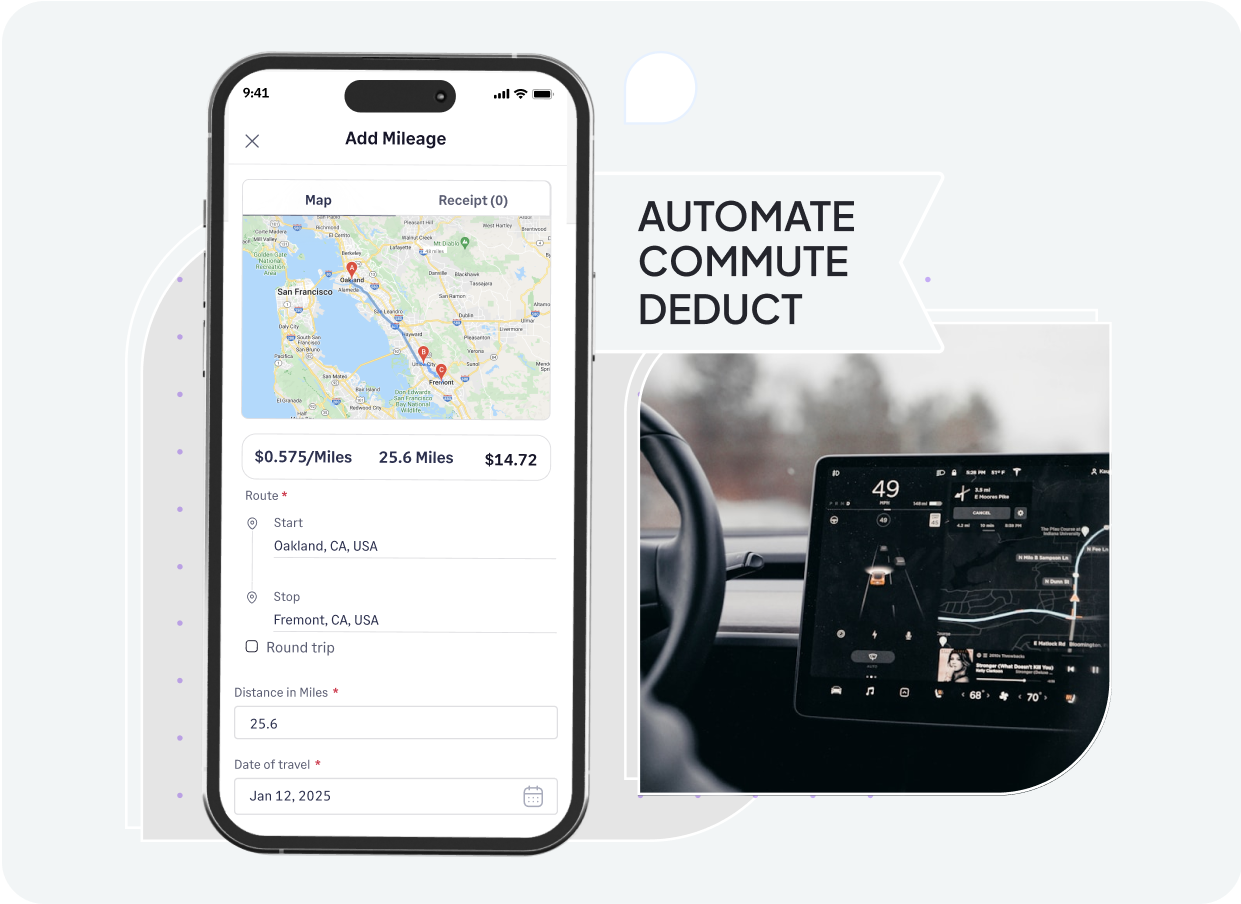

How Sage Expense Management (formerly Fyle) Can Automate Mileage Tracking

Say goodbye to tedious mileage logs and complex calculations. Sage Expense Management introduces a smarter way for Nevada businesses to handle mileage reimbursement, ensuring accuracy and saving valuable time.

- GPS accurate mileage: Automatically logs travel distances using Google Maps, reducing errors.

- Flexible rate application: Easily set IRS, state, or custom rates that apply automatically to claims.

- Easy commute deduction: Define home/work locations to accurately exclude non-reimbursable commute miles.

- Recurring trip automation: Set up frequent routes once; Sage Expense Management creates future claims automatically.

- Built-in policy checks: Embed your rules to flag out-of-policy claims before submission.

- Accounting software sync: Approved mileage reports flow directly into QuickBooks, Xero, NetSuite, etc.

- Direct ACH payments (US only): Reimburse employees quickly for approved mileage via ACH.

With Sage Expense Management, Nevada companies streamline mileage tracking for better compliance and efficiency.